On March 13, the Bitcoin price reached a low of $3,875 and immediately bounced upwards to reach successive weekly closes above $5,000. These higher closes allow for the outline of a support line that suggests the price will gradually increase.

One such tool that is used to measure long-term support and resistance levels and determine long-term movement is the pitchfork. In addition, it can be used to measure the rate of increase for a period of time, based on which part of the pitchfork the price is in.

🙈🙉🙊 pic.twitter.com/39G8EYDhU1

— MAD MAXi. 🇵🇸🕊️ (@888Velvet) March 29, 2020

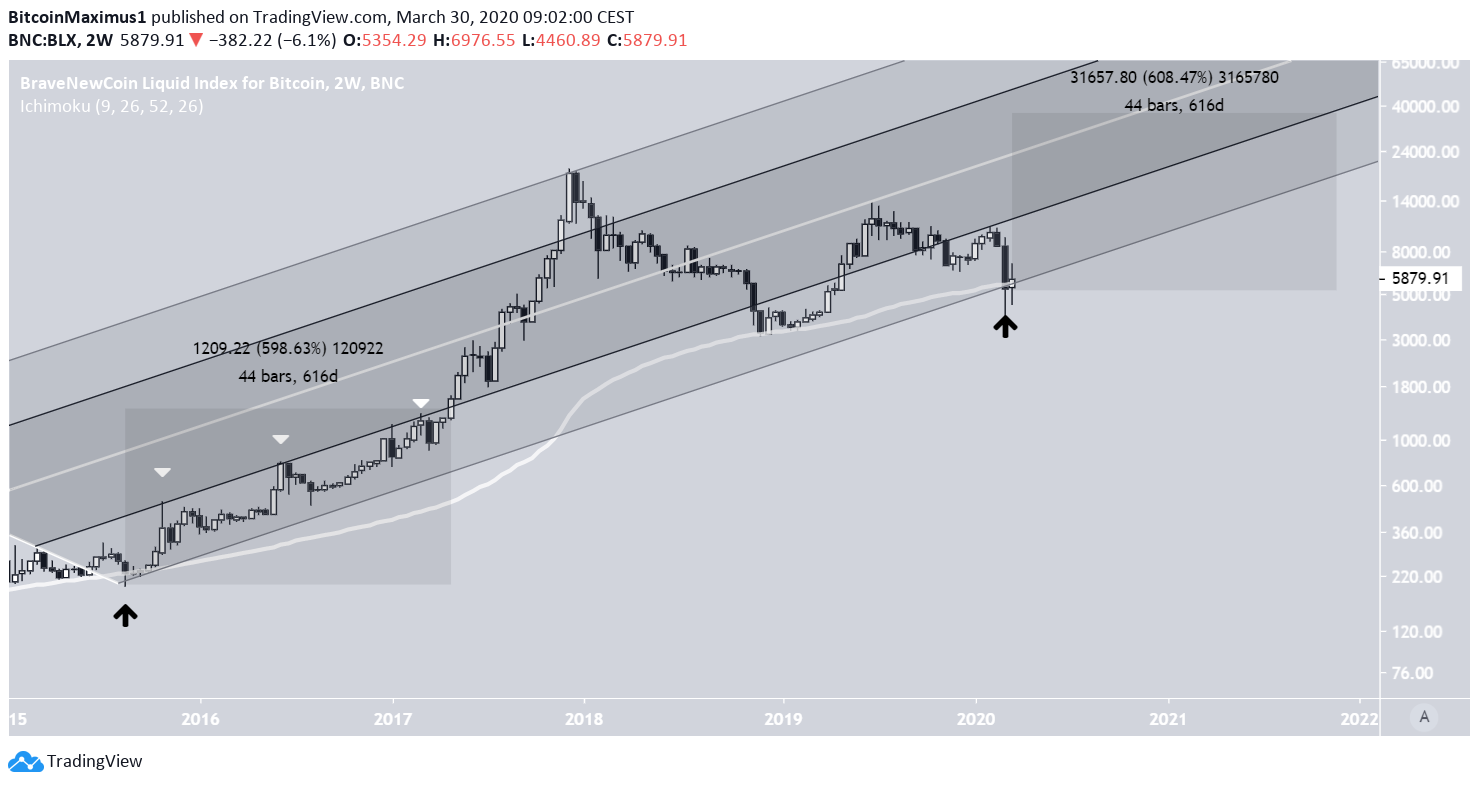

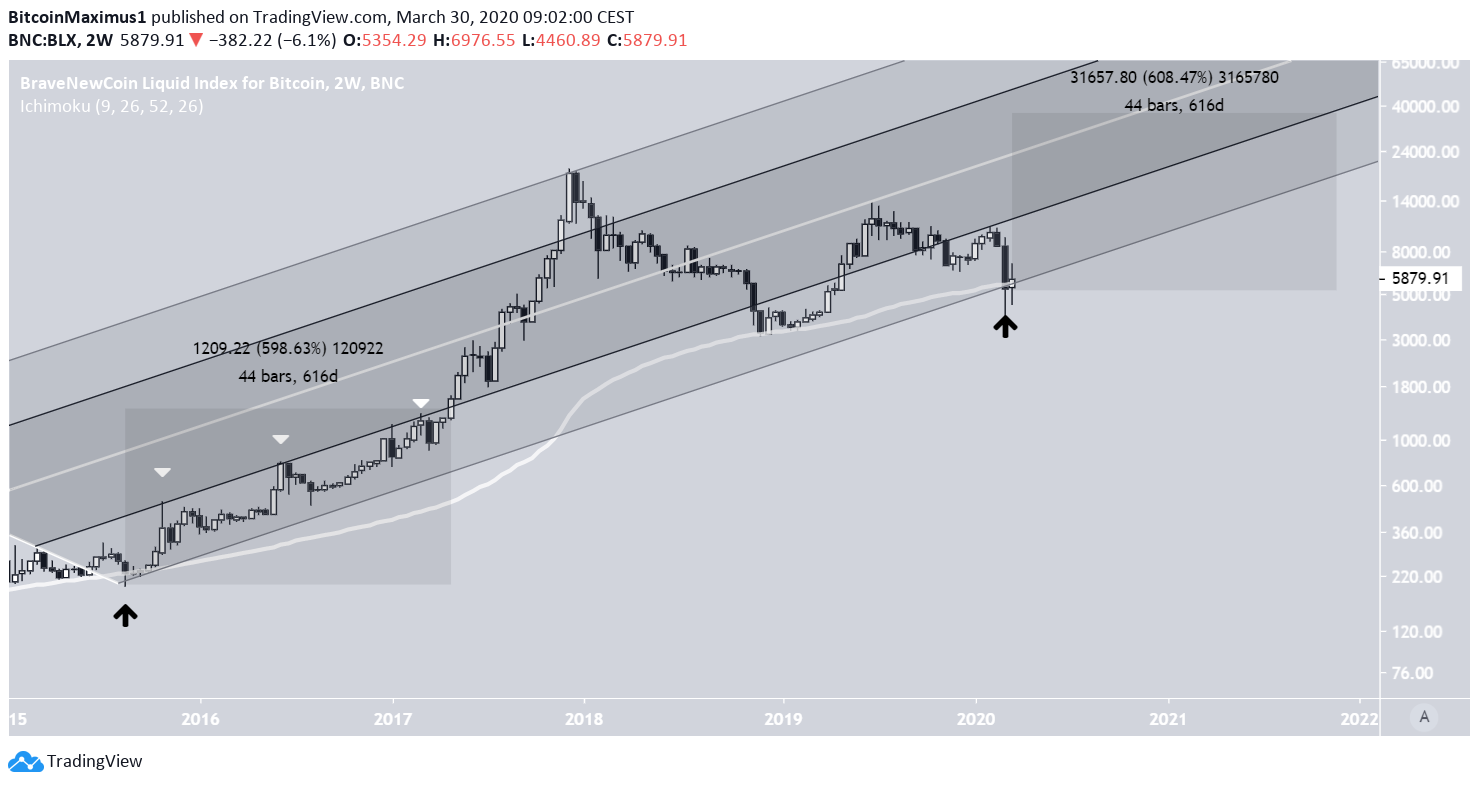

Well-known trader @velvet888 tweeted a Bitcoin chart, which shows that the price has bounced on the bottom support line of this indicator. According to the pitchfork, the price has reached its lower bound and is expected to increase gradually from here.

Outlining the Bitcoin Range

The pitchfork is outlined using three dates:

- The median line is drawn from the April 2013 high of $160.

- The resistance line is drawn from the November 2013 high of $1,177, which marked the end of the upward market cycle for BTC.

- The support line is drawn from the August 2015 low of $224, which marked the low before the price began the subsequent market cycle that led to the all-time high reached in December 2017.

So far, all three lines have only been touched once. The resistance line was reached at the all-time high of $19,677. Next, the median line was touched in June 2020, with a high of $13,834. BTC is currently perched just above the bottom support line.

Since the pitchfork has been extended to its limit, another price decrease would invalidate its viability as an indicator. However, since we are using closing prices instead of wicks, the price would have to close below the support line of the pitchfork, rather than just decrease below it in the short-term.

Future Movement

The tweet has also added the 0.5 Fibonacci level inside the pitchfork. The line reacted thrice to the movement throughout 2015-2017 before BTC was finally able to break out successfully. Afterward, the rate of increase greatly accelerated. This movement began once the price bounced on the confluence of the 200-week moving average (MA) and the support line of the pitchfork. Throughout the time the price was in this lower band, it increased by 600% in 616 days, for a daily increase of 1%.

The price is now sitting on the same confluence of the MA and the support line. If it begins a similar movement with the same rate of increase, it could reach a high of $40,000 by November 2021. This would also still allow the price to remain inside the lower band. A breakout above would presumably greatly increase this acceleration rate.

To conclude, the Bitcoin price has reached the support line of a long-term pitchfork and the 200-week MA. If it acts in a similar manner to the previous time it reached this support level, it will increase gradually until November 2021, reaching a high of around $40,000.