Bitfarms CEO Emiliano Grodzki has resigned. He will be replaced by Geoffrey Morphy, the company’s chief operating officer. This comes amid a disastrous year for Bitcoin miners, causing some large firms to declare bankruptcy.

The miner announced Grodzki’s departure in a statement, adding that he will continue serving as a Board Director. Meanwhile, Co-founder Nicolas Bonta will transition from Executive Chairman to Chairman of the Board of Directors.

Bonta gives Geoff credit for transforming Bitfarms from a wholly Canadian trading business into a global force.

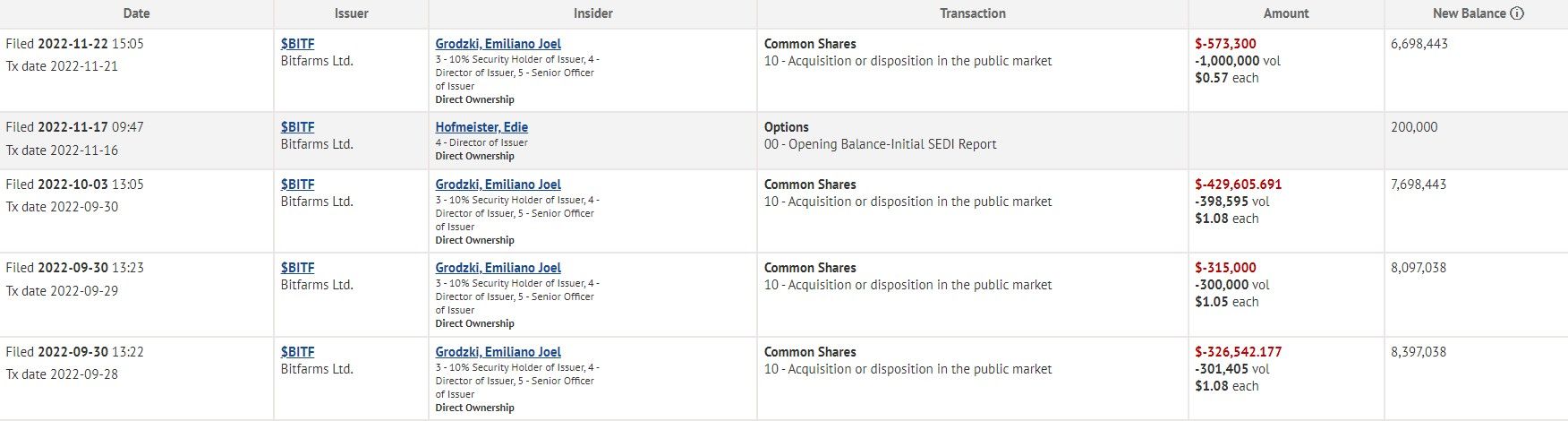

Bitfarms Exec Sold Stake

Bitfarms is a multinational, publicly traded, self-mining firm established in 2017. Ten Bitfarm-operated mining farms are located in Canada, the United States, Paraguay, and Argentina.

After the change, a Twitter user expressed concern about Argentina’s position in the mining space:

According to Balmy Investor, Grodzki also sold his stock in the company in H2 2022. Based on SEDI insider filing data, the former CEO sold 1 million common shares of the company last month. After this, the common stock balance he held reduced to 6.69 million shares from almost 10.83 million held in December 2021.

In the last year, Bitfarms’ trading price on Nasdaq has also dropped from $5.39 to $0.3760. This is almost a 93% fall in value. Additionally, industry players say that mining operations have suffered due to a sustained drop in the price of BTC, rising electricity costs, and an increase in the network’s total hash rate.

BTC has been recording weak sentiments, with its price remaining in the red. At the time of press, Bitcoin is treading water above $16,400. In 2022, Bitcoin fell by 65% fall— 75% if you count from its all-time high of $69,000. Meanwhile, in the previous 24 hours, the global cryptocurrency market cap has dropped to $826 billion per CoinGecko.

