Bitcoin (BTC) decreased significantly on Feb 13-20, invalidating several bullish wave counts in the process.

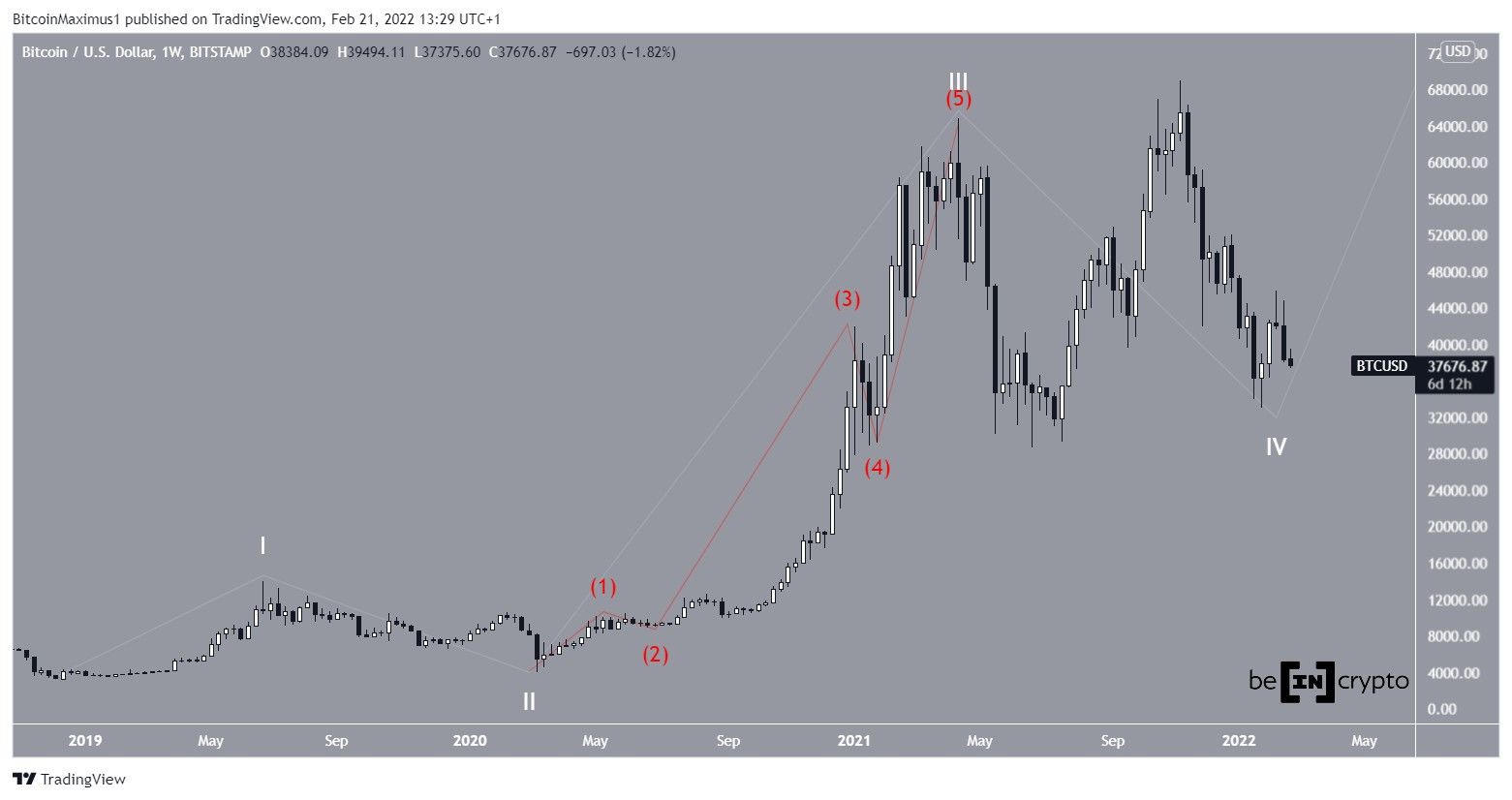

BTC has been in a bullish market cycle since Dec 2018, when it had just fallen to a low of $3,122. The upward movement is developing in five waves (white), from which BTC is currently in wave four.

While it seems very likely that BTC is in wave four, it is not yet certain if wave four has come to an end.

In this article, several possibilities for the construction of wave four will be analyzed, in order to determine if the correction is complete.

