Bitcoin’s price recently broke out of a bullish pattern, signaling the potential for a rise to $80,000. However, despite this positive technical setup, the biggest obstacle preventing the leading cryptocurrency from achieving a new all-time high is the behavior of its own holders.

BTC holders have been actively selling off their assets, creating a roadblock for Bitcoin’s upward trajectory.

Bitcoin Investors Are Greed

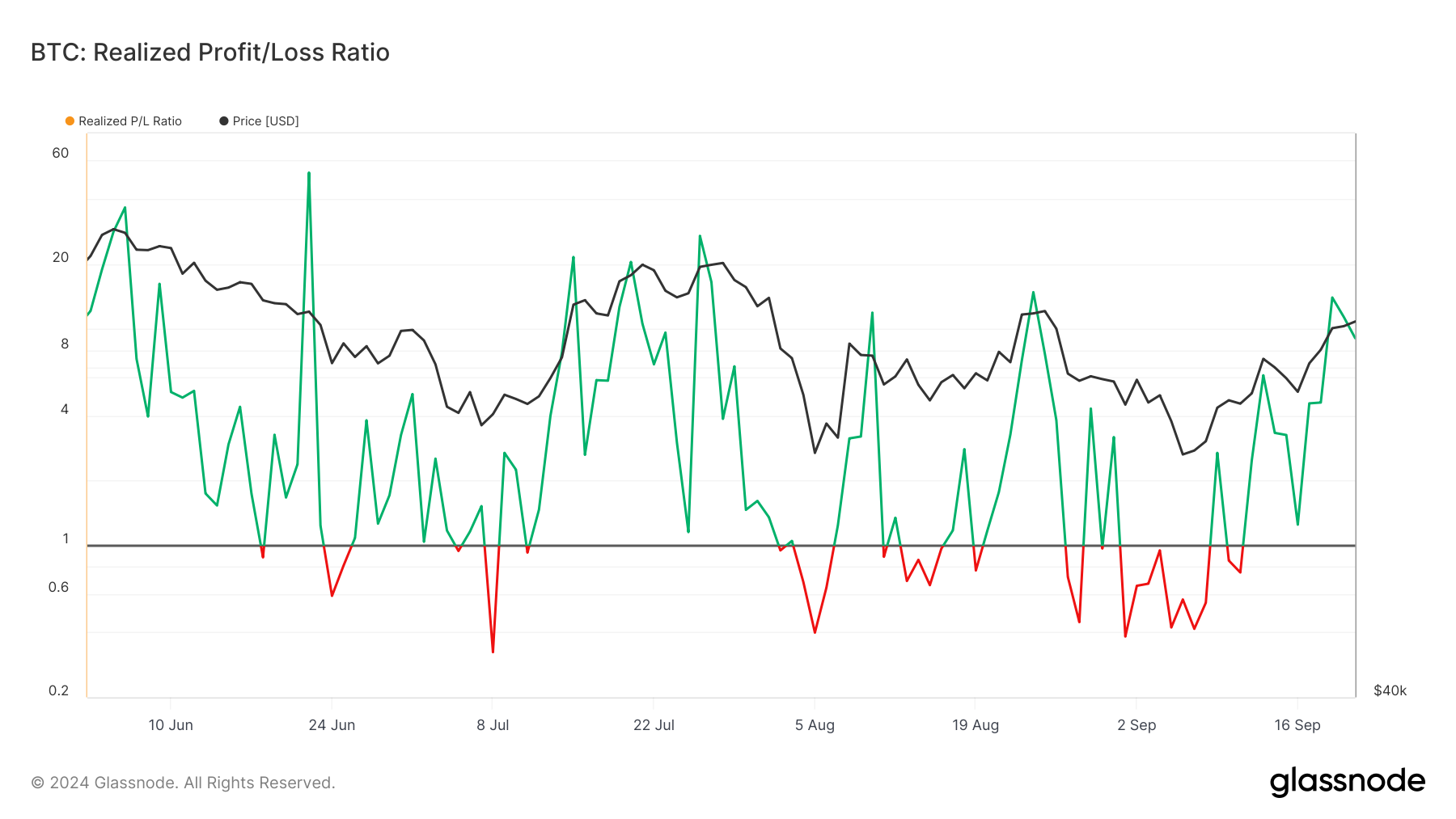

In recent days, investors have begun selling their Bitcoin holdings, as reflected in the rising realized profit/loss ratio. This metric, which measures the profitability of coins moved on-chain, has been increasing for the last ten days after bouncing back from the negative zone.

Historically, a spike in this ratio tends to precede corrections, as it indicates that investors are taking profits rather than holding their positions for further gains. The increase in realized profits signals selling pressure in the market. This behavior has the potential to slow down or even reverse the bullish momentum needed for Bitcoin to reach a new all-time high.

Read more: Bitcoin Halving History: Everything You Need To Know

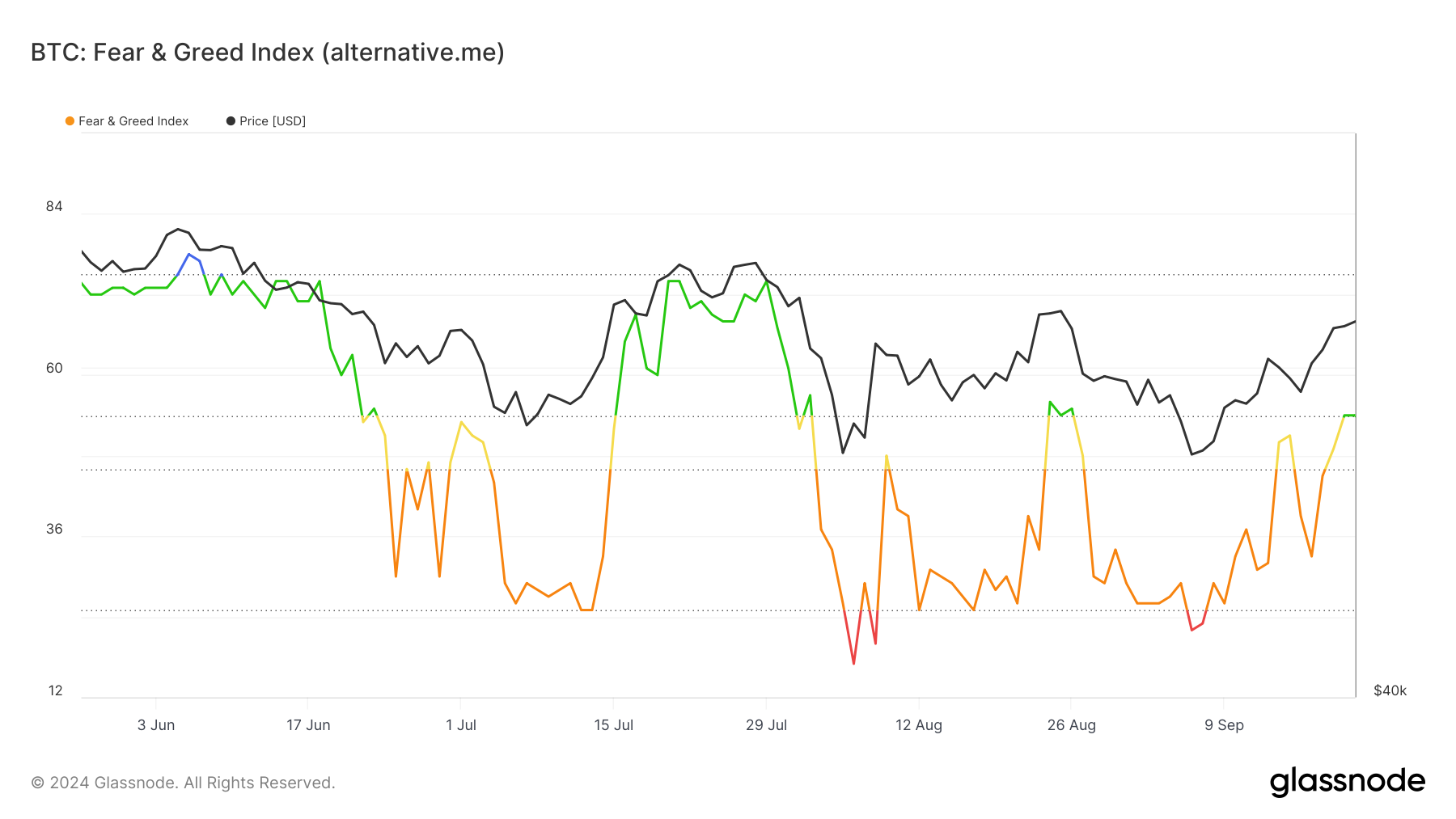

The macro momentum of Bitcoin also presents challenges. The Fear and Greed Index, which measures market sentiment, recently breached into the greed zone.

As Bitcoin’s price rises, more investors are becoming motivated by the desire to secure profits rather than continuing to HODL and support further gains. This shift in sentiment toward greed can lead to increased selling pressure.

When the market leans too heavily into greed, it often results in a pullback as holders begin to sell off their assets. This greed-driven behavior is a key factor in Bitcoin’s inability to maintain its upward momentum, as it creates a self-fulfilling cycle of selling pressure that prevents the cryptocurrency from reaching new heights.

BTC Price Prediction: Falling Back

Bitcoin is currently trading at $62,623, struggling to close above the critical resistance level at $63,724. The breakout remains unconfirmed until BTC can reclaim $65,000 as support, making the anticipated 35% rally to $80,000 uncertain.

Given the current market conditions, Bitcoin may face a potential drawdown below $61,846, which could lead to a loss of the $60,000 support level. This would delay the anticipated rally.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

However, if Bitcoin manages to overcome the bearish pressure and reclaim $65,000, it could trigger a significant rally. While validating the pattern with a 35% rise would result in the formation of a new all-time high, the most BTC can rise to is $68,500 but still manage to invalidate the bearish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.