The Bitcoin (BTC) price had been slowly retracing upwards after a sharp drop on Aug 11.

Technical indicators and the price movement indicate that the increase is more likely to be a correction rather than the beginning of a new upward trend.

Bitcoin Retraces After Drop

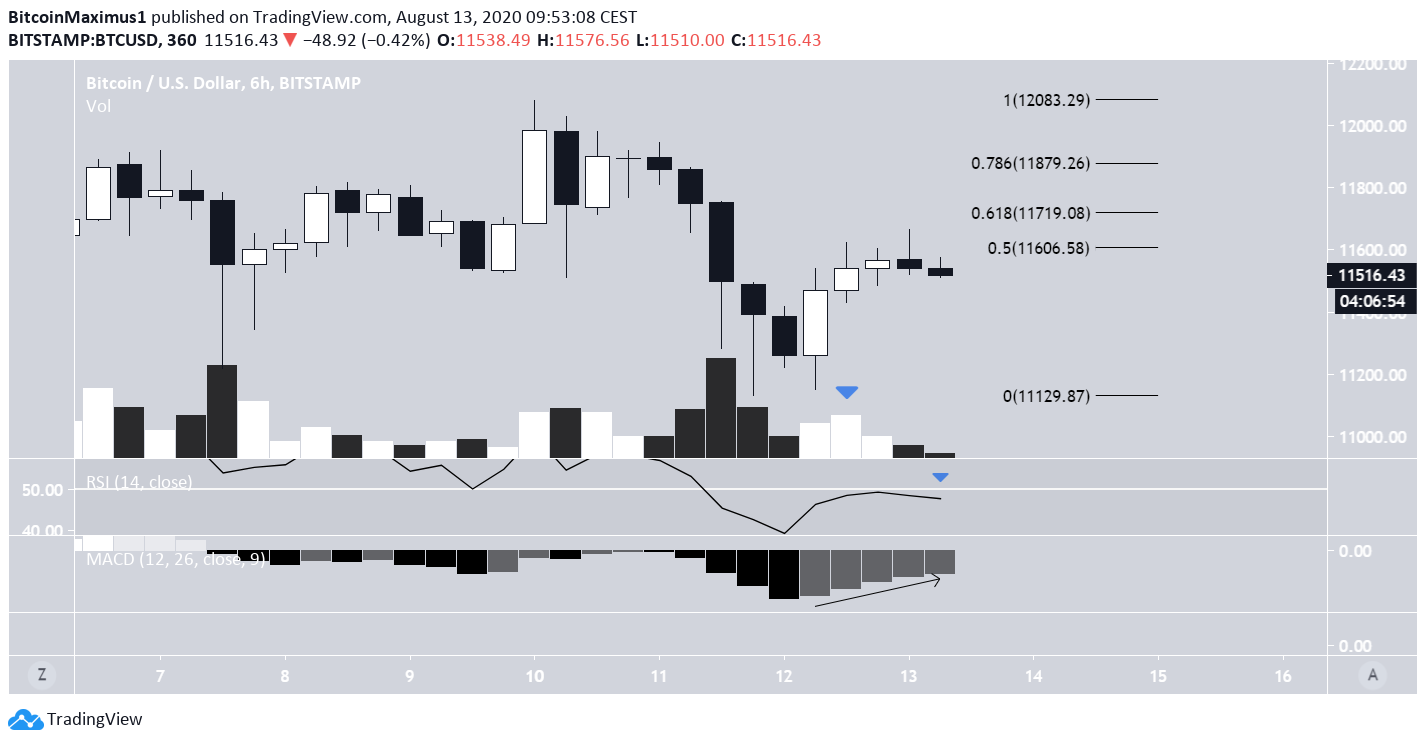

In yesterday’s analysis, BeInCrypto stated that “The price has created what resembles a double-top,” with the second top being completed on Aug 10. Last night, the price was rejected between the 0.5-0.618 Fib levels found between $11,606 and $11,719. It then began a downward move that is still ongoing. While the RSI was rejected by the 50-line and is moving downwards, there is a bullish divergence in the 6-hour MACD, casting some doubt in the possibility of a continued downward move transpiring. However, the daily MACD is still bearish. In addition, volume has been weak during bullish candlesticks. An increase above the 0.786 Fib level would likely void any regular corrective patterns.

