BlackRock, the world’s leading investment manager, has recently unveiled the BlackRock USD Institutional Digital Liquidity Fund through an SEC filing.

This innovative fund, based in the British Virgin Islands, emerges from a partnership with Securitize.

BlackRock’s Fund Sparks RWA Boom Anticipations

Details about the fund’s holdings are still under wraps. However, the collaboration with Securitize, known for its asset tokenization expertise, hints at a focus on Real-World Assets (RWA) tokenization.

This process transforms physical assets like real estate into blockchain tokens, thus enhancing their liquidity and market accessibility.

Following the fund’s announcement, blockchain enthusiasts noticed a significant transaction. A sum of $100 million in Circle’s USDC stablecoin was transferred on the Ethereum network, likely linked to BlackRock’s new venture.

Although the investment’s specifics remain unconfirmed, the market perceived it as a potential seed for the fund.

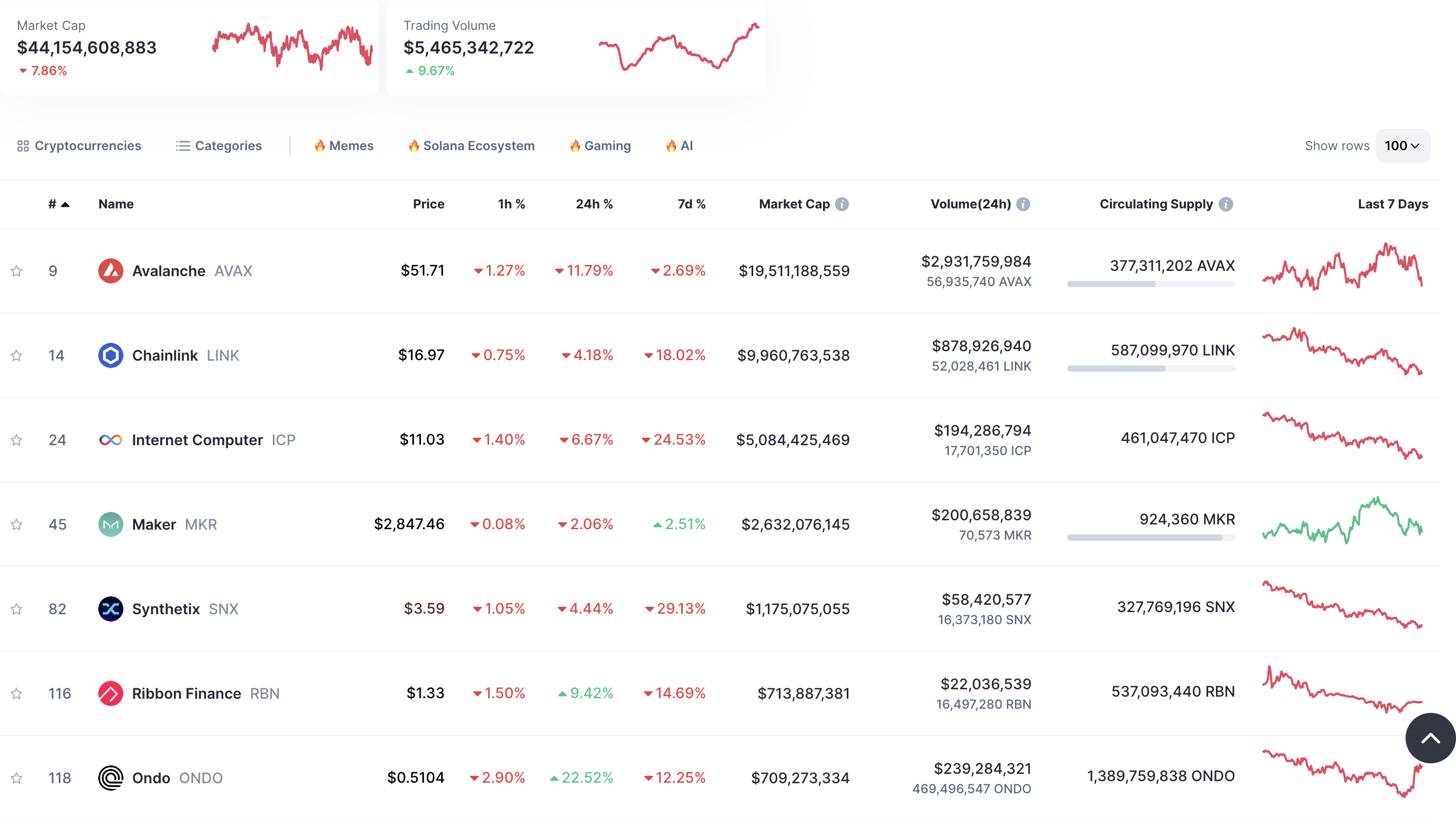

The RWA tokens saw an uptick as the crypto community responded swiftly to BlackRock’s initiative. Ribbon Finance (RBN) and Ondo, for instance, experienced gains of 9.42% and over 22%, respectively. These movements highlighted the market’s optimistic view of institutional investments in crypto.

“This is a huge step towards RWA adoption,” The DeFi Investor said.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

Despite these positive trends, the broader RWA token sector still faces challenges. CoinMarketCap data shows a 7% decline in the total market capitalization for RWA tokens, now at $44.15 billion.

This downturn mirrors the larger market’s struggles, emphasizing the volatile nature of cryptocurrency investments.

This strategic move by BlackRock is not its first in the crypto ecosystem. Earlier, the firm launched a spot Bitcoin (BTC) exchange-traded fund (ETF) and filed for a similar product for Ethereum (ETH), reflecting its growing commitment to crypto investment solutions.

In January, Larry Fink, BlackRock’s CEO, discussed the transformative potential of tokenization. He highlighted how tokenized securities, combined with identity verification, could redefine financial transactions.

Read more: Where To Buy Tokenized or Fractionalized Real Estate and Art

“We have the technology to tokenize today. If you have a tokenized security and identity, the moment you buy or sell an instrument on a general ledger, that is all created together. You want to talk about issues around money laundering. This eliminates all corruption by having a tokenized system,” Fink explained.