Bitcoin (BTC) has broken out from a short-term pattern and is in the process of validating it as support.

Bitcoin is expected to continue increasing towards the targets given in this analysis.

Bitcoin Creates Long-Term Double Top

During the week of Dec 1-7, the BTC price created a small bullish candlestick which briefly took it to a new all-time high of $19,888 on Dec. 1 before dropping.

This weekly candlestick followed a Doji candle from the previous week, a sign of potential strength after a period of indecision.

While this could seem like a potential double top pattern relative to the high from December 2017, technical indicators do not yet show any weakness.

A decisive breakout above the current resistance area would likely take BTC into a price discovery phase due to the lack of overhead resistance.

Despite this, technical indicators in the daily time-frame are bearish.

The RSI has generated a bearish divergence, the MACD is decreasing and is almost negative, while the Stochastic oscillator has made a bearish cross and is moving downwards.

If BTC were to decrease, the closest support area would likely be found back at $16,000. The next support levels beneath that are found at $14,850 and $13,650.

Possible Breakout

Lower time-frames provide a more bullish outlook. A look at the six-hour chart shows that BTC is currently trading inside the $19,400 resistance area, making its fourth attempt at breaking out.

On Dec. 1, BTC deviated above this area before returning to fall back below. It has made two more breakout attempts since.

Both the RSI and MACD are increasing. The former is above 50 while the latter above 0, supporting the possibility that BTC will be successful in breaking out.

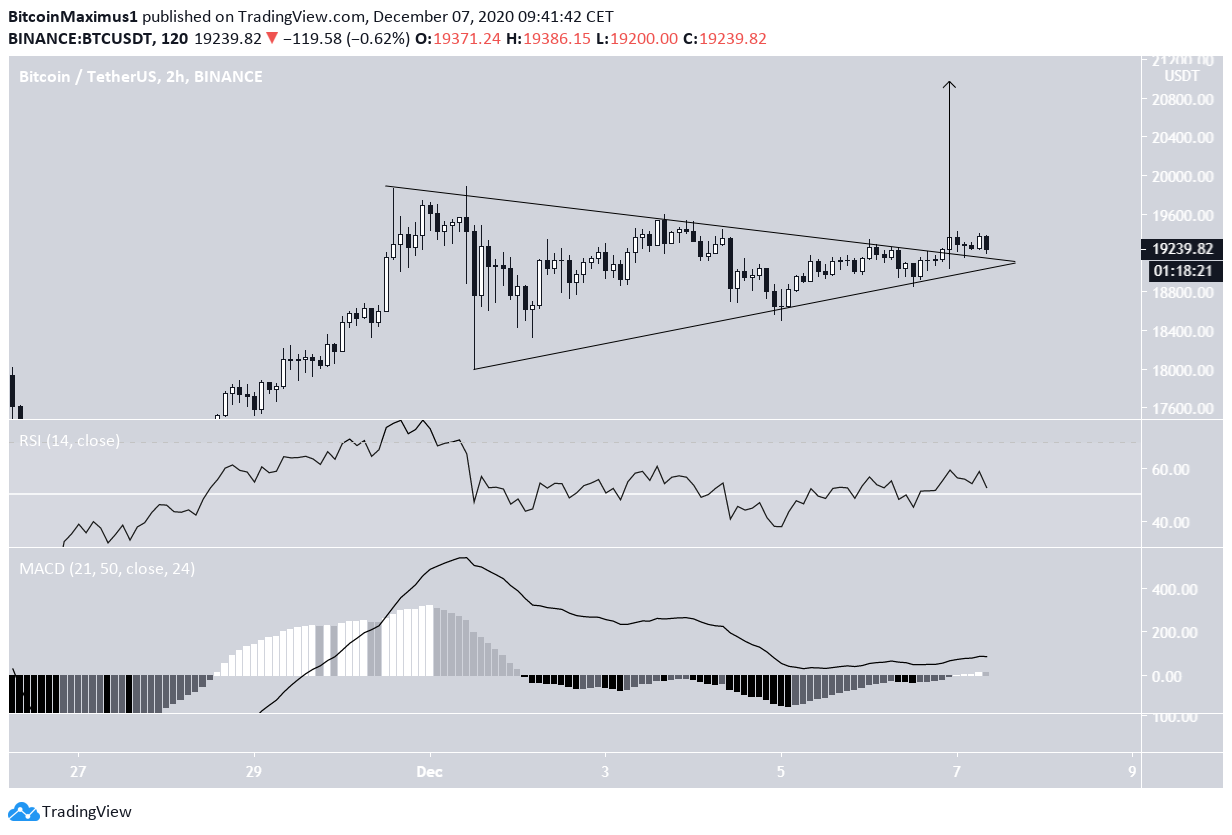

The two-hour chart shows that a breakout above a symmetrical triangle has already been completed, and BTC is in the process of validating the resistance line as support.

A breakout that travels the entire height of the pattern would take BTC just above $20,800.

BTC Wave Count

The movement inside of and breakout from the triangle afterward reveals that this was likely the fourth wave of a bullish impulse (shown in red below) that began on Nov. 27. If correct, BTC has just begun the fifth wave.

Fib extensions are in alignment, and all provide a possible target between $22,100-$22,600.

The target is found from (from left to right):

- The 4.61 Fib extension of wave 1

- The 3.61 external Fib retracement of wave 4

- The length of waves 1-3 projected to the bottom of wave 4.

A closer look at the triangle movement and its subdivisions is given below (black), in which the A sub-wave of the triangle was an irregular flat.

Conclusion

The BTC price is expected to break out from the $19,400 area and continue its ascent towards the range of $20,800-$22,000.

For BeInCrypto’s previous Bitcoin analysis, click here!

Disclaimer: Cryptocurrency trading carries a high level of risk and may not be suitable for all investors. The views expressed in this article do not reflect those of BeInCrypto.