Wave Count

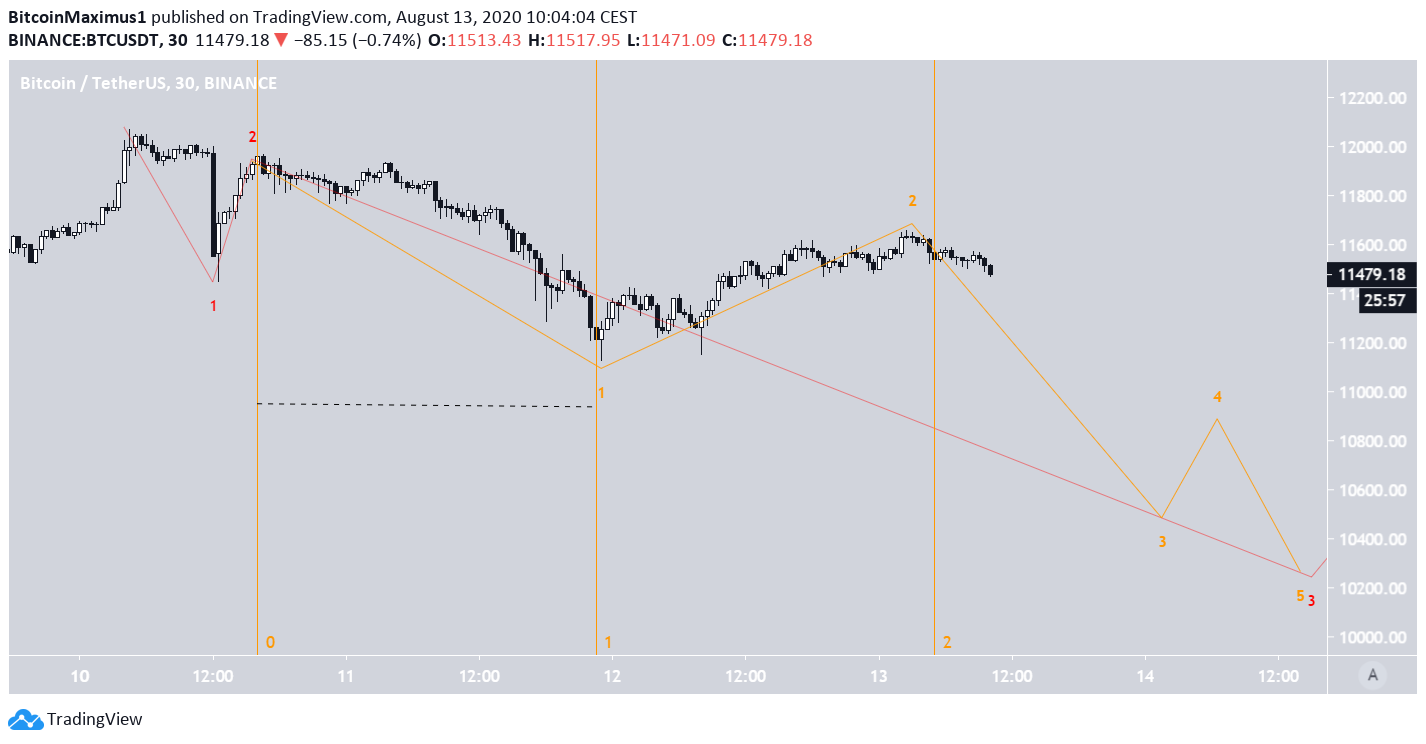

In yesterday’s analysis, BeInCrypto stated that the price is likely in a C wave, which could end around “$10,220-$10,500 on August 15.” The C wave is expected to transpire in a five-wave formation, outlined below in red. There are two possible wave counts for this movement, both of which suggest that the third wave has been extended. The sub-waves for this extended wave are shown in yellow. The first wave count suggests that the price has currently begun the fifth sub-wave. However, the fourth corrective sub-wave has taken a very long time to transpire, going further than the Fib time retracement level of 2, so it is possible that another wave count is correct.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored