The number of whale wallets holding large amounts of Bitcoin is declining. This is a good thing, as asset distribution to smaller wallets increases decentralization properties and reduces the risk of market manipulation by whales.

On June 26, on-chain analytics provider Glassnode reported that the number of Bitcoin whales has “experienced a perpetual decline.”

Bitcoin Whales Distributing

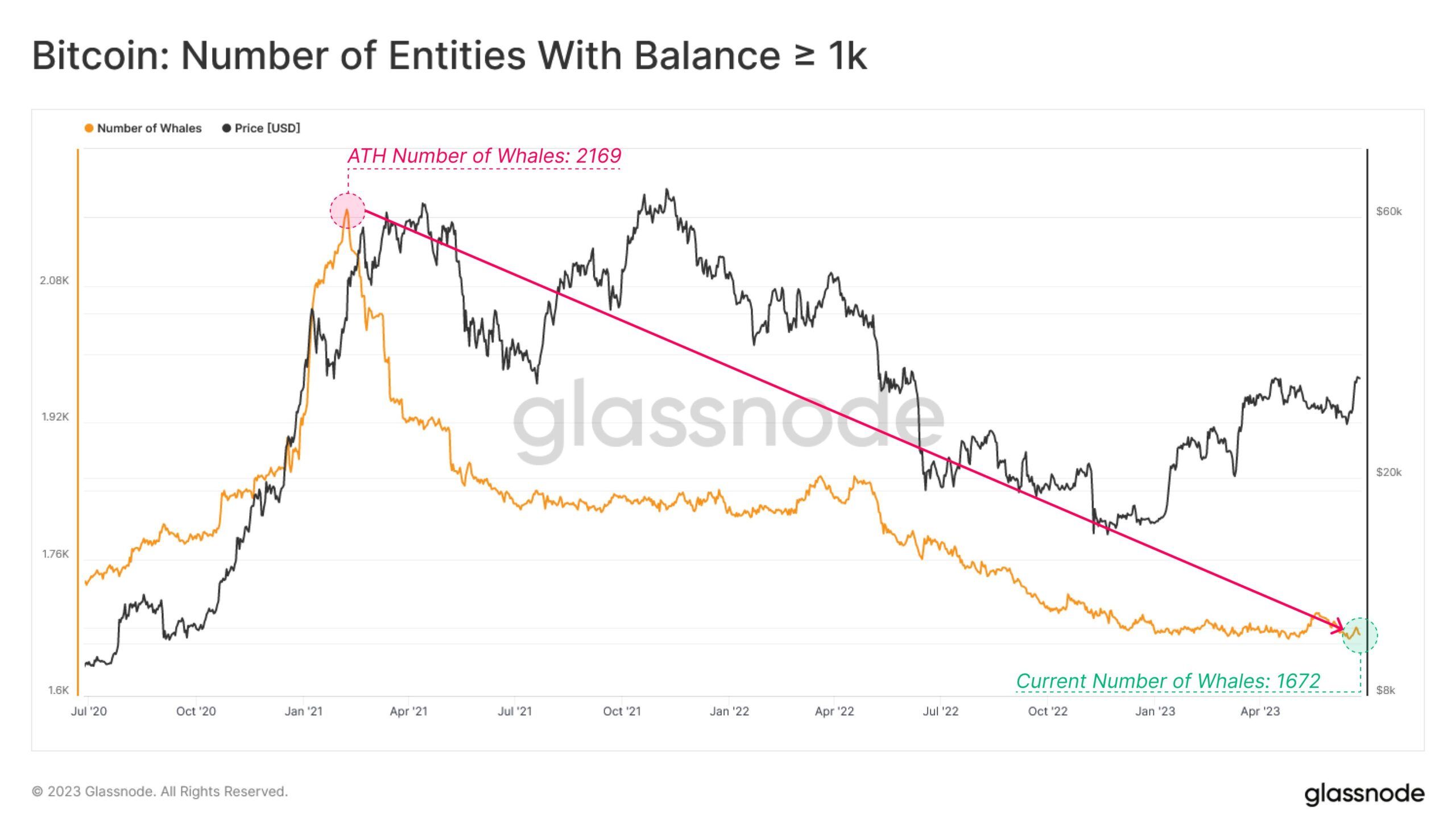

The firm defines a whale as a wallet holding 1,000 BTC or more.

Glassnode reported that there was an all-time high of Bitcoin whales just before the bull market in 2021. A figure of 2,169 whales holding more than a thousand coins was recorded.

However, the current figure is 1,672, a decrease of 23% or 497 whales, it noted. The number fell sharply during the first half of 2021 and plateaued until May 2022. It continued its decline following the big selloff in the wake of the Terra/Luna ecosystem collapse that month.

Furthermore, the number of Bitcoin whales is at its lowest level for more than three years despite recent price gains.

The Bitinfocharts Bitcoin “rich list” shows the breakdown in distribution. The majority of the richest BTC wallets were exchange addresses. Binance topped the list holding 248,597 BTC worth around $7.5 billion.

Although the number of addresses holding less than one coin has increased, the vast majority of BTC is still concentrated in just a handful of accounts.

Find out how to get Bitcoin from an ATM:

7 Best Bitcoin ATMs With Low Fees and High Privacy

In its “week on chain” report, Glassnode attempted to ascertain how much BTC is active and available for sale.

It revealed that just 11.9% of the circulating supply (2.28 million BTC) is held in exchange balances.

The short-term holder supply is 13.6% or 2.65 million BTC. However, the vast majority of it, around 74.5% of the circulating supply (14.4 million BTC), is being held or is unavailable.

BTC Price Outlook

Bitcoin prices are currently consolidating at heavy resistance levels of just over $30,000. It is the second time this year that BTC has reached this price zone and been halted.

The asset has gained half a percent on the day to change hands at $30,437 at the time of writing.

A spike in exchange inflows has been seen this week which could be the precursor for taking profits.

Moreover, the longer BTC remains constrained at current levels, the higher the probability that it will pull back to support.