A dormant Bitcoin wallet has resurfaced after almost 12 respite years, moving 1,000 BTC worth over $60 million at current rates.

Crypto markets show signs of a recovery, starting the week with nearly 5% gains in total market capitalization to $2.31 trillion. Bitcoin dominates with 53.9%.

Dormant Bitcoin Wallet from 2012 Moves 1,000 BTC

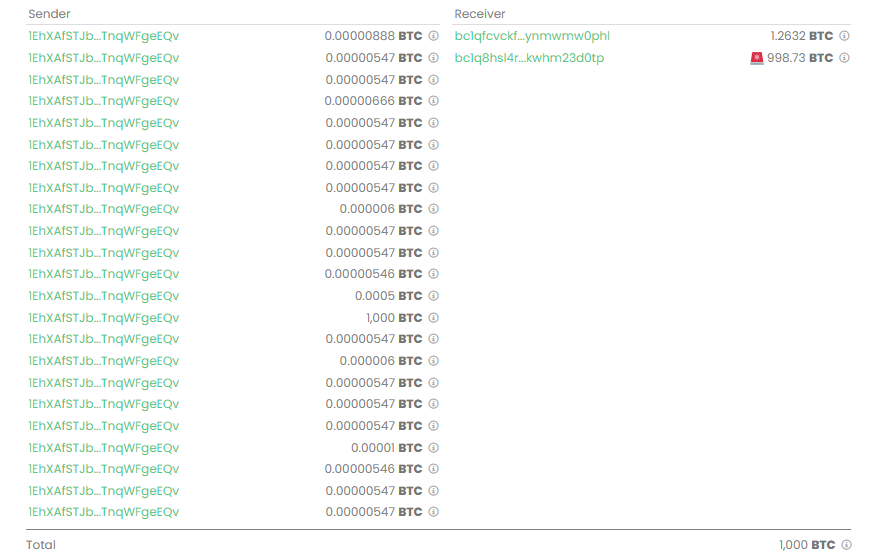

Blockchain tracking and analysis system Whale Alert reported the transaction on Sunday. The dormant Bitcoin wallet, holding 1,000 BTC, activated its account for the first time since 2012. When the account became inactive, their Bitcoin portfolio was worth $11,908.

As Bitcoin trades above $60,000, this large holder will earn over 500,000% in gains at current BTC rates. The whale spent 0.00019107 BTC on transaction fees (worth $11.46) for two transfers to unknown addresses.

Read more: Who Owns the Most Bitcoin in 2024?

A dormant Bitcoin wallet is one that has not recorded any transaction over a prolonged duration. When they resurface, therefore, they tend to attract attention as traders weigh possible implications, particularly for large transactions. Analysts often interpret the movement as bearish indicators anticipating a potential supply shock.

Nevertheless, this transaction comes amid a recovery, with Bitcoin price back above the $62,000 threshold. The 5% gains over the last 24 hours caused $115.64 million in total crypto market liquidations, Coinglass liquidation data shows. Futures traders who had taken short positions on BTC make up most of the liquidated traders.

Over 85% of Bitcoin Holders Sit On Unrealized Profit

Amid ongoing recovery, IntoTheBlock data shows that 85.47% of active BTC addresses are sitting on unrealized profit. According to the real-time on-chain analytics and market intelligence platform, only 14.53% of active addresses are recording losses.

This indicates positive sentiment among holders and investors. It could lead to increased hodling behavior amid anticipation of further price increases.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Most holders bought their Bitcoin at lower prices and are currently experiencing gains, which could create a strong psychological support level. These holders may be less inclined to sell without a significant price increase.

“If we keep holding here then this evolves from a retest to the capturing of a key level and another leg up. We are at a key rejection level here. And yes, it was STILL a good idea to be buying in the early 50Ks region,” venture capitalist Kyle Chassé noted.

Meanwhile, on-chain data analytics provider CryptoQuant observes increased buy orders among US Bitcoin whales and institutional BTC purchases.

“If you look at the Coinbase premium gap, you can see that the movement of American whales, which had a strong selling trend, has recently become stronger,” CryptoQuant noted, citing a popular investor, Dan.

The investor anticipates additional fund inflows into the BTC market from the spot Bitcoin spot ETFs (exchange-traded funds) this week.