Blockchain analytics firm, Crystal Blockchain, has analyzed cryptocurrency flows in and out of the darknet, revealing that transfers (measured in $) are peaking.

Altcoins also appear to be growing in use. Transactions largely involve exchanges without KYC requirements. The report, published on July 14, shows that Bitcoin and altcoin use on the darknet has increased, at least in dollar terms for Q1 2020.

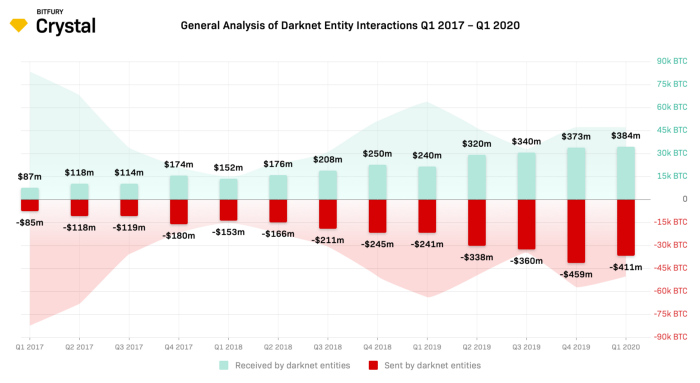

The report compared the Bitcoin darknet flows to previous quarters. While the amount of Bitcoin notably declined, the higher price of the alpha-crypto led to a 65% increase in USD terms. Both this and growing altcoin use have contributed to the reduction in the amount of Bitcoin transferred.

In BTC terms, Q1 2020 saw a 22% and 26% drop in received and sent Bitcoin compared with Q1 2017. Compared to Q1 2019, outflows dropped from 64,000 to 47,000 BTC while inflows dropped from 64,000 to 50,000 BTC.

Loose Exchanges the Main Culprits

Crystal Blockchain also examined the types of entities that were at the sending and receiving ends of the transactions. Most of these entities were exchanges that had loose identity verification requirements. Exchanges accounted for 45% and 48% of the entities sending and receiving funds. Given the nature of the darknet, this makes sense. Mixers have also grown in popularity, though they stand at only 1% of all transactions. Legitimate Mixers hide the source of transactions, making it near impossible to track.Bitcoin Still a Popular Darknet Choice

Bitcoin gained notoriety in the darknets early years, most notably on the Silk Road marketplace. It continues to be a popular choice for transactions on similar marketplaces. Darknet activity too remains a much talked about topic with notable research from Messari and CipherTrace in recent times.

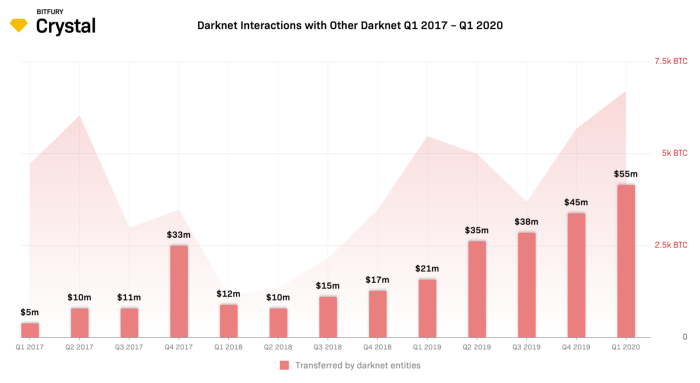

“The share of bitcoin sent from one darknet entity to another (i.e., all transactions between different darknet entities) also grew from 10% in Q1 2019 to 19% in Q1 2020 — indicating overall growth in darknet revenue and cooperation.”The statement infers that darknet users may be hiding Bitcoin flows within the darknet to avoid tracing. The report concludes by saying that darknet entities will likely evolve to combat the Financial Actions Task Force (FATF) and European Union (EU) regulations.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Rahul Nambiampurath

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

READ FULL BIO

Sponsored

Sponsored