During the week of Aug 24-31, Bitcoin created a bullish hammer above a significant resistance area. This is a bullish sign that suggests continuation.

However, short and long-term indicators aren’t aligning. Daily signals are bullish while weekly technicals appear bearish.

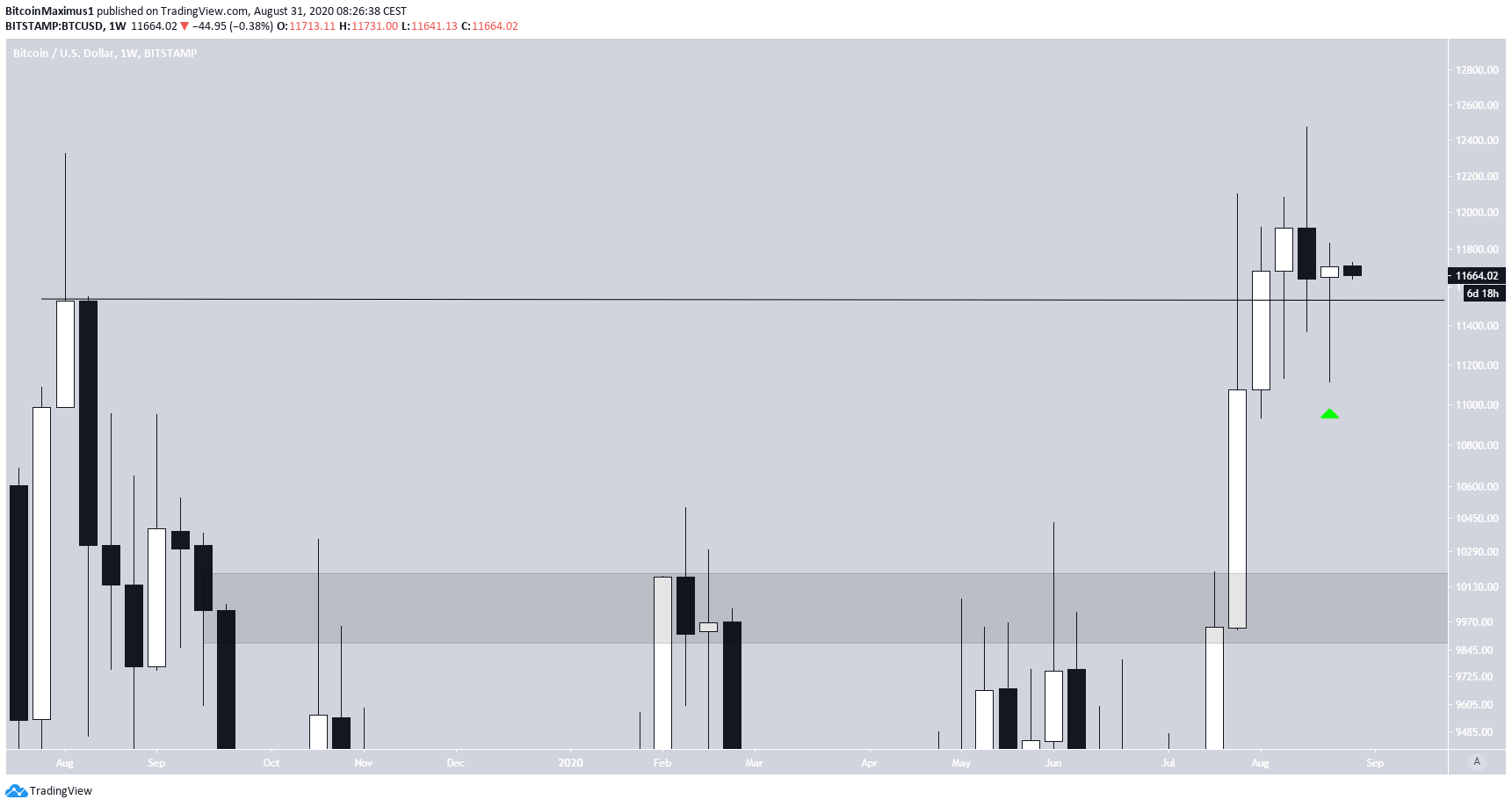

Bitcoin Weekly Outlook

During the week of August 24-31, the Bitcoin price created a bullish hammer. The candlestick succeeded a shooting star, which was a bearish sign coming after a parabolic uptrend.

The week concluded with a bullish close over the July 2019 highs. This is a strong sign of continuation since BTC was able to sustain the higher prices after the breakout.

However, technical indicators are showing weakness. There is a very significant bearish divergence that has developed in both the RSI and MACD relative to the July 2019 highs. Furthermore, the Stochastic RSI is overbought and could be getting ready to make a bearish cross.

While the MACD is decreasing, it failed to give a bearish reversal signal due to the bullish weekly close.

Therefore, while the candlestick outlook in the weekly chart is bullish, almost all other technical indicators are bearish.

