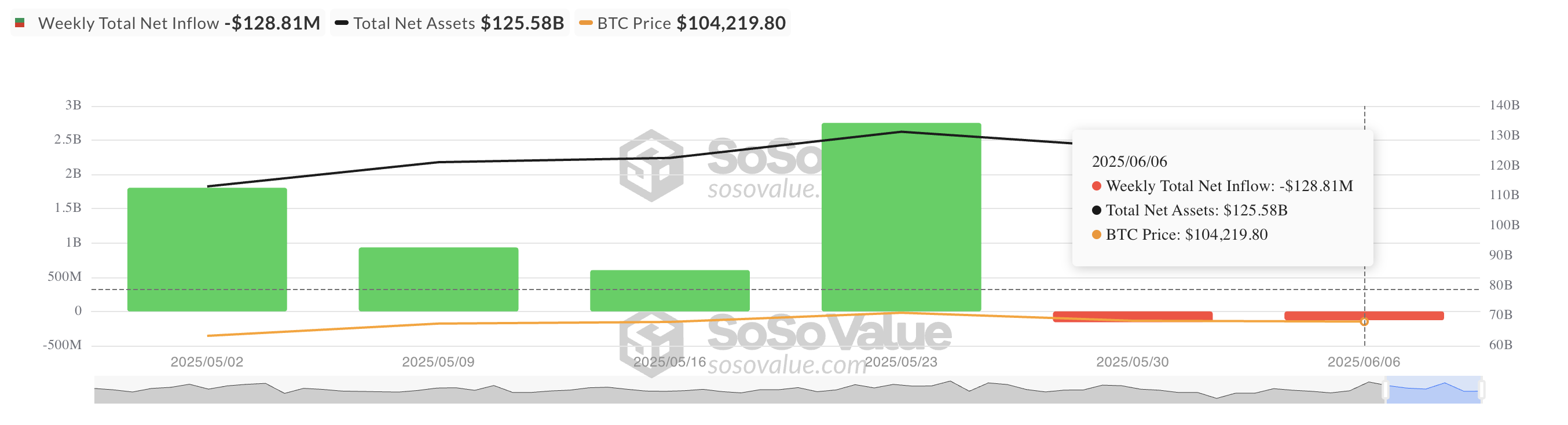

Last week, US-listed spot Bitcoin exchange-traded funds (ETFs) recorded net outflows exceeding $120 million.

While the figure reflects continued investor caution, it also represents a slight improvement from the previous week’s larger outflows, signaling a tentative resurgence in bullish sentiment.

BTC ETF Outflows Cool After Heavy June 5 Dump

According to SosoValue, net outflows from spot BTC ETFs totaled $129 million between June 2 and June 6. The moderation in capital flight suggests that while some institutional investors remain wary, others may be growing more risk-on sentiment.

Last week, the heaviest single-day outflow occurred on June 5, when BTC’s price fell to an intraday low of $100,372. The drawdown dampened sentiment across ETF markets, with net outflows totaling $278.44 million that day.

However, the fact that outflows lessened on the following trading day points to growing resilience in the market, despite BTC’s lackluster price performance.

Bitcoin Futures Turn Bearish, Options Stay Bullish

Today, BTC has posted a mild 0.13% price decline to trade at $105,488 at press time. The coin has resumed its sideways trading, reflecting ongoing uncertainty in the broader crypto market.

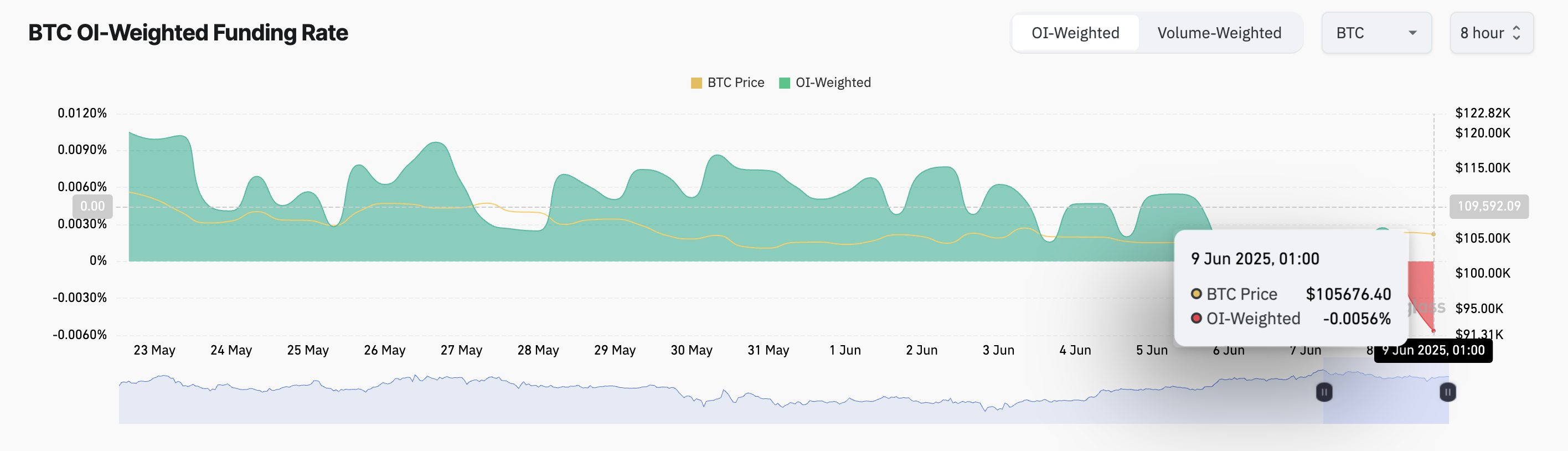

Meanwhile, the funding rate across major perpetual futures markets has turned negative, indicating that more traders are betting on further downside in the short term. As of this writing, this is at -0.0056%.

