On July 27, the Bitcoin price began a massive rally, reaching a daily close 11% higher than the opening price.

This move also caused a breakout above a resistance line that had been in place for nearly three years.

Bitcoin’s Massive Breakout

The Bitcoin price had been following a descending resistance line since it reached an all-time high in December 2017. Yesterday’s pump finally caused a breakout above this descending resistance line. The price has yet to validate this line as support. The closest resistance area is found near $12,000, created by the highs of June 2019.

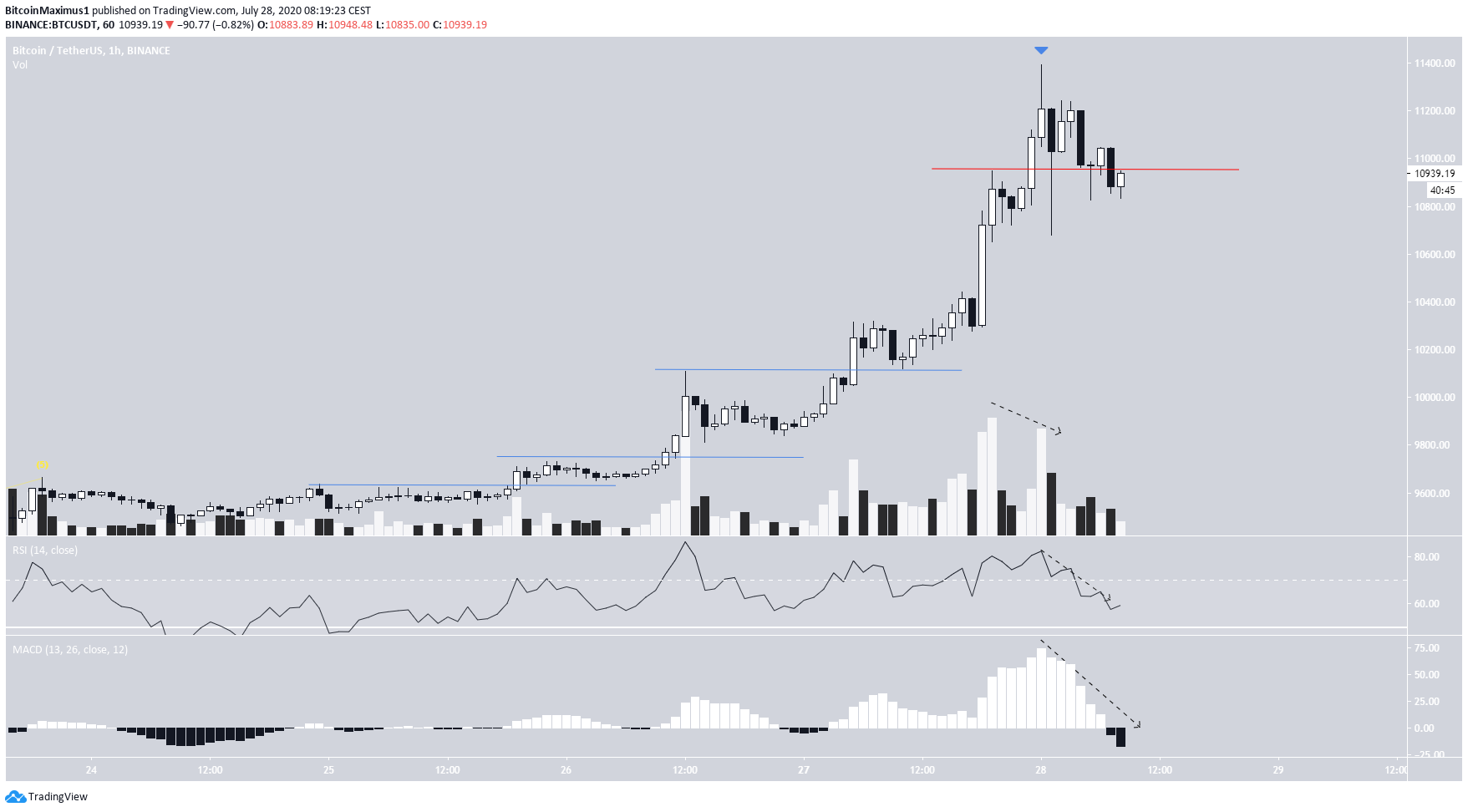

Health Of The Trend

The daily chart shows that yesterday created a massive bullish engulfing candlestick transpiring with very significant volume. This shows us that the breakout was legitimate. While the RSI is overbought, there is no bearish divergence and the MACD is still going upwards, creating its strongest momentum to date yesterday. In other words, while the trend is overbought, it has not shown any signs of weakness yet, at least not in the daily time-frame.

