The price of Bittensor (TAO), a leading artificial intelligence-based token, has surged dramatically in recent weeks. The altcoin is currently trading at $638.43, marking a 126% increase over the past month.

On October 7, a golden cross was formed on TAO’s one-day chart, suggesting that the AI token will extend its rally and trade above $700. The question remains: how soon can this happen?

Bittensor Enjoys the Goodwill of the Bulls

BeinCrypto’s assessment of Bittensor’s price movements on a daily chart has revealed that a golden cross was formed on October 7. This technical indicator emerges when an asset’s 50-day Simple Moving Average (SMA) crosses above the 200-day SMA.

Traders view it as a strong buy signal because it suggests that momentum is shifting in favor of buyers and that the asset’s price may continue to rise.

Read more: Top 9 Safest Crypto Exchanges in 2024

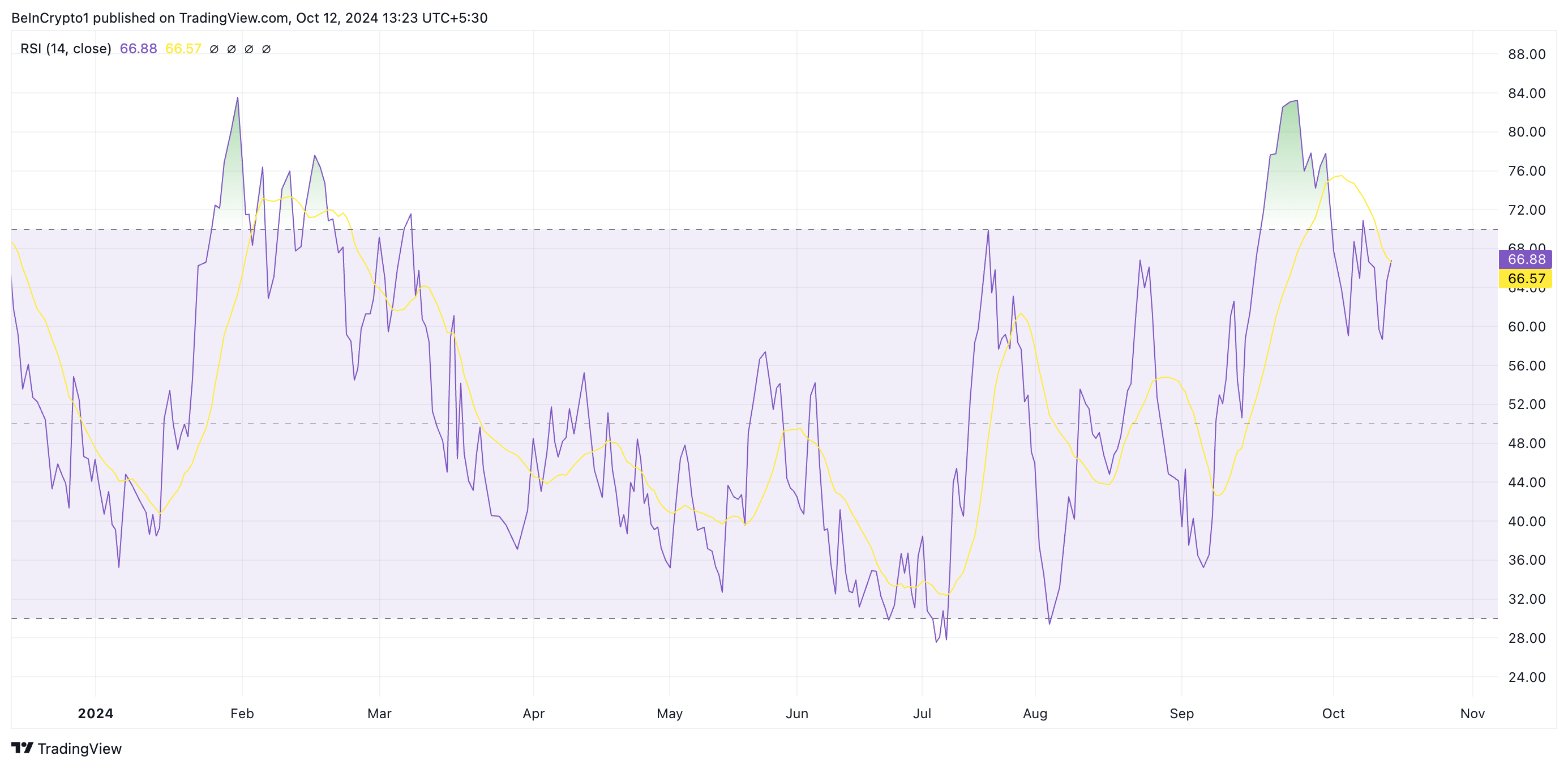

TAO’s Relative Strength Index (RSI) supports this bullish outlook. As of this writing, TAO’s RSI, which measures its overbought and oversold market conditions, is in an uptrend at 66.13. This RSI value indicates that TAO’s buying pressure is strong, and it is experiencing positive price momentum.

