The iShares Bitcoin Trust ETF (IBIT) has become BlackRock’s most profitable exchange-traded fund (ETF) in terms of annual revenue.

Despite launching less than 2 years ago, the spot Bitcoin ETF has outpaced longstanding traditional funds. This reflected a surge in demand for regulated cryptocurrency exposure amid Bitcoin’s (BTC) record-breaking price rally.

BlackRock’s Bitcoin ETF Becomes Its Most Profitable Fund Ever

In a recent post on X, Bloomberg’s senior ETF analyst, Eric Balchunas, pointed out that IBIT has generated $244.5 million in annual revenue for BlackRock. The fund has already out-earned every long-established iShares ETFs.

This includes surpassing the Core S&P 500 ETF (IVV), which is 25 years old and manages nearly seven times more assets.

BlackRock earns money from IBIT by charging a 0.25% management fee on the fund’s total assets under management (AUM), which currently stands at $97.8 billion. Balchunas also added that the product is just ‘a hair away from $100 billion,’ with only about $2.2 billion left to go.

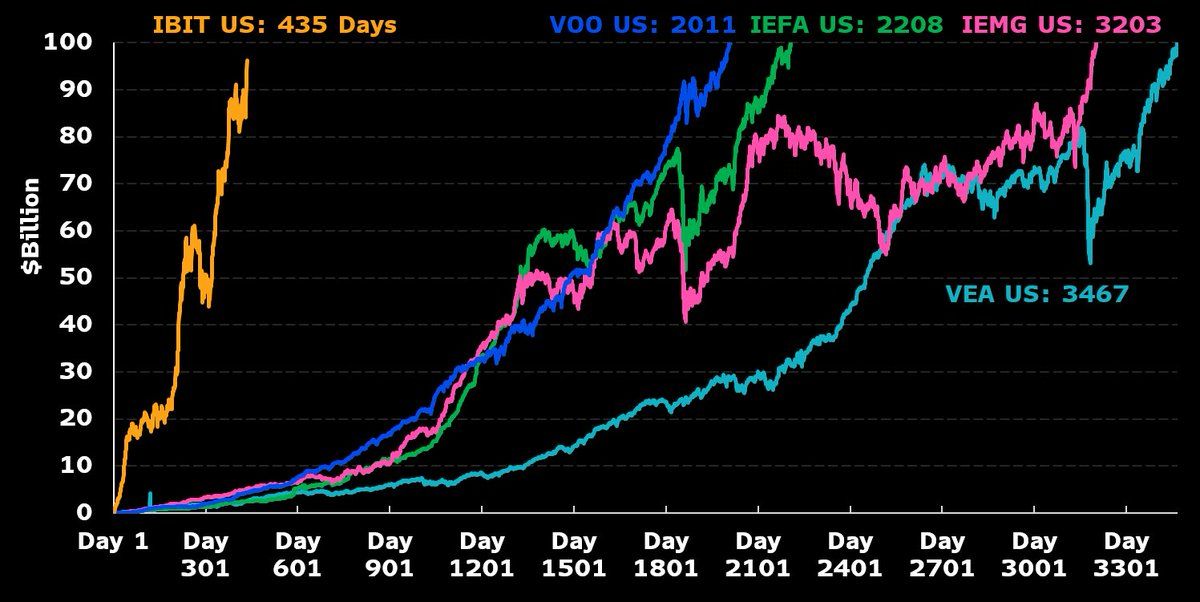

He highlighted the fund’s remarkable growth by comparing it to other major ETFs, pointing out that the Vanguard S&P 500 ETF (VOO) reached $100 billion in assets under management after 2,011 days.

Meanwhile, IBIT is close to accomplishing the same feat even though it has been in the market for less than 2 years, making it one of the fastest-growing ETFs ever.

“World’s largest ETF, Vanguard S&P 500 ETF, took 2,000+ days to hit that mark. IBIT about to do it in < 450 days. Easily fastest ever. First ETF launched in 1993, so we’re talking 30+yrs of history,” Nate Geraci added.

Bitcoin ETF Inflows Hit Record Highs in Uptober

Meanwhile, the growing enthusiasm around IBIT comes as Bitcoin and spot Bitcoin ETFs continue to post record highs during what the crypto community calls ‘Uptober.’ Last week, Bitcoin ETFs saw $3.2 billion in net inflows.

This represented the largest weekly inflow of 2025 and the second-highest on record. BlackRock’s IBIT accounted for the lion’s share, attracting $1.78 billion in inflows.

Even on October 6, Bitcoin ETFs recorded $1.19 billion in net inflows — the first billion-dollar day since July and the largest single-day inflow of 2025. According to SoSoValue data, of that amount, $969.95 million came from BlackRock’s IBIT, reinforcing its dominance as the largest Bitcoin ETF

So far in October, total inflows have reached $2.29 billion in just six days, compared to $3.53 billion total in September, suggesting this month could become one of the strongest yet for Bitcoin ETFs.

These inflows come amid Bitcoin’s latest price rally. As BeInCrypto previously reported, the leading cryptocurrency broke above $125,000 over the weekend and surpassed $126,000 shortly afterward to reach a new all-time high.

BeInCrypto Markets data showed that at the time of writing, BTC traded at $124,569, up nearly 9% over the past week. This reflects strong market momentum supported by massive institutional inflows.