Bitcoin has long been regarded as a store of value, often compared to digital gold. However, with the rapid advancements in decentralized finance (DeFi) and blockchain infrastructure, the demand for new ways to utilize Bitcoin beyond passive holding has surged.

SatLayer, a pioneering Bitcoin-based infrastructure provider, is at the forefront of this transformation. Through restaking and Bitcoin Validated Services (BVS), SatLayer aims to unlock new use cases for Bitcoin (BTC), ensuring its integration into the changing financial ecosystem. BeInCrypto spoke exclusively with SatLayer’s Co-Founder and CEO, Luke Xie, to explore how Bitcoin’s role expands and what the future holds for Bitcoin-based infrastructure.

SponsoredBeyond a Store of Value: Bitcoin’s Next Evolution

According to Xie, Bitcoin has transitioned through multiple phases—from an experimental digital currency to a widely recognized store of value. Now, as the broader crypto ecosystem has evolved with smart contract capabilities, Bitcoin holders have sought new opportunities beyond simply holding their assets.

Xie highlights that Bitcoiners have observed Ethereum (ETH) and other chains, including Solana (SOL), offering staking and yield-generating opportunities. Meanwhile, Bitcoin itself has remained largely passive.

According to Xie, SatLayer’s mission is to change that by introducing restaking. In doing so, it enables Bitcoin holders to generate yield while securing decentralized applications (dApps).

“Naturally Bitcoiners, who’ve watched this innovation occur while they’ve been hodling hard, want a piece of that action: the yield, the use cases, the onchain opportunities. As we all know, the Bitcoin network was not built for that sort of stuff, but developers have painstakingly assembled the infrastructure for Bitcoin DeFi on Layer 2. The fees are low, the throughput is high, and the sort of primitives you’d hope to find – for trading, borrowing, and much more – are all in place,” Xie told BeInCrypto.

Bitcoin Validated Services (BVS): Enhancing Security and Utility

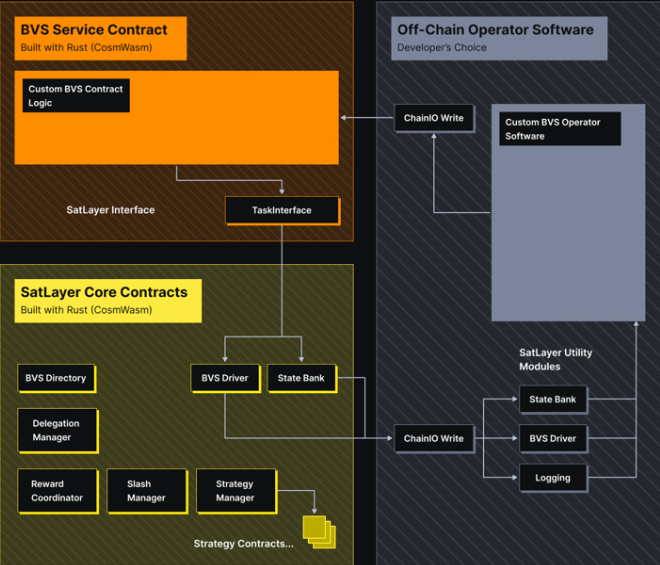

At the core of SatLayer’s vision is Bitcoin Validated Services (BVS). This concept allows dApps to be secured by restaked BTC. Unlike native tokens, which may lack liquidity and stability, Bitcoin’s unmatched value and liquidity make it the ideal asset for securing DeFi protocols.

BVS enables Bitcoin holders to collateralize their assets while simultaneously earning staking rewards. Xie explained how BVS enhances the security and utility of dApps.

Sponsored Sponsored“BVS describes any decentralized application or protocol that uses restaked BTC to secure its network. In real terms, this means that participants will use restaked BTC as collateral in return for having the right to validate network transactions. Because Bitcoin is valuable, this effectively eliminates the incentive for validators to act dishonestly,” Xie noted.

Any crypto asset, such as a native token, could serve as collateral for this purpose. However, it will be less liquid, valuable, and stable than BTC.

Restaking on Bitcoin: Unlocking Yield and Security

Further, Xie shared that SatLayer’s restaking mechanism is designed to be user-friendly and secure. By leveraging Wrapped Bitcoin (WBTC) or BTC Liquid Staking Tokens (LSTs), users can participate in restaking through the SatLayer platform, selecting protocols like Lombard, Lorenzo, or SolvBTC to restake with.

SponsoredThis process allows BTC holders to earn rewards while actively participating in securing emerging Bitcoin-based applications. The system mirrors the success of Ethereum-based restaking protocols like EigenLayer (EIGEN). It allows Bitcoin holders to contribute to network security without custodial risk.

Binance’s recent integration with Babylon, a major staking infrastructure provider, is a significant boost to this ecosystem. BeInCrypto reported that Binance has incorporated Babylon’s BTC staking solutions into its offerings. This marks a major step in legitimizing Bitcoin staking at scale.

This integration provides Bitcoin holders on Binance seamless access to staking and restaking services, further driving institutional and retail adoption. Likewise, with partnerships like Babylon, SatLayer enhances Bitcoin’s staking ecosystem.

“It’s a symbiotic relationship in which everyone benefits – Babylon, SatLayer, and most importantly Bitcoin holders,” he added.

By collaborating with Babylon, SatLayer strengthens Bitcoin’s DeFi presence. It creates a strong framework where BTC can be staked and restaked without compromising security. The synergy between these platforms accelerates Bitcoin’s growth from a passive store of value into an active financial instrument within the broader crypto economy.

Sponsored SponsoredSecurity and Future Innovations

Security remains a top priority for SatLayer. Xie emphasizes that rigorous audits and careful protocol design ensure that Bitcoin restaking maintains the security and decentralization that Bitcoin is known for.

Looking ahead, SatLayer plans to introduce AI-powered yield optimization. The firm also anticipates on-chain insurance backed by Bitcoin collateral and streamlined restaking services. Xie also sees Bitcoin infrastructure growing rapidly over the next five years.

“It’s still very early for restaking, so the obvious answer is a massive increase in TVL and the number of active users. It’s a self-fulfilling Simpsons nuclear power plant ‘days without incident’ narrative: the longer that Bitcoin restaking operates successfully, the greater the trust it will gain,” Xie concluded.

As Bitcoin grows, SatLayer’s innovations could be crucial in transforming the world’s most valuable cryptocurrency into a yield-generating asset. With Bitcoin’s infrastructure expanding, coupled with these developments, the pioneer crypto could go beyond its role as digital gold and transition into a fully integrated, yield-generating asset within the broader crypto economy.

Its dominance in the digital economy is poised to grow beyond being just a store of value.