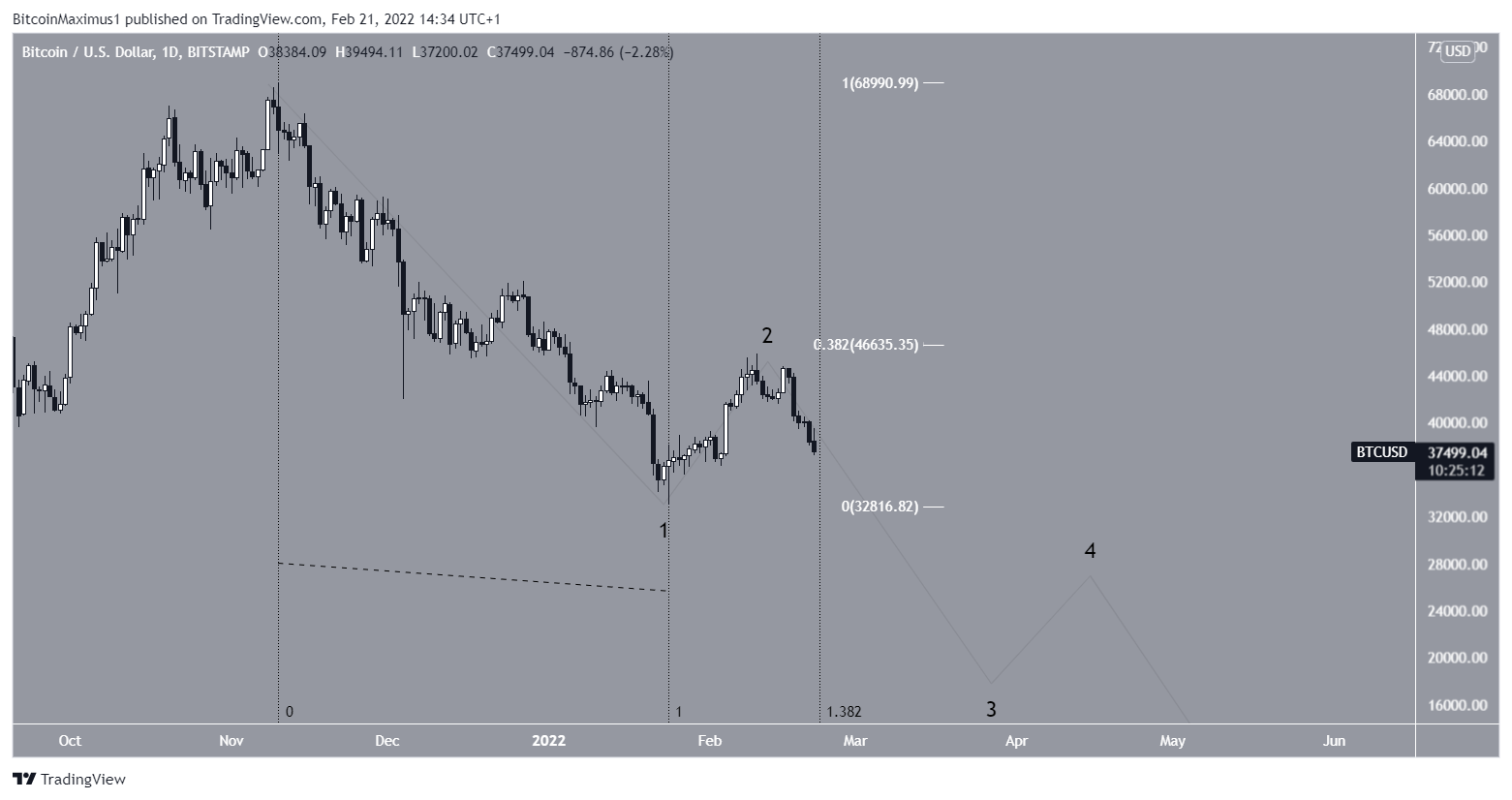

Completed correction

Previously, the most likely count seemed to suggest that the correction was complete. The structure was a simple A-B-C correction (red), in which waves A:C had an exactly 1:1 ratio.

In this scenario, the BTC correction ended on Jan 24. The sub-wave count is given in black.

However, the short-term count has invalidated this possibility. The reason for this is that sub-wave four has crossed into wave one territory (red line).

Therefore, this renders the upward movement as a three wave increase instead of a five wave one, hence invalidating the count.

