The BlockStack (STX) price has broken out from a long-term resistance level at $0.30 and is currently in the process of validating it as support.

Blockstack (STX) is expected to resume its upward movement towards the resistance targets which we will outline below.

Blockstack (STX) Flips Resistance to Support

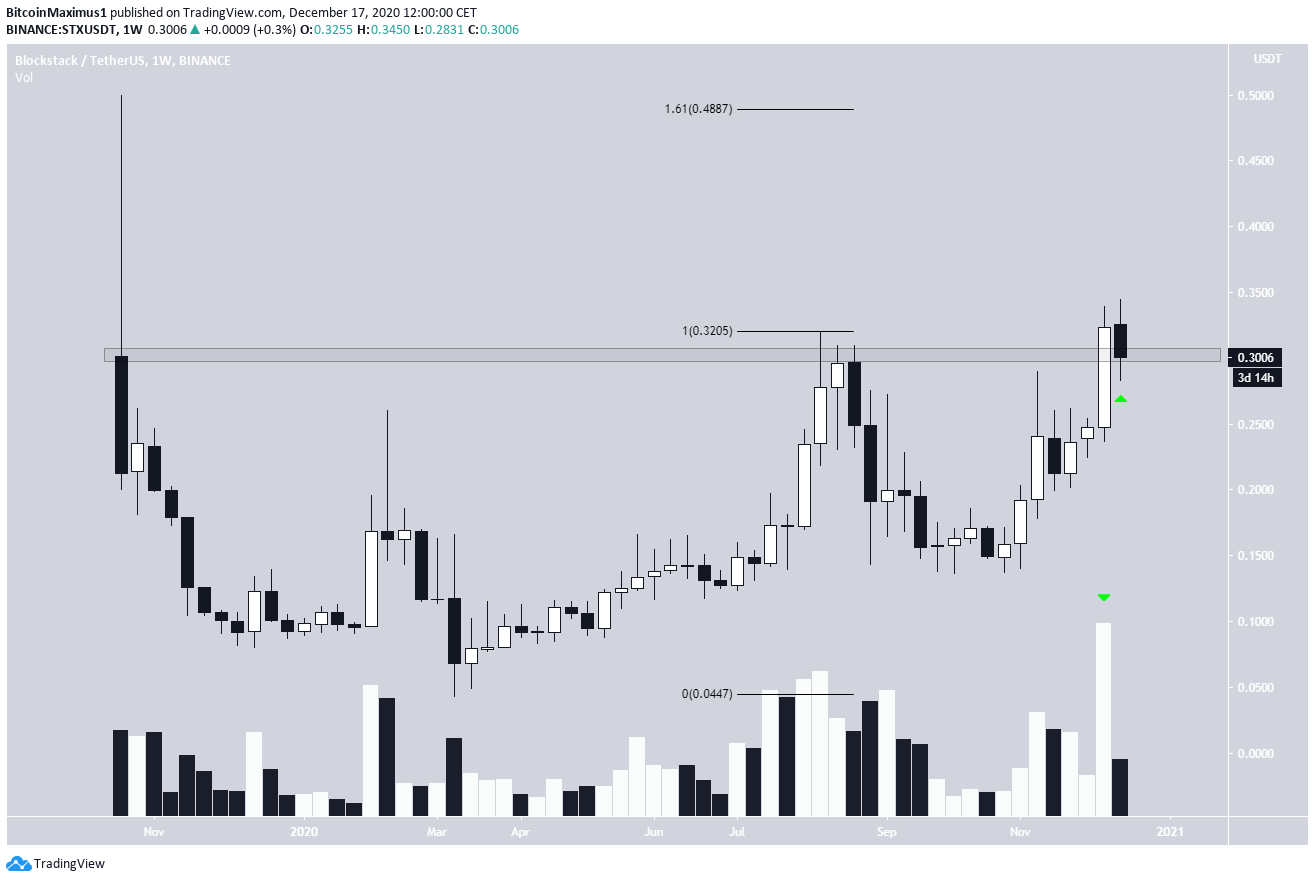

The weekly chart for STX shows that while it has been increasing since March, it has struggled to break out above the $0.30 resistance area.

STX successfully broke out above this resistance on Dec. 12, reaching a high of $0.345 two days later. In addition, STX reached a weekly close above this level and the weekly volume was the highest on record.

At the time of press, STX has returned to validate this area as support,

Considering the price is nearly at an all-time high (excluding the wick during the first week of price action), we need to use Fib extensions to find the next resistance area. Doing so gives us a target of $0.48 for the next closest resistance area.

Ascending Support Line

A look at the daily chart shows that STX has been following an ascending support line since Nov. 3. During this time, STX has broken out from the $0.30 area and is currently in the process of validating it as support (shown with the green arrow below).

Technical indicators in the daily time-frame are bullish, supporting the possibility that STX continues moving upwards towards the previously outlined target.

As long as STX is trading above this ascending support line, it is expected to continue moving higher.

