The recent downturn in Bitcoin (BTC) prices has captured the attention of crypto investors, as it currently hovers around $57,000.

The low is fueled by a sharp reduction in demand, signaling potential shifts in the market sentiments.

Why Bitcoin Price Has Been Falling?

Traditionally driven by robust demand from permanent holders and large investors, Bitcoin has seen a stark reversal in this trend. According to a CrytoQuant report shared with BeInCrypto, there has been a dramatic 50% drop in monthly growth from permanent holders.

The demand decreased from over 200,000 BTC in late March to 96,000 BTC currently. Permanent holders are investors who buy to hold and never sell. They are pivotal in maintaining Bitcoin’s market stability.

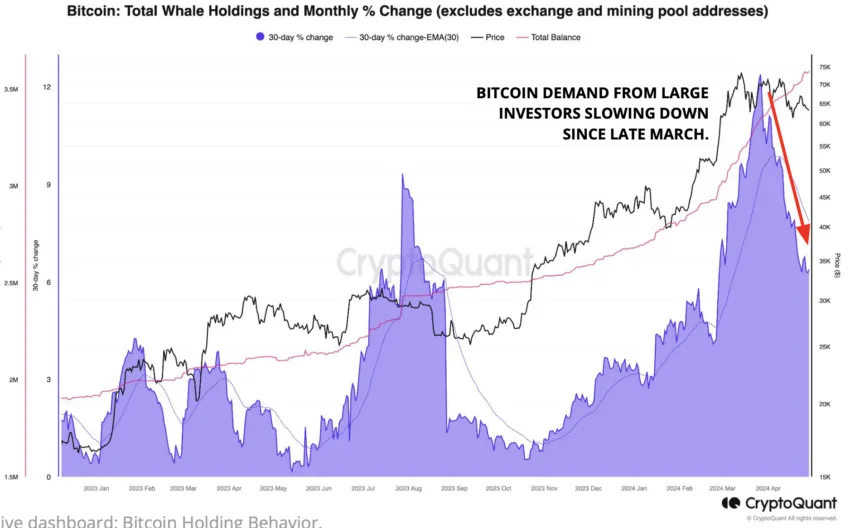

Similarly, large investors, often called ‘crypto whales,’ have also shown a slowdown in demand. These investors, who typically hold between 1,000 to 10,000 BTC, saw their demand growth rate peak at 12% in March. However, the rate has since halved to 6%.

Experts like Matteo Greco, a Research Analyst at Fineqia International, suggest that increased selling pressure, particularly from long-term holders, usually signals a broader market anticipation of a downturn.

“When there’s a significant increase in selling pressure from long-term holders, it typically indicates that most ‘relevant’ market participants anticipate a sell-off,” Greco told BeInCrypto.

Read more: Who Owns the Most Bitcoin in 2024?

Moreover, the decrease in demand is further evident in the sharp reduction of Bitcoin purchases from spot exchange-traded Funds (ETFs) in the United States. Following a peak in mid-March, where daily purchases exceeded $1 billion, the current buying rate from these ETFs has dwindled to virtually zero.

BlackRock’s iShares Bitcoin Trust (IBIT) has reported no new inflow in the past five days, highlighting broader market hesitancy.

Adding to the pressure is an increase in Bitcoin selling by miners. Over the last month, there has been a noticeable rise in daily sales by miners, reaching the highest levels since early January.

This selling activity often indicates Bitcoin miners’ need to cover operational costs or take profits, which can exacerbate downward price movements.

Can Bitcoin Find Support at $57,000?

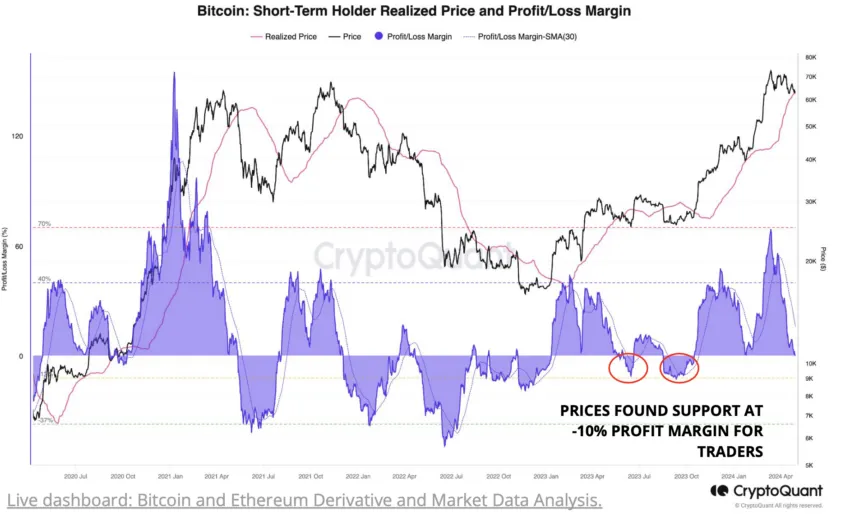

From a valuation perspective, the immediate future could see Bitcoin prices reversing from the $55,000 to $57,000 range. This projection is based on the short-term holders’ realized price, which falls around $63,000.

“$55,000 to $57,000 level is 10% below the current realized price of short term holders, which has been the ultimate support for prices during bull markets. Current Bitcoin price is already below short-term holders realized price,” CryptoQuant explained.

Read more: Bitcoin Price Prediction 2024/2025/2030

Bitcoin’s price movements have historically shown resilience, with reversals occurring around key realized price levels. For instance, in January 2024, Bitcoin’s price bottomed after declining to the short-term holders’ realized price levels, which was around $38,500.

“During bear markets, the realized price acts as a ceiling, and as a floor in bull markets,” the firm noted.

Thus, investors might anticipate price reversals from the $55,000 to $57,000. Otherwise, the market might enter into a broader downtrend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.