Wave Count

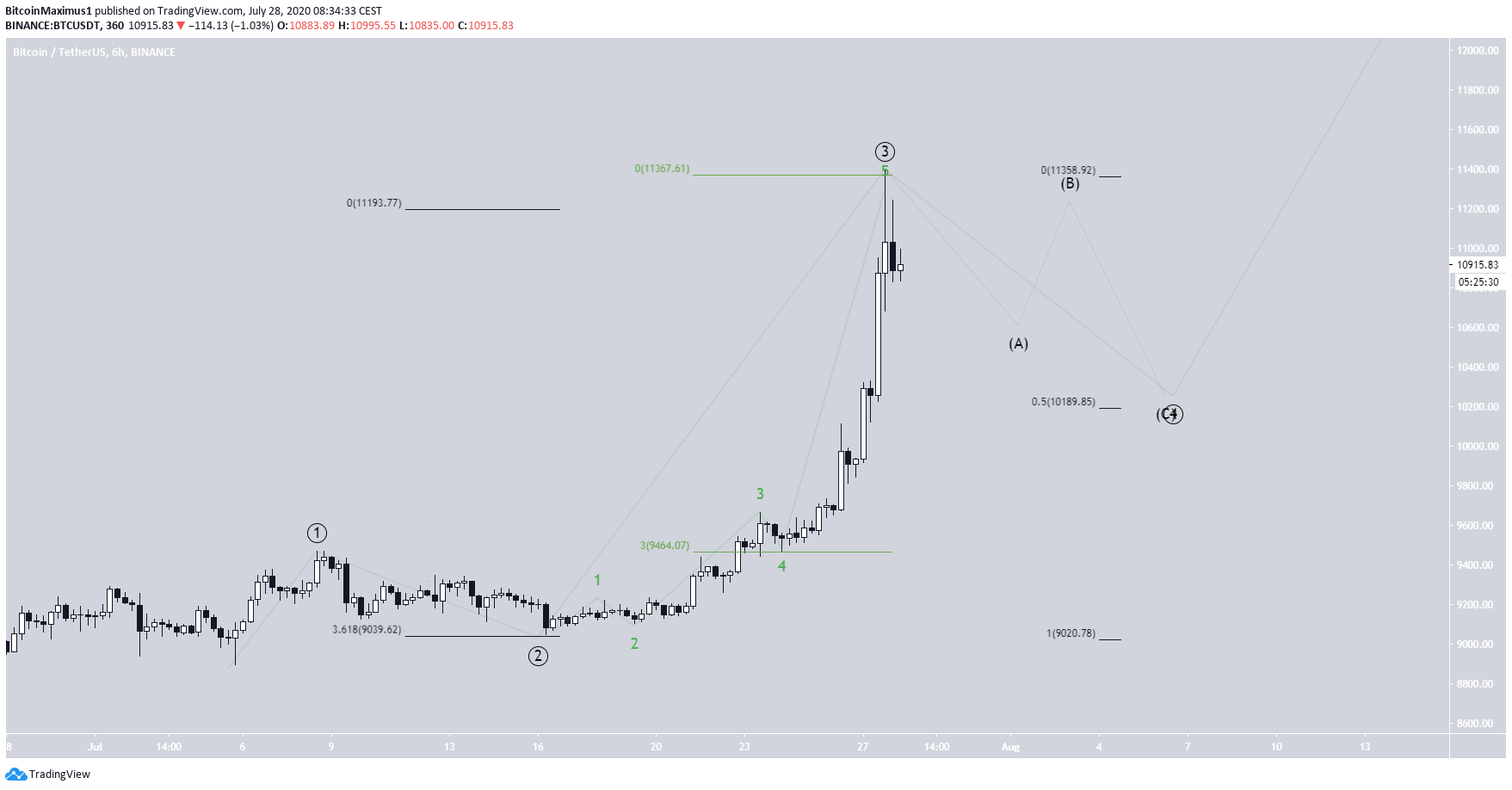

Beginning on July 6, BTC has likely begun a five-wave Elliott Formation. Currently, it seems to be near the top of the third wave. The wave has been extremely extended, going slightly higher than the 3.618 Fib level of the entire wave-2. We can also outline the sub-wave count for wave 3 (in green below). There is a similar extension for sub-wave five, which is three times bigger than waves 1-3. The price is nearing the limit of textbook extensions, which would suggest a maximum high of around $11,500. But, combining the movement with short-term weakness and overlap, it is possible that BTC has reached the top of wave 3. If so, the 0.5 Fib extensions would be found at $10,189. The shorter-term wave count for sub-wave 5 shows both an extended wave 3 and 5, suggesting that indeed we are nearing the end of the upward move, and a correction could soon ensue.

The A-B-C pattern outlined in the chart below would complete the longer-term A-wave (black) from the previous image.

The shorter-term wave count for sub-wave 5 shows both an extended wave 3 and 5, suggesting that indeed we are nearing the end of the upward move, and a correction could soon ensue.

The A-B-C pattern outlined in the chart below would complete the longer-term A-wave (black) from the previous image.

To conclude, while BTC is clearly in a bullish trend, it is nearing the end of the current upward move based on numerous Fib extension levels. If a correction occurs, BTC could fall back towards $10,200.

For our previous analysis, click here.

To conclude, while BTC is clearly in a bullish trend, it is nearing the end of the current upward move based on numerous Fib extension levels. If a correction occurs, BTC could fall back towards $10,200.

For our previous analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored