The Bitcoin (BTC) price initiated a breakout attempt on Jan. 29, but was promptly pushed down and is now trading well below resistance.

Bitcoin is likely still correcting and is expected to eventually drop towards $26,000.

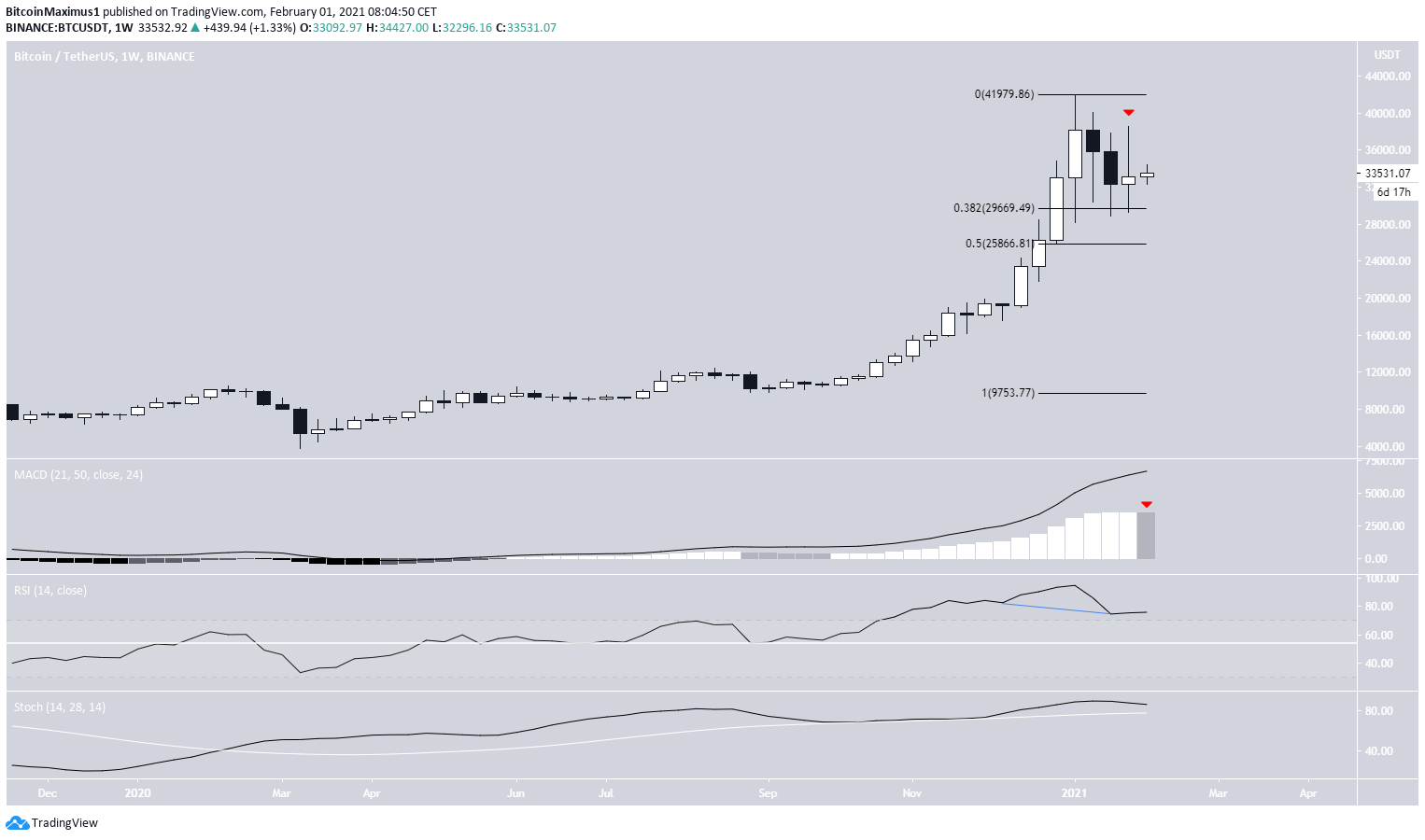

Weekly Bitcoin Outlook

After two consecutive bearish weekly candlesticks, BTC managed to create a neutral Doji candlestick last week, which also had a slightly bullish close. Nevertheless, it left a long upper wick in its wake — a sign of selling pressure.

Despite the possibility of the first lower momentum bar in the MACD, technical indicators are still bullish. The RSI is above 70 and has generated some hidden bullish divergence while the Stochastic oscillator has yet to make a bearish cross.

BTC has also bounced at the 0.382 Fib retracement level of the most recent upward move at $29,670. The next closest support area is found at $25,870.

