Recent on-chain data from Binance reveals a significant divergence in whale activity between Bitcoin (BTC) and Ethereum (ETH). This highlighted contrasting market sentiments as investor caution intensifies.

While large holders of BTC exhibit conflicting behaviors, ETH whales demonstrate a unified strategy, consistently withdrawing funds from the exchange. The divergence highlights how large investors are treating the two largest cryptocurrencies differently.

Bitcoin Faces Whale Tug-of-War While Ethereum Marches Forward

In a recent X (formerly Twitter), on-chain analyst Murphy highlighted that from August 13 to September 3, Binance’s Bitcoin balance rose by 7,709 BTC. This suggests that more coins were being deposited than withdrawn.

“During this period, the amount of BTC bought and withdrawn from the exchange was less than the amount transferred in with the intention to sell,” Murphy wrote.

Two whale groups emerged: one (with single transfers between $10–100 million) consistently deposited BTC, while another (transfers over $100 million) withdrew coins. Their opposing actions created a tug-of-war, though selling pressure currently dominates.

“Back in April this year, both groups were aligned in withdrawing BTC. But since August 13, divergence has emerged,” the analyst added.

In contrast, Binance experienced a sharp outflow of 1.616 million ETH during the same period. The same two whale groups—the $10 million to the $100 million and above $100 million whale groups—acted in alignment, withdrawing ETH from Binance.

This uniform behavior reduces potential selling pressure and indicates a preference among large investors for ETH over BTC in the current market environment.

“When prices fall, there is indeed demand entering the market, although it may not necessarily mean more funds buying ETH, but at least looking at the larger-scale funds, their intentions are clearly more consistent toward ETH, or in other words, they favor ETH more. However, BTC has divergences and clashes among large holders, so it has always been unable to quickly reduce the potential selling pressure within the exchange,” Murphy stressed.

Thus, the BTC whale split may reflect indecision or a hedging strategy amid volatile conditions. At the same time, ETH’s unified withdrawals and declining exchange balance align with accumulation signals. This suggests confidence in its long-term value.

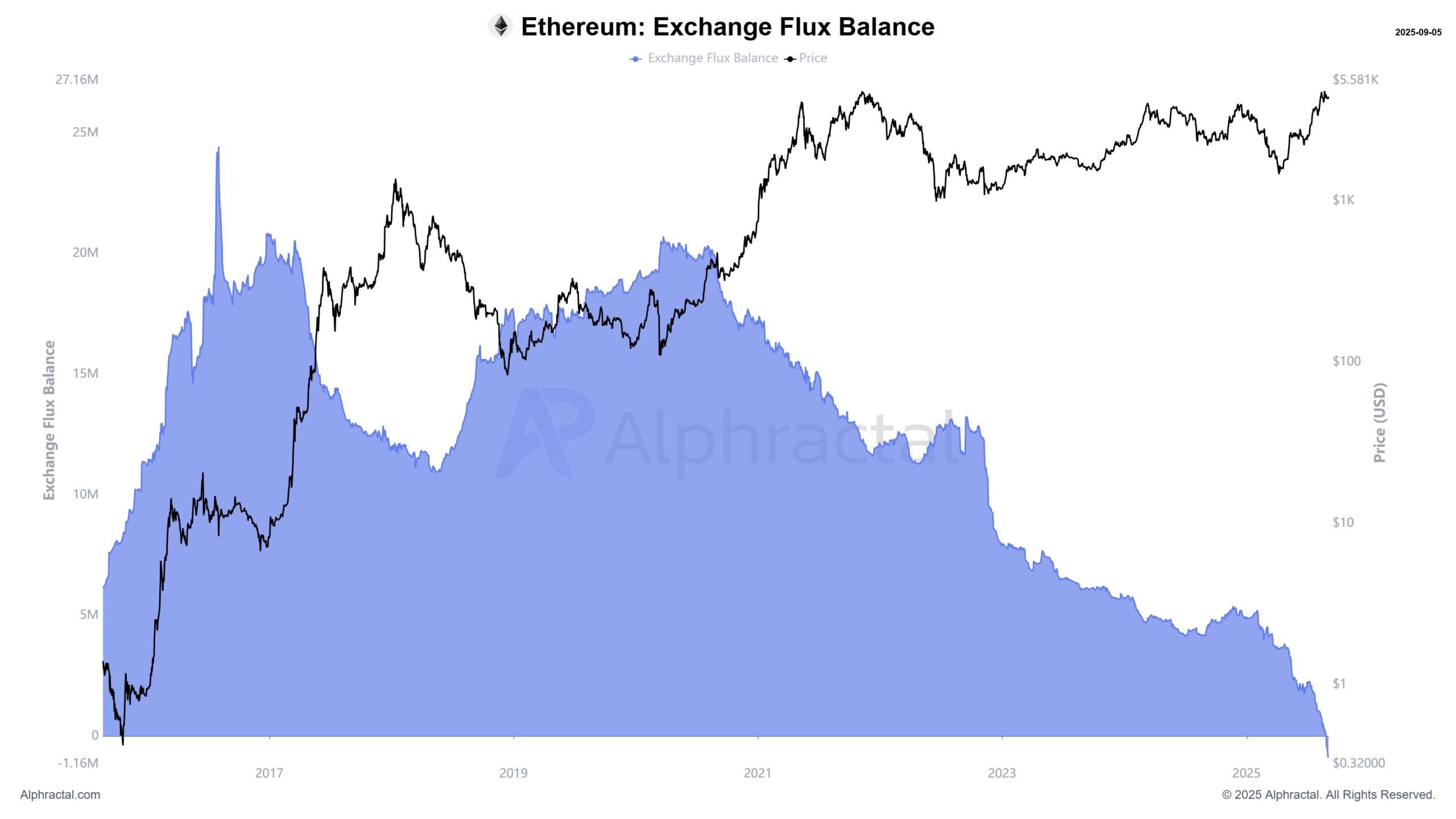

Additional on-chain indicators point in the same direction. According to analyst Cas Abbé, Ethereum’s Exchange Flux Balance has slipped into negative territory for the first time on record.

Data now shows net ETH outflows across major trading platforms, with billions being removed. This means that the available supply is contracting even as prices hover above $5,500.

Abbé explained that historically, such negative balances have signaled structural shifts: selling pressure eases, long-term holders absorb supply, and market peaks tend to form only once this trend sharply reverses—not at its onset.

“The signal is clear: ETH isn’t being positioned to sell, it’s being positioned to hold. This could define Ethereum’s next leg in the cycle,” he added.

As selling pressure drops, demand on the buy side also rises. Data from blockchain analytics firm Lookonchain showed that whales and institutions snapped up roughly 218,750 ETH (about $942.8 million) over just two days.

Among the largest moves, Bitmine acquired 69,603 ETH (≈$300 million) from BitGo and Galaxy Digital. In addition, five newly created wallets purchased a combined 102,455 ETH (≈$441.6 million) via FalconX.

Analyst Ted Pillows highlighted a similar trend, noting that three newly created wallets purchased about $148.9 million worth of ETH. The steady accumulation by whales reinforces the broader pattern of large investors consolidating their Ethereum positions.

Together with recent institutional purchases, the data suggests sustained confidence among deep-pocketed players, even as overall market sentiment remains cautious.