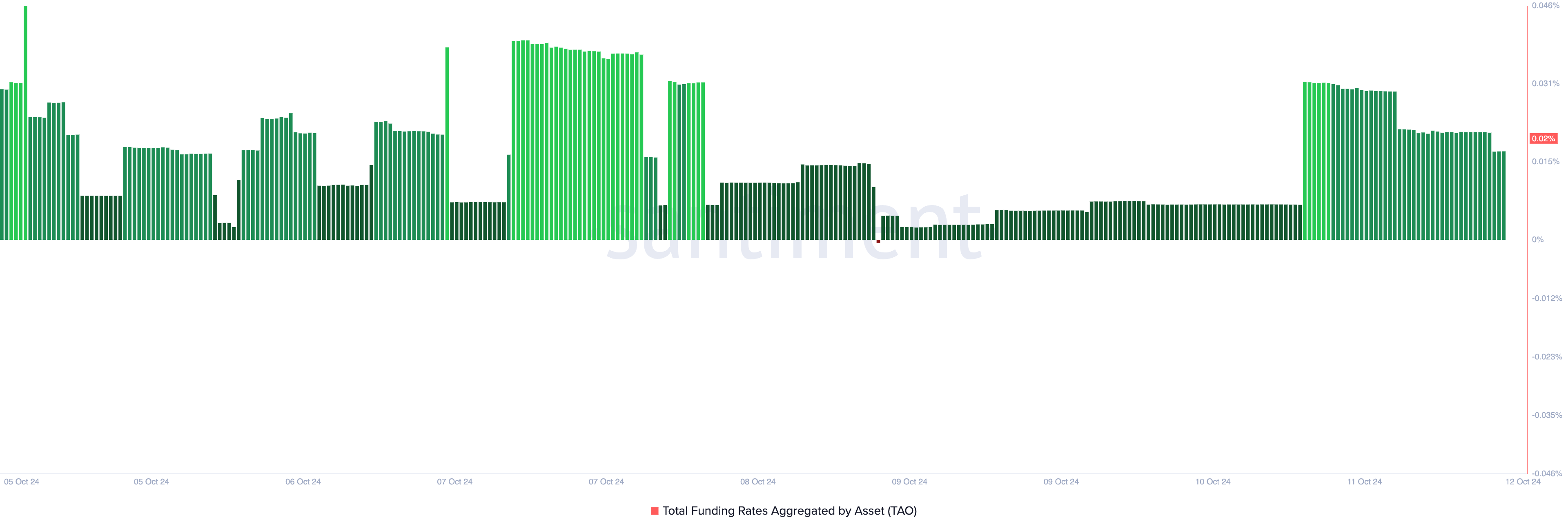

Additionally, the same bullish bias exists in the token’s derivatives market, as evidenced by its positive funding rate. This periodic fee ensures an asset’s contract price stays close to its spot price. At press time, TAO’s funding rate stands at 0.02%.

A positive funding rate signals that bullish sentiment dominates the market. It suggests that more traders hold long positions and expect the asset’s price to increase than those anticipating a decline.

TAO Price Prediction: $700 Is Just Right Ahead

TAO is currently trading at $645.58, just right above the key resistance level of $643.74, a barrier it has not surpassed since April 11. If the ongoing uptrend persists, TAO’s price could remain above this resistance and rally toward $774.86, its year-to-date high, last reached on April 10.

Read More: How To Invest in Artificial Intelligence (AI) Cryptocurrencies?

However, if holders decide to take profits, selling pressure could cause another failed attempt to breach the $643.74 resistance. This might lead to a decline toward the major support level at $540.81.

If that support fails to hold, TAO’s price could fall further, potentially reaching $306.77.