Ethereum’s staking landscape has shifted sharply over the past month as institutional investors, led by BitMine and new ETFs, have saturated the network.

This influx has created a logistical bottleneck, forcing new participants to wait roughly a month before their staked assets begin earning returns.

Institutions Flock to Ethereum Staking Despite Record-Low Yields

On January 9, blockchain analyst Ember CN reported that BitMine has moved more than 1 million ETH (over $3.2 billion) into Ethereum’s proof-of-stake system over the past 30 days.

This single allocation, comprising roughly a quarter of BitMine’s total corporate treasury, has swollen the entry queue to 1.7 million ETH, its highest level since 2023.

Meanwhile, this surge was also fueled by the arrival of regulated US financial products in the staking ecosystem.

Over the past week, the Grayscale Ethereum Staking ETF and 21Shares’ TETH ETF distributed their first rounds of rewards. The payouts demonstrated that traditional investment vehicles can successfully pass protocol-level earnings to shareholders.

Notably, this institutional momentum comes even as the network’s staking rewards have compressed significantly.

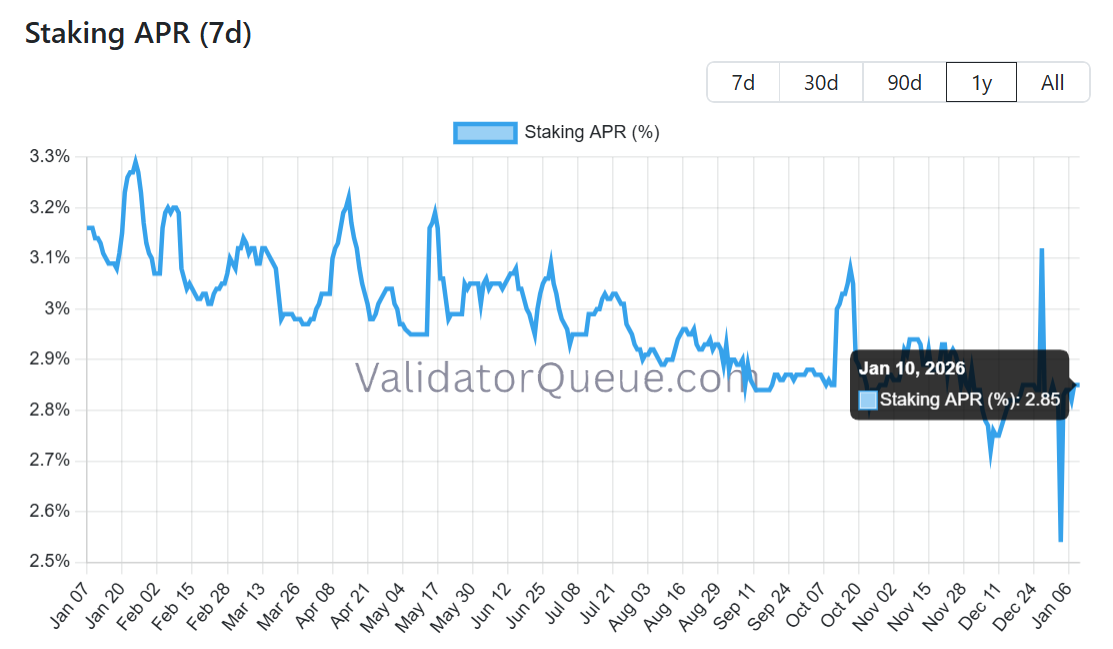

According to validator queue data, ETH’s staking annual percentage rate (APR) dropped to an all-time low of 2.54% earlier this year before recovering slightly to 2.85% as of press time. Over the past year, the APR had averaged over 3.0%.

This data highlights that investors remain willing to stake their assets despite significantly lower returns.

Despite the influx of regulated US entities, ETH’s staking control remains concentrated among a few incumbents.

According to data from Dune Analytics, decentralized autonomous organization Lido DAO retains dominance with 24% of all staked Ether, followed by Binance at 9.15% and Ether.fi at 6.3%. Coinbase, the largest US-based crypto trading platform, controls 5.08%.

Perhaps most significant is the persistence of anonymous actors. The Dune Analytics data also shows that untagged entities control about 27% of the network’s total stake.

This leaves a significant share of Ethereum’s security infrastructure in the hands of unidentified operators who face none of the compliance requirements that bind firms like BitMine.