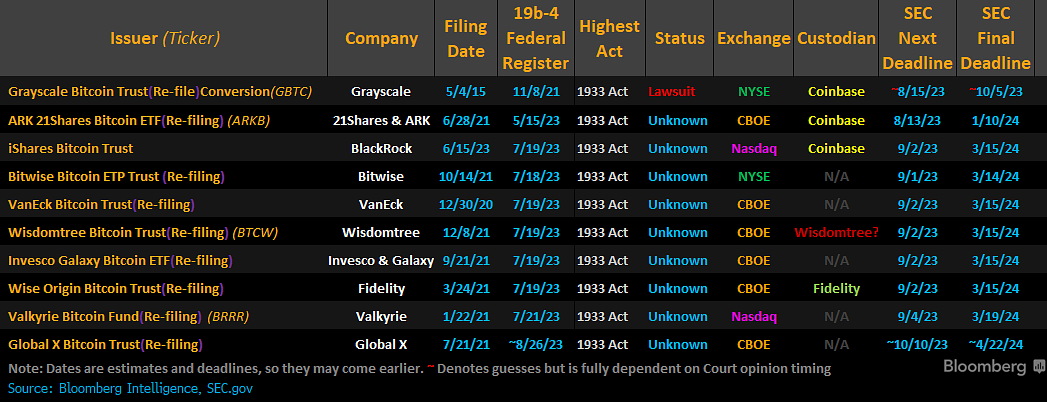

Amid surging anticipation surrounding a greenlight for Bitcoin ETFs, a whiff of uncertainty lingers. The US Securities and Exchange Commission (SEC) is set to evaluate Bitwise’s Bitcoin ETP Trust application by Sept. 1.

Following on its heels, giants like BlackRock, VanEck, WisdomTree, and Invesco await their verdicts.

BlackRock Bitcoin ETF and an Army of Contenders

Many consider the BlackRock Bitcoin ETF to have the highest chance of acceptance. With a near-spotless record of launching ETFs, its name has added an aura of credibility to this entire initiative. Nonetheless, the path to potential approval remains rocky.

Crypto enthusiasts and the larger audience have pinned their hopes on introducing a spot-Bitcoin ETF. Advocates suggest that its establishment could act as a conduit, making Bitcoin investments more mainstream.

However, concerns over fraud and manipulation persist, casting shadows over these aspirations. For example, Gemini’s initial attempt at a physically-backed Bitcoin ETF in 2013 fell through after the SEC’s refusal.

Read our guide on the SEC’s case against Ripple: Everything You Need To Know About Ripple vs SEC

Interestingly, the recent atmosphere of enthusiasm has spurred issuers to venture beyond Bitcoin ETFs, exploring the territories of Ether futures or a blend of Bitcoin-and-Ether futures ETFs. The SEC, however, remains hesitant; their earlier resistance to Ether-futures ETFs is a testament.

In a ray of hope, the successful launch of Volatility Shares 2x Bitcoin Strategy ETF (BITX) garnered attention. Inaugurated in June, it has since accumulated assets exceeding $20 million, being the first of its kind. This success story notwithstanding, the SEC has a structured timeline to determine the fate of spot-fund applications, culminating in a final verdict within 240 days.

The consensus among market pundits predicts another delay come September. Stephane Ouellette, CEO of FRNT Financial, emphasized the historical trend: the administrators’ propensity to maximize their powers to postpone their decisions.

“Even if these products were ultimately approved, it would be very surprising to see them approved at the first instance they are able to be.”

SEC Gets the Final Say

A lingering question then remains: Will the SEC nod in favor of the current flurry of Bitcoin spot ETF applications? Former SEC attorney, John Reed Stark, remains skeptical. He references the Better Markets’ Comment Letters, highlighting concerns over the Bitcoin market’s vulnerability to manipulations.

Better Market’s letter reads,

“The spot bitcoin markets (1) have a history of artificially inflated trading volumes due to rampant manipulation and wash trading; (2) are highly concentrated; and (3) rely on a select group of individuals and entities to maintain bitcoin’s network. These are features of the bitcoin network that make a proposed spot bitcoin-based ETP extremely vulnerable to manipulation by bad actors, posing unnecessary risks to investors and the public interest.”

Stark opines that the present SEC is unlikely to approve such an ETF, citing multiple potential risks.

However, Stark suggests a potential shift in the SEC’s approach post-Election Day. Over the years, the previously non-partisan crypto issue has now split the two major political parties in the US.

With an impending election in 2024, a Republican triumph could ease the SEC’s current strict crypto stance, possibly making the road smoother for a Bitcoin spot ETF.