Bitcoin (BTC) increased considerably last week, reaching an all-time high price of $58,352 on Feb. 21.

While a short-term correction could occur, the long-term trend is still bullish and BTC is expected to eventually make a new all-time high price.

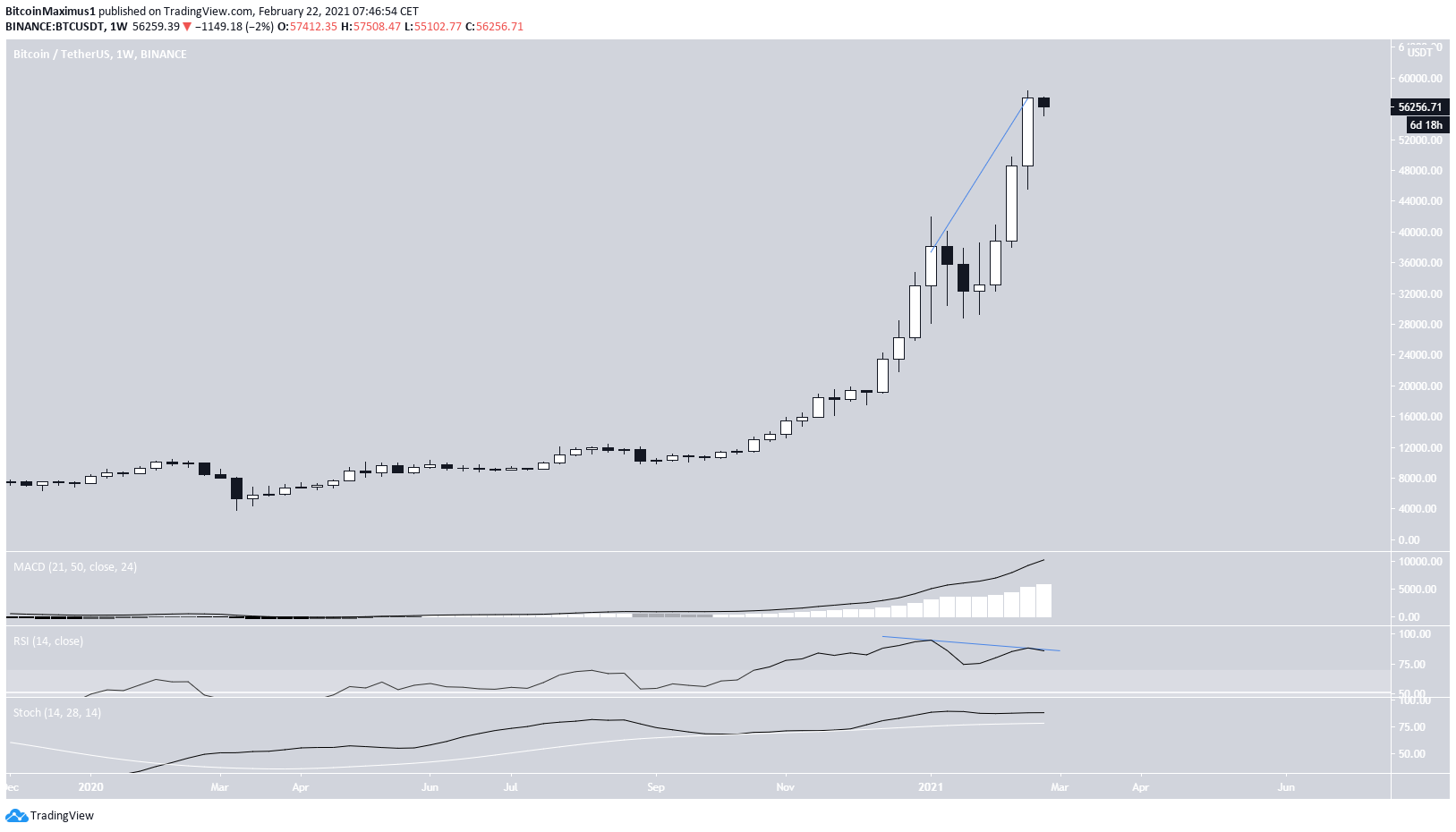

Weekly Bitcoin Close Generates Weakness

The Bitcoin price increased considerably during the week of Feb. 15 – 22, going from a low of $45,570 to an all-time high price of $58,352. The closing price was near the all-time high, creating a bullish belt hold candlestick in the process.

While the MACD and Stochastic oscillator are increasing, the weekly RSI has generated a considerable bearish divergence. This is a potential sign that the price might be approaching a top.

Future Movement

Despite the bearish divergence in the weekly time-frame, the daily chart still shows a bullish trend.

Bitcoin created a Doji candlestick on Feb. 20 — a sign of indecision. The MACD, RSI, and Stochastic oscillator are all increasing, suggesting that the trend is still bullish.

However, a short-term correction may be expected when looking at the two-hour chart. It shows a decreasing MACD and RSI. The latter has just crossed below 50.

If BTC decreases, there is a minor support area at $52,500. This target also coincides with a potential ascending support line that has been in place since Feb. 8.

Besides the wick support from Feb. 20, there is no other support below the current price until $52,500.

BTC Wave Count

The wave count suggests that BTC is in the fifth and final wave of a bullish impulse that began in March 2020 (shown in white below). The most likely target for the top of the movement is found between $63,882-$66,548.

The sub-wave count is shown in orange.

A decrease below the sub-wave one high at $38,620 would invalidate this particular wave count.

The shorter-term count indicates that BTC has potentially begun sub-wave four, which is normally corrective. The most likely target for the bottom of the correction is found between $44,862- $47,861. This range is the 0.382-0.5 Fib retracement levels of the most recent upward movement.

The minor sub-wave count is shown in black.

Conclusion

It’s possible that BTC has begun a corrective period and will decrease towards $44,861-$47,861. Nevertheless, the longer-term trend is still bullish and Bitcoin is expected to make another high afterwards.

A decrease below $38,640 would indicate that the bullish trend is over. At the current time, this does not seem likely.

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here!

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.