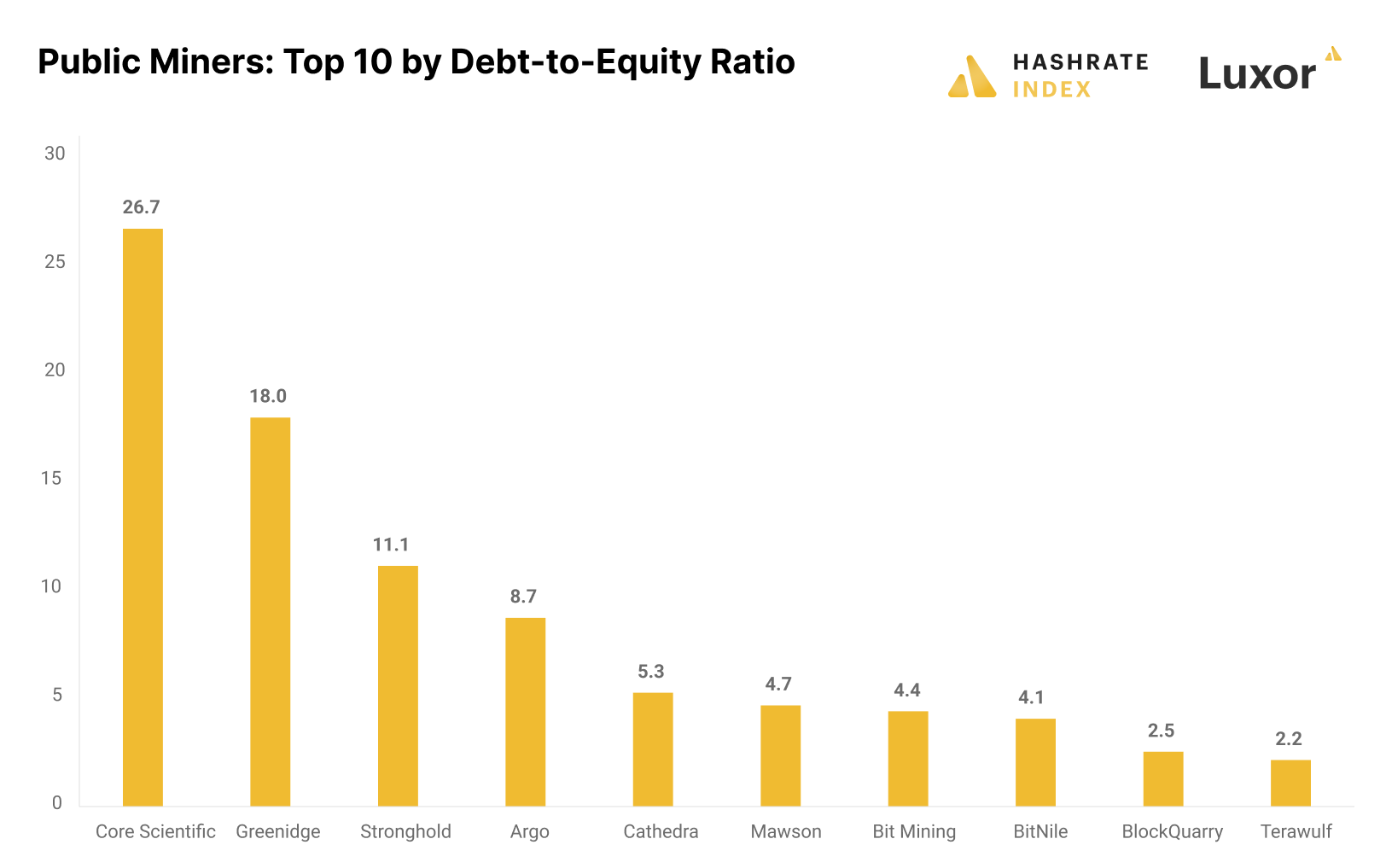

Miners Record High D/E Ratio

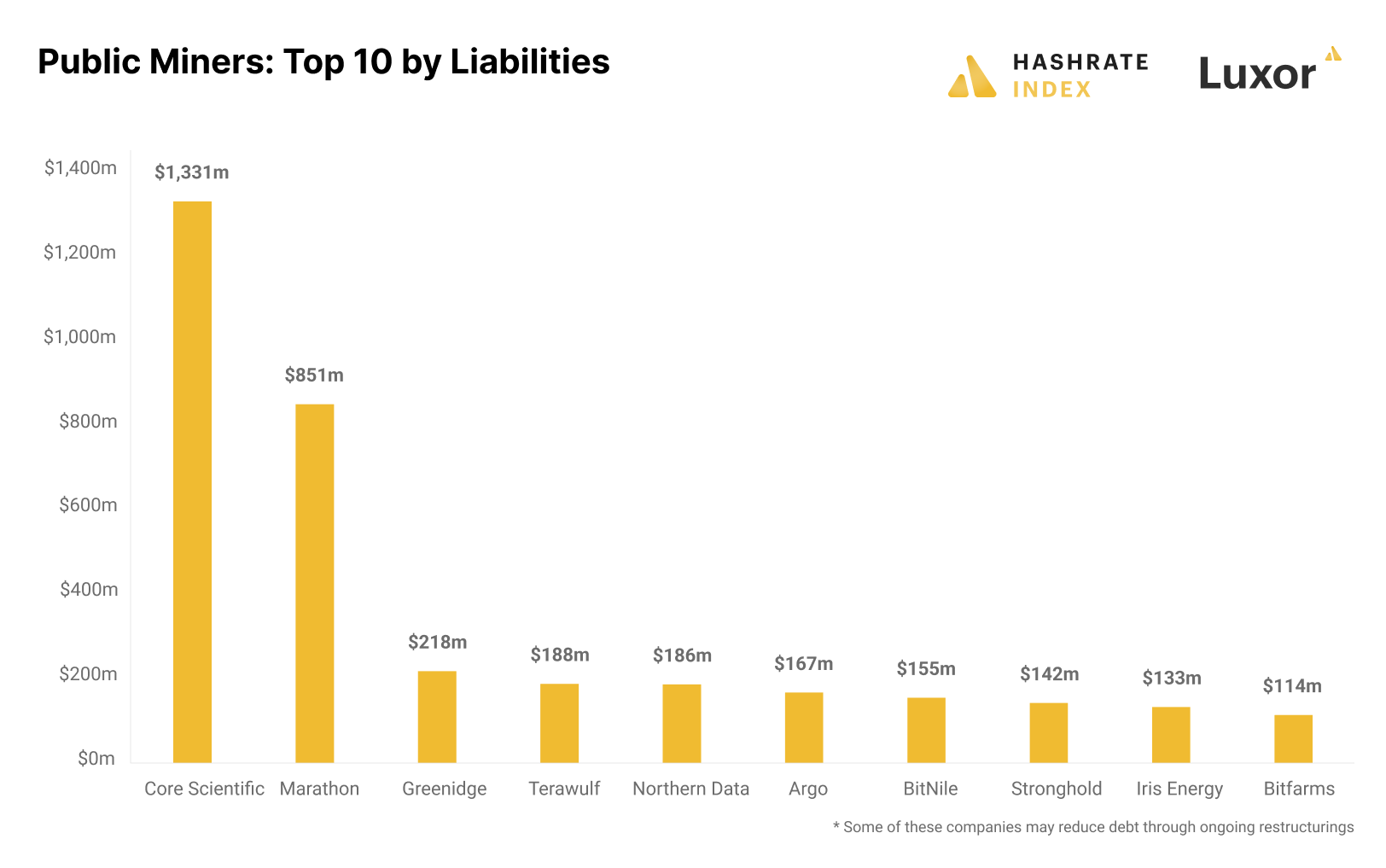

Last week, well-known American publicly traded Bitcoin miner Core Scientific filed for Chapter 11 bankruptcy protection. The news follows a protracted crypto winter and sluggish Bitcoin price movement; both made worse by the FTX bankruptcy. The company seemingly had the highest debt-to-equity (D/E) ratio among its competitors and the most debt borrowing.

Marathon, with $851 million in obligations, is the second-largest debtor. BitFarms is positioned in a safe tenth place, with $114 million in debt and no apparent risk of bankruptcy.

According to Hashrate Index’s analytics, the combined debt of publicly traded bitcoin mining companies exceeds $4 billion.

The platform notes that a debt-to-equity ratio of two or above is regarded as dangerous in most sectors. While Core Scientific had a D/E ratio of 26.7, it had an enormous amount of obligations. Argo’s D/E ratio of 8.7 is also extremely high per the platform’s parameter.

Peers like Riot Blockchain, Canaan Inc., and Marathon Digital Holdings didn’t make it to the list. But another top player, BIT Mining Limited, also has a high D/E of 4.4.