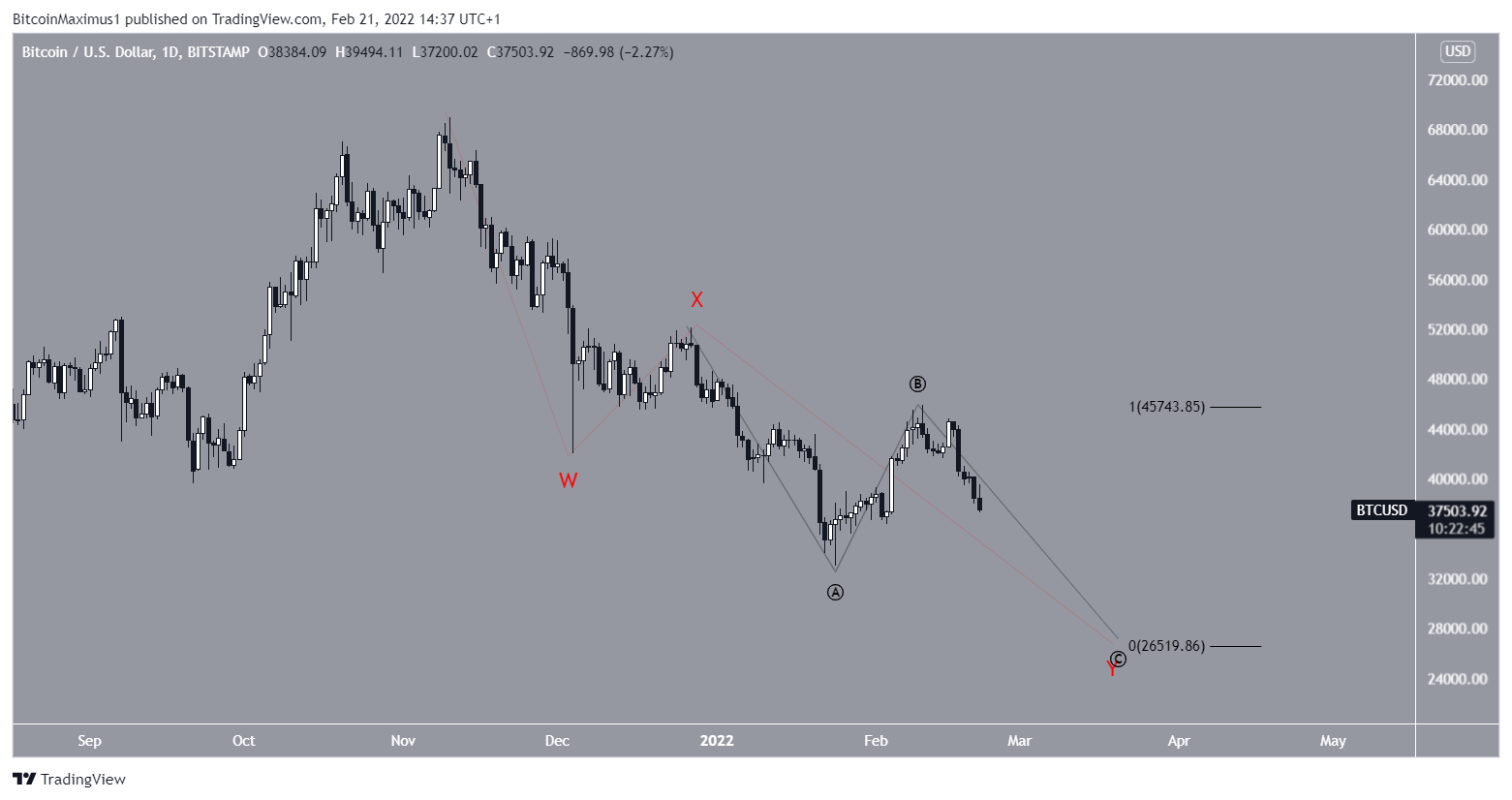

Triangle count

Cryptocurrency trader @XForceGlobal tweeted a chart of BTC, which shows that the price is potentially completing a long-term symmetrical triangle.

While not yet confirmed, the possibility is still valid.

As of right now, the length of the sub-wave is as follows:

- A : 96 days

- B : 112 days

- C : 75 days

- D : 28 days (until now)

While the fact that sub-wave B is longer than sub-wave A might seem unusual, it is somewhat common in cases where B goes above the beginning of A, as is the case in the current BTC movement.

A potential target for the top of the current increase would be at $55,300, the 0.618 Fib retracement resistance level when measuring the previous decrease.

The short-term three wave increase is not an impediment to this count, since sub-wave D could very well be an A-B-C structure.

Therefore, in this possibility, BTC will re-test the support line of the channel once more before initiating a strong upward movement.

The $55,300 target (white) also fits with the extension of A (black).

Bearish alternative

The bearish alternative suggests that the low of wave four is not yet in. The most bearish count would suggest that the entire downward movement and ensuing bounce since the all-time high is part of wave one and two of a bearish impulse.

However, wave two failed to reach the 0.382 Fib retracement level in both time and magnitude. Therefore, this count is also invalid.

So, the only remaining valid count suggests that the decrease since the all-time high is a complex corrective structure (red).

In it, the BTC price is currently in the C and final decrease.

The most likely target for the bottom of this move is at $26,500, created by giving waves A:C a 1:1 ratio.

Afterwards, BTC would be expected to increase.