American asset manager BlackRock has listed its Ethereum ETF (exchange-traded fund) on a Brazilian stock exchange, with trading set to begin on Wednesday, August 28.

The Brazilian market is increasingly embracing crypto ETFs, providing institutional investors with greater access to digital assets. This development marks another step in the growing acceptance of cryptocurrencies in traditional financial markets.

BlackRock Takes Ethereum ETF to Brazil

BlackRock has expanded its recently launched Ethereum ETF, known in the US as iShares Ethereum Trust (ETHA), to the Brazilian market under the ticker ETHA39. This offering is available to Brazilian investors through Brazilian Depositary Receipts (BDRs) traded on the B3 stock exchange. BDRs are certificates that represent shares of foreign companies, making BlackRock’s ETHA39 an ETF BDR.

ETHA39 is valued at one-third of ETHA’s share, trading within the range of R$40 to R$50 ($7.26 to $9.07) with a management fee of 0.25%. However, BlackRock has temporarily reduced this fee to 0.12% on the first $2.5 billion in AUM for a year.

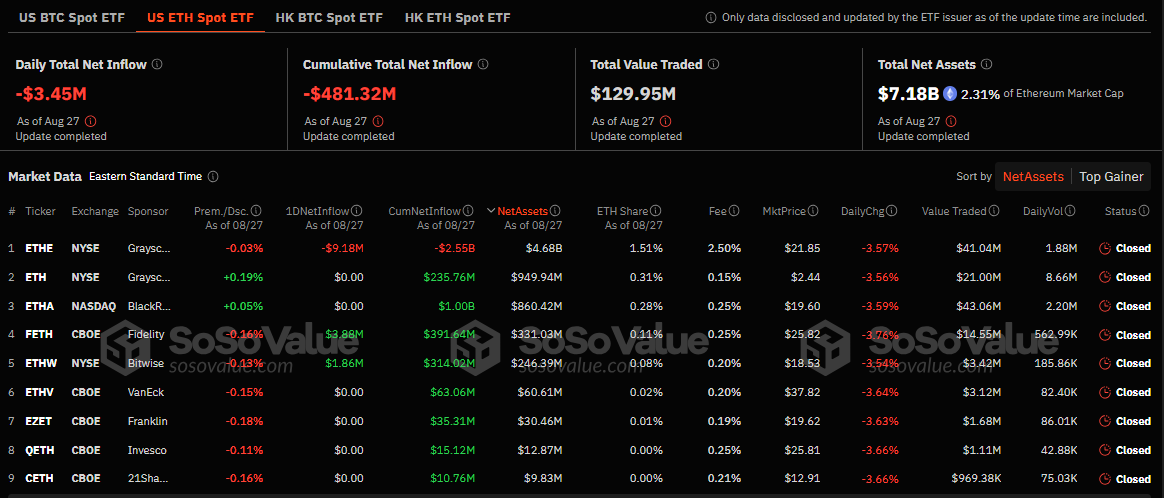

Recently, BlackRock’s ETHA achieved an important milestone by becoming the first Ethereum ETF to surpass $1 billion in net inflows. In comparison, its competitors — Fidelity’s FETH, Bitwise’s ETHW, and Grayscale’s ETH — recorded net inflows of $367 million, $310 million, and $227 million, respectively.

Read more: How to Invest in Ethereum ETFs?

ETHA, BlackRock’s Ethereum ETF, currently holds $860 million in net assets. It surpasses Grayscale’s mini Ethereum trust (ETH) and Ethereum trust (ETHE). Moreover, BlackRock’s Bitcoin fund has ranked among the top five ETFs by 2024 inflows, including non-crypto ETFs, further solidifying BlackRock’s leadership in the market.

In addition to Ethereum, BlackRock also offers a spot Bitcoin ETF in Brazil, known as IBIT39. Launched in March following a landmark decision in January, IBIT39 is advertised as the BDR of BlackRock’s Bitcoin ETF.

“The launch of ETHA39 expands the offering of digital assets and simplifies investors’ access to an asset that has the potential to support a wide and diverse range of blockchain applications,” said Cristiano Castro, BlackRock’s director in Brazil.

While BlackRock’s expansion of its crypto ETF portfolio in Brazil continues, Ethereum ETFs in the US have been underperforming. Adding to the recent trend of outflows, Ethereum ETFs saw $3.45 million in net outflows on Tuesday.

Despite the outflows, this development highlights Brazil’s commitment to expanding digital asset access for its investors. Notably, Brazil is ahead of the US in this area, having pioneered the first Solana ETF in early August.

This financial instrument, listed on Brazil’s B3 stock exchange, already began trading. With ETHA39 now available alongside IBIT39 and the QSOL11 Solana ETF, Brazil continues to position itself as a leader in the crypto ETF space.

Read more: Ethereum ETF Explained: What It Is and How It Works

Meanwhile, the path for Solana ETFs in the US remains challenging. As reported earlier by BeInCrypto, recent regulatory actions suggest that approval under the current administration is unlikely.

“A snowball’s chance in hell of approval unless there’s a change in leadership. Near-zero chance in 2024, and if Kamala Harris wins, there’s probably near-zero chance in 2025, too. The only hope, in my opinion, is if Donald Trump wins,” Bloomberg ETF analyst Eric Balchunas said.