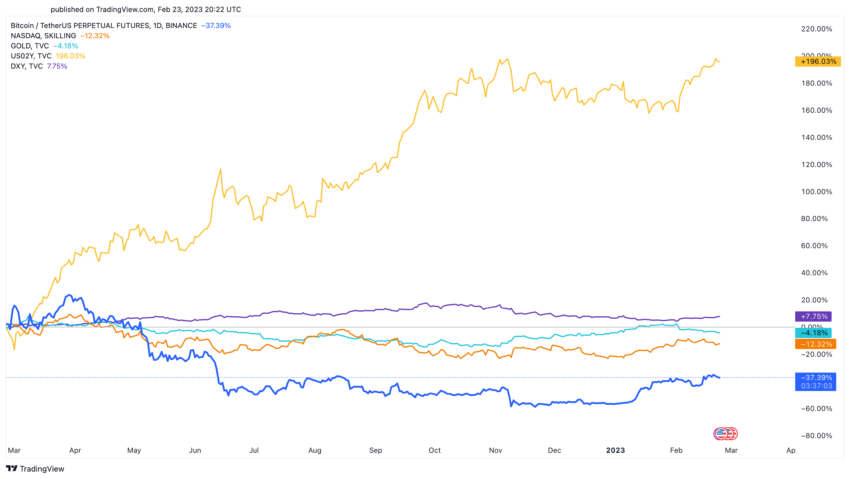

In the world of finance, Bitcoin (BTC), Ethereum (ETH) and the crypto market have been showing impressive resilience amidst a cross-asset selloff, outperforming the Nasdaq, gold, and 2-year yields.

Still, there are concerns over whether this resilience is sustainable. QCP Capital, a full-suite crypto asset trading firm, believes BTC is following in the footsteps of Wile E Coyote, who runs off a cliff without realizing it until he looks down.

Global and Crypto Market Outlook

In a recent market report, QC Capital affirmed BTC is still catching up with the massive Q4 2022 – Q1 2023 rally in other markets. As a result, expressing views through a long USD or short Gold position may be preferable, as crypto is expected to remain more resilient on the way down.

On the two other occasions when yields and risk assets diverged in March and July 2022, other assets quickly caught up. Nonetheless, yields have moved exponentially since this month’s NFP and CPI. And they are expected to take a breather from the current high levels.

For the break to happen, it would require next month’s set of NFP, CPI, and FOMC to back up this move. Currently, the global and crypto market is already pricing a higher rate for 2023 than the Fed’s dots. This means that it would take another strong set of data to move up their median to kick off the next leg lower for risk assets.

Until then, BTC will likely be in a range awaiting its next cue.

The Risk of Any Reversal of Liquidity

The driving force behind BTC’s divergence is that it is the most direct global liquidity proxy. It is not tied to any one central bank or nation, affirmed QC Capital. While the focus has been on USD liquidity, there has been a missed massive liquidity injection by the Bank of Japan (BOJ) and People’s Bank of China (PBOC) over the past three months.

Central banks have net added $1 trillion of liquidity since the market’s bottom in October 2022. The PBOC and BOJ ranked as the largest contributors. Therefore, such a large injection of liquidity will find its way to the crypto market. Even despite what appears to be the current US administration’s best efforts to prevent that.

Apart from US data and Fed guidance, one also has to be conscious of BOJ and PBOC liquidity injections. Any reversal of liquidity from these two sources would remove the underlying support that Bitcoin has seen this past month. Therefore, the next two BOJ meetings will mark the transition of BOJ governors for the first time in 10 years, which will take on added importance for crypto traders.

Additionally, one must watch China’s CPI over the next few months – not as a market-moving event but as a sign of when the PBOC will be forced to slow down its stimulus. The risks are tilted to the downside, as the BOJ and PBOC liquidity injections will have to slow down in Q2. Meanwhile, the Fed’s QT continues at full throttle, with the possibility of an even higher Fed terminal rate to come.

Bitcoin (BTC) Price Prediction: Signs of a Double Top

On the technical side, QC Capital maintains that Bitcoin is potentially forming a double top against the August 2022 correction high and May 2022 reaction low at 25,300.

Above that, the huge $28,800-$30,000 resistance is the Head and Shoulders neckline. Until these levels break, the 5 wave count still remains valid, with a final Wave 5 lower to come. Bitcoin momentum continues to be stronger than Ethereum, as seen from momentum indicators like the MACD.

Ethereum (ETH) Price Prediction: The Struggle Continues

Ethereum is still struggling to break the support-turned-resistance level of $1700-$2030. While it remains under, the final Wave 5 count still remains valid.

A short entry on Ethereum would be a crossover on the weekly MACD line. Possibly after a sell the news following the Shanghai merge.

Potential for a Rough 2023

As for upcoming 2023 risk events, several key events may impact the global and crypto markets. These include the US debt ceiling, the Federal Reserve balance sheet reduction, and potential tapering or tightening by central banks worldwide. These events may contribute to a potential crypto market correction. It is essential to remain vigilant and stay informed of any developments.

Although Bitcoin has been showing impressive resilience amidst a cross-asset selloff, concerns over sustainability remain. While liquidity injections from central banks have been driving the market, any reversal of liquidity may impact BTC’s performance.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.