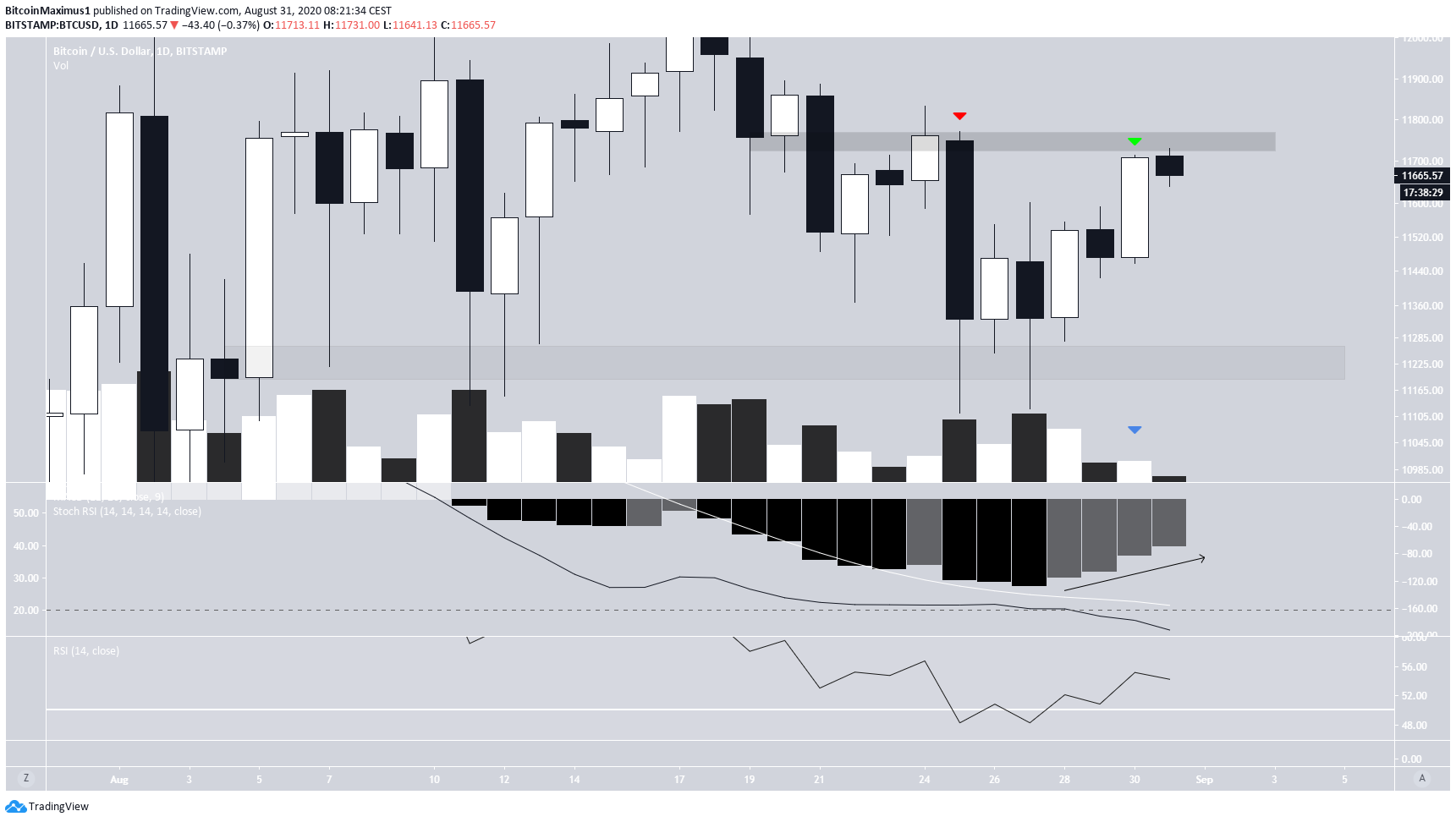

Bullish Daily Close

In BeInCrypto’s Bitcoin analysis from Aug 30, we stated that:

$11,540 is the key level to watch, while a daily close above $11,640 would almost remove all doubt that the price is going higher.

The daily close was $11,719. This is a bullish sign since it gave a bullish reversal signal in the MACD that has been increasing over the past four days.

Furthermore, the Stochastic RSI is heavily oversold and the RSI is above 50, so the readings are still bullish, even though volume was relatively low during Sunday’s rally.

The main resistance area is found at the top of the Aug 25 bearish engulfing candlestick near $11,750. The primary support area is found at $11,250.

A price increase above $11,750 and its validation as support would create a higher-high and likely confirm that the price is in a bullish trend.

Short-Term Weakness

The hourly chart shows that BTC has been trading inside an ascending wedge since Aug 27. This is a bearish pattern that suggests the price will decrease. Furthermore, it has been combined with a considerable bearish divergence in both the RSI and the MACD.

A drop would likely take the price back to the $11,400 level.

As outlined in our Aug 30 wave count analysis, the invalidation of the bulish wave count is $11,117 (green line) while the invalidation of the bearish count is $11,825 (red line).

To conclude, there is no perfect confluence between time-frame readings for the BTC price. The hourly reading is bearish, the daily reading bullish, and the weekly chart looks neutral.

Until one of the levels outlined above is broken, we cannot determine the direction of the next move.

For BeInCrypto’s previous Bitcoin analysis, click here!