Cryptocurrency trader @kaisercrypto outlined an STX chart that shows the resistance/support flip and also suggests a continued upward movement. T

his fits with the outlook from both the weekly and daily time-frames.

Wave Count

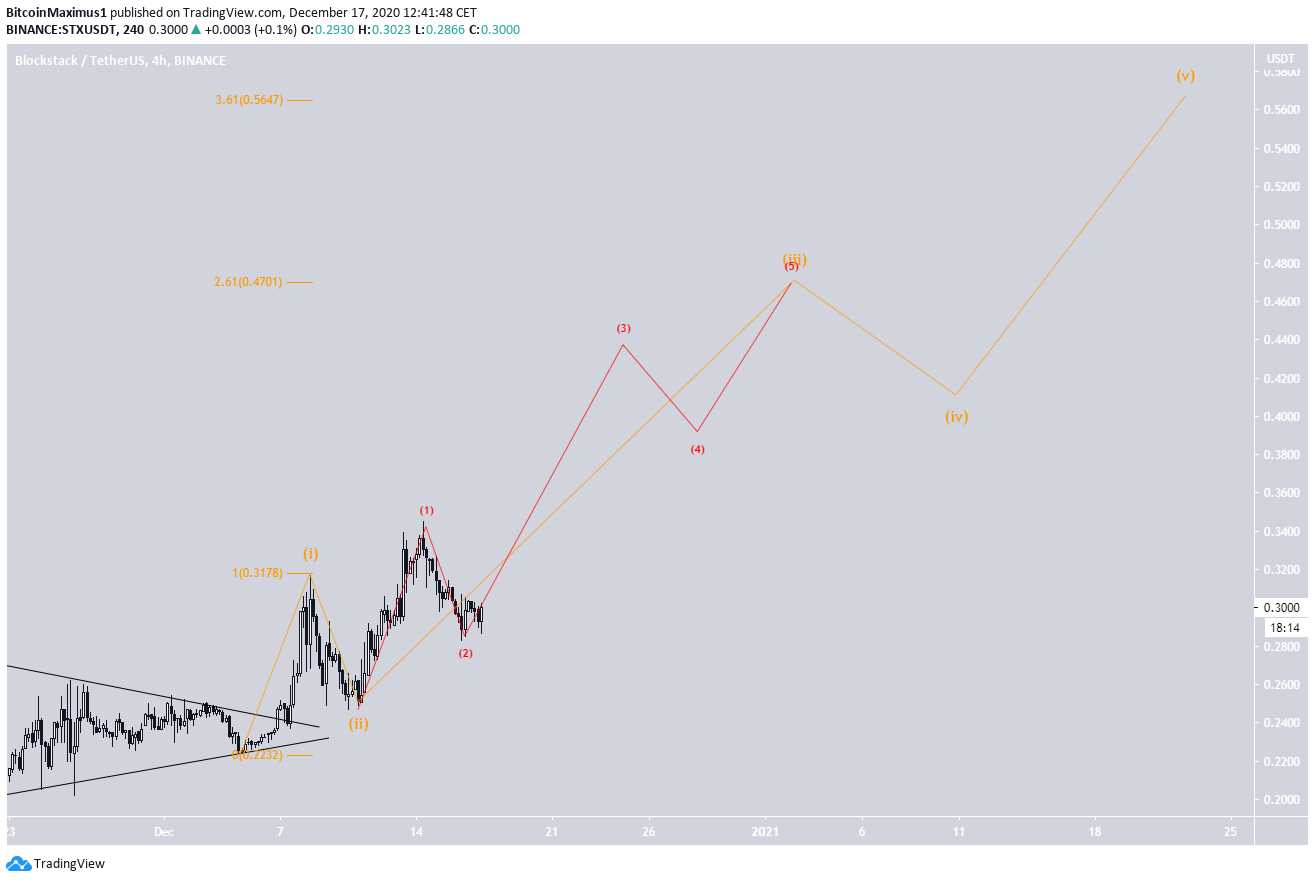

The wave count suggests that STX is in its third cycle wave which began on Oct. 7 with a low of $0.136. A possible target for the top of the wave is found at $0.58, which would give waves 1:3 a 1:1.61 ratio.

A closer look at the movement shows that STX is likely in an extended fifth wave (black), The sub-wave count for this wave is shown in orange.

The reason for the extension is the creation of what looks like a 1-2/1-2 wave formation (orange & red) after the triangle breakout.

The most likely targets for sub-wave 3 and 5 (orange) to end are found at $0.47 and $0.57, fitting with both targets found from the long-term charts.

A decrease below the sub-wave 2 low at $0.246 would invalidate this particular count.

Conclusion

The Blockstack (STX) price is expected to continue its upward movement towards the targets at $0.48 and could possibly reach $0.57.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here!

Disclaimer: Cryptocurrency trading carries a high level of risk and may not be suitable for all investors. The views expressed in this article do not reflect those of BeInCrypto.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.