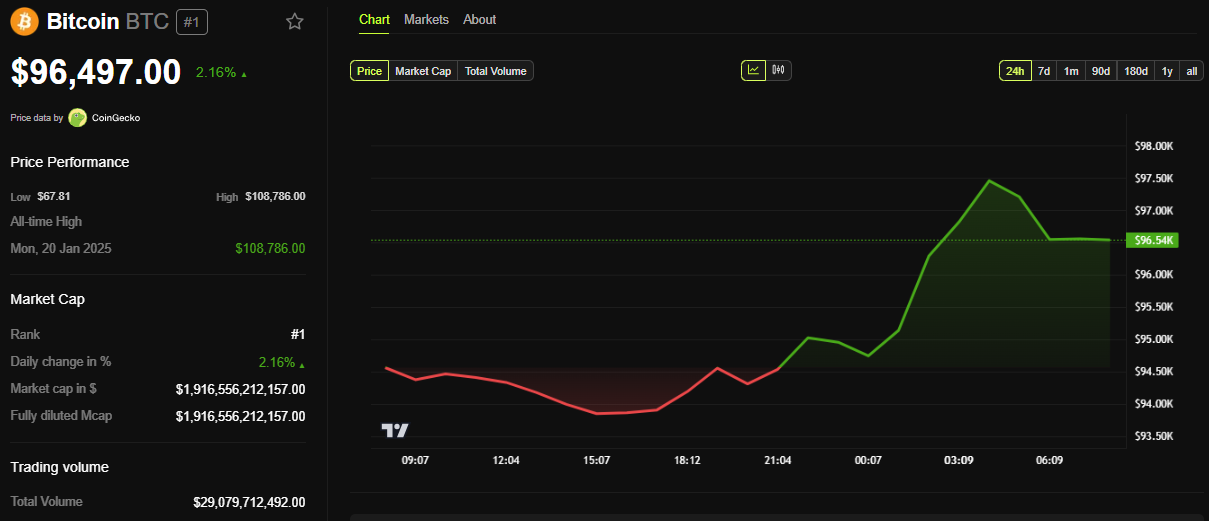

Bitcoin (BTC) jumped above $97,000 on Wednesday before retreating to the $96,000 range. The brief test came as markets absorbed a wave of liquidity-boosting announcements from China and growing speculation that the US Federal Reserve (Fed) may be edging toward a return to quantitative easing (QE).

The moves’ timing, just hours before a crucial FOMC (Federal Open Market Committee) meeting, has sent traders scrambling to reassess the global macro picture.

China Unleashes $138 Billion in Liquidity As Trade Talks Reignite Risk-On Sentiment

The State Council Information Office hosted a press conference. In attendance, Governor Pan Gongsheng of the People’s Bank of China (PBOC) announced interest rate cuts.

The PBOC said it would cut the reserve requirement ratio by 0.5 percentage points, releasing roughly 1 trillion yuan ( ~ $138 billion) in long-term liquidity, and lower the policy interest rate by 10 basis points.

“Pan Gongsheng, governor of the People’s Bank of China, announced at a press conference that the reserve requirement ratio would be cut by 0.5 percentage points, providing the market with about 1 trillion yuan of long-term liquidity, and lowering the policy interest rate by 0.1 percentage points,” local media reported.

The PBOC cut the seven-day reverse repo rate from 1.5% to 1.4%. This will lower the loan prime rate by another 10 basis points.

It also unveiled additional support measures, including a 500-billion-yuan re-lending tool for elderly care and consumption. Further, it reduced mortgage rates and reserve requirements for auto financing firms.

The timing of China’s stimulus was not coincidental. Hours earlier, US Treasury Secretary Scott Bessent confirmed he would meet with Chinese Vice Premier He Lifeng in Switzerland on May 10 and 11. This would mark the first official trade talks since President Trump escalated tariffs to 145% on Chinese imports.

“Thanks to POTUS, the world has been coming to the US, and China has been the missing piece—we will meet on Saturday and Sunday to discuss our shared interests. The current tariffs and trade barriers are unsustainable, but we don’t want to decouple. What we want is fair trade,” Bessent stated.

Markets reacted swiftly. According to The Kobeissi Letter, S&P 500 futures surged over +1% on this news. Bitcoin followed suit, spiking above $97,000 before sliding back.

As of this writing, BTC was trading for $96,497, up by a modest 2.16% in the last 24 hours. This retraction to the $96,000 range comes amid market uncertainty, as traders brace for the FOMC later today.

Fed Bond Buying Raises Quantitative Easing Flags

Meanwhile, the Fed’s balance sheet activity this week is raising eyebrows. On May 6, the Fed purchased $14.8 billion worth of 10-year Treasury notes, following a $20 billion purchase of 3-year notes on May 5, totaling $34.8 billion in two days.

“The Fed bought $14.8 billion worth of 10-year bonds today. This is on top of the $20 Billion it bought yesterday. That’s $34.8 Billion in 2 days,” The Coastal Journal reported.

With no formal announcement, these purchases suggest that the Fed quietly injects liquidity in a subtle quantitative easing move.

Arthur Hayes, former BitMEX CEO, sees a dovish shift as wildly bullish for crypto. In a recent column, Hayes argued that Bitcoin would be worth $250,000 by the end of 2025 if the Fed restarts QE. He sees the Fed’s liquidity moves as the beginning of that process.

BeInCrypto also explored the odds of QE returning and its implications. Any fresh wave of QE could reduce real yields, devalue fiat, and potentially drive significant inflows into crypto assets.

However, not everyone is convinced QE is necessary. In a counterpoint report, macro experts argue that quantitative easing is unnecessary amid the current market turmoil. They contend that the financial system has not yet shown signs of systemic distress.

Meanwhile, gold surged to near-record highs of $3,437.60 per ounce, up 28.84% year-to-date, reflecting investor unease.

The surge in gold suggests a fear of trade as investors maneuver the ongoing economic instability.

Investors are bracing for clarity or further ambiguity as Fed Chair Jerome Powell prepares to address markets later today. Bitcoin’s brief rally above $97,000 signals optimism, but the broader crypto market may remain range-bound until the Fed shows its cards.

Bitcoin could soon establish support above the $97,000 threshold if Powell signals a subtle pivot. If not, traders may face more volatility.