Current Movement

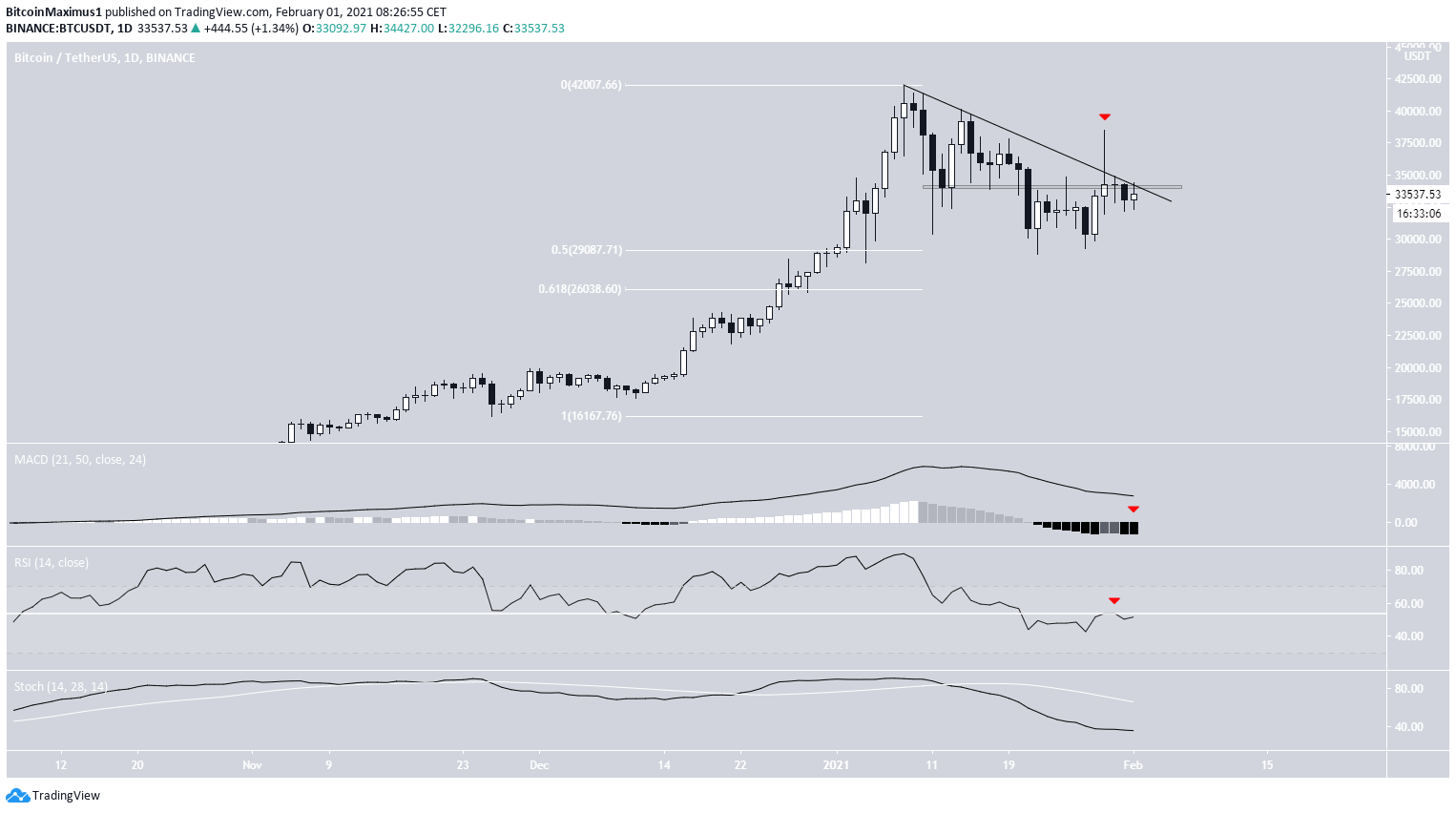

The daily time-frame provides a more bearish outlook.

BTC has been following a descending resistance line since the all-time high price of $41,950 was reached on Jan. 8.

BTC made a breakout attempt on Jan. 29. The breakout was initially successful but decreased back below the level on the same day, leaving a long upper wick in place. This is a sign of selling pressure and invalidated the breakout.

Furthermore, BTC did not manage to close above the previous support area now turned resistance at $34,000.

Technical indicators are also bearish. The MACD is negative, the RSI was rejected by the 50-line, and the Stochastic oscillator has made a bearish cross.

If BTC breaks down from the $29,000 support area, the next closest support would be found at $26,000.

BTC Wave Count

The wave count suggests that BTC is in the C wave of an A-B-C flat corrective structure. This correction could be encapsulated in a parallel descending channel, which would give a bottom target of $26,000.

The wave count is shown in white in the chart below. The sub-wave count is shown in orange, in which BTC is in sub-wave 2.

For the long-term wave count article, click here.

Conclusion

Bitcoin is likely mired in a correction that began from the all-time high price of $41,950 on Jan. 8. It’s likely that this correction will continue while BTC drops towards $26,000.

For BeInCrypto’s previous Bitcoin (BTC) analysis click here