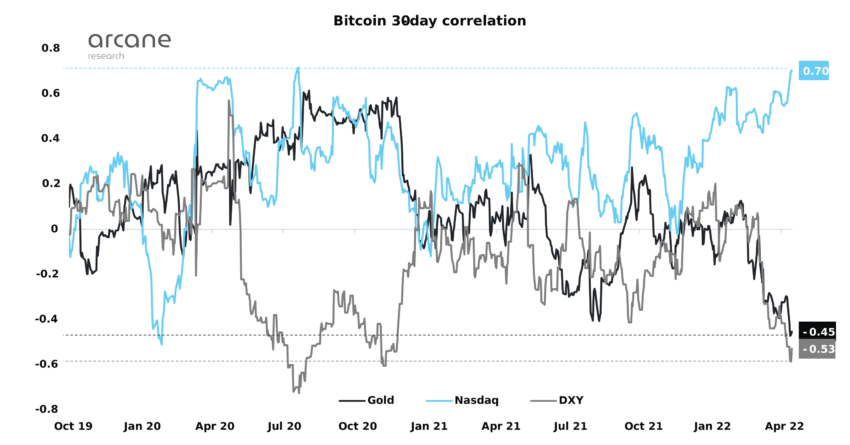

Bitcoin’s 30-day correlation with tech stocks has climbed to its highest point since Jul 2020, and its correlation to the S&P 500 is also at high levels. This may pose a problem for the crypto market, which is often talked about as a hedge.

Bitcoin’s 30-day correlation with big tech stocks has climbed to Jul 2020 levels, with its correction to gold plunging to all-time lows. Arcane Research published a blog post discussing the development, which also occurs at a time when bitcoin’s correlation with the S&P 500 is also at some of its highest levels.

Arcane Research has talked about these developments before, tentatively suggesting that they may pose some risk to the crypto market. Crypto assets have long been seen as something separate from other financial markets, an island that offers some safety as a hedge. However, that narrative appears to be changing as the larger financial world dives deeper into crypto.

Bitcoin’s growing adoption may lead to weakening correlation

It’s hard to say if the correlation will change significantly going forward, but it’s clear that as bitcoin’s adoption grows, its ability to remain detached from the rest of the world weakens.

The increase in correlation comes at a time when the S&P 500 and associated stocks are experiencing heavy volatility. Those who believe that crypto’s link to tech stocks is a cause for concern will only be more worried about this trend.

Big tech stocks tanking hard

There might be some cause for concern for crypto investors, as some major tech stocks have not been having the best ride of late. The most recent of these shocking drops is that of Netflix, with its stock plummeting by more than 25% yesterday and over 40% year-to-date.

This occurred after it revealed that it had lost subscribers for the first time in 10 years. It also expects to lose two million subscribers in the next quarter.

Meanwhile, Meta lost hundreds of billions in its market value earlier in the year, also to issues surrounding growth. The company is now moving to a metaverse-focused approach — though that too is not without controversy.

The company’s decision to take a 47.5% cut from content creators in its Horizon Worlds VR app was widely criticized.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.