The funding rate is a periodic payment between traders in perpetual futures contracts to keep the contract price aligned with the spot price. When the funding rate is negative, there is a higher demand for short positions. This trend indicates more traders are betting on BTC’s price decline, adding to the bearish pressure in the market.

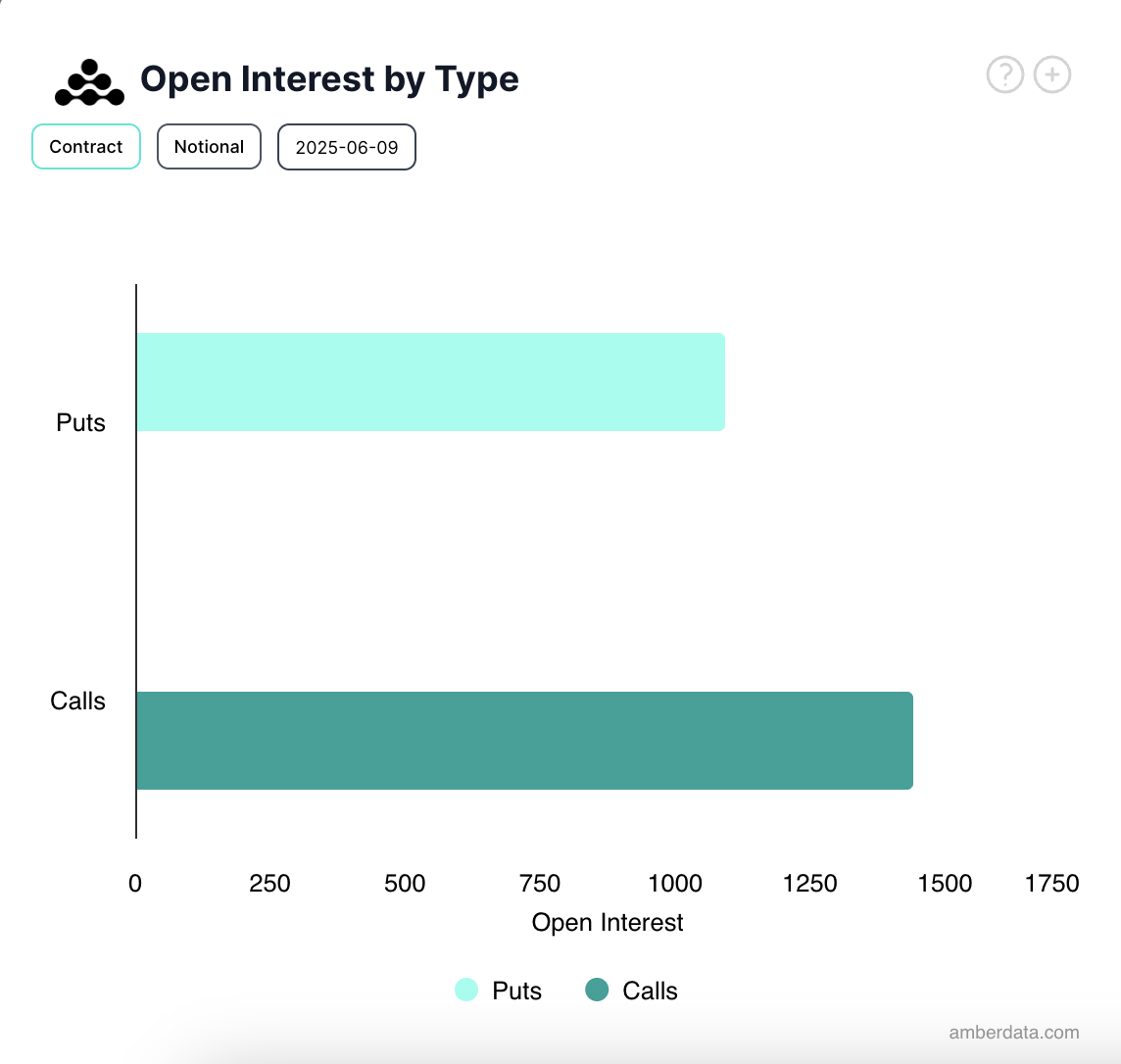

However, BTC options data offers some respite. Per Deribit’s data, BTC options traders continue to show strong demand for call options. This points to optimism among sophisticated market participants, even as short-term indicators remain mixed.

Overall, while BTC ETF weekly flows remain in the red, the deceleration in outflows and a rise in bullish derivatives positioning suggest that market participants may be bracing for a potential turnaround.