Bitcoin (BTC) increased considerably last week, reaching an all-time high price of $58,352 on Feb. 21.

While a short-term correction could occur, the long-term trend is still bullish and BTC is expected to eventually make a new all-time high price.

Weekly Bitcoin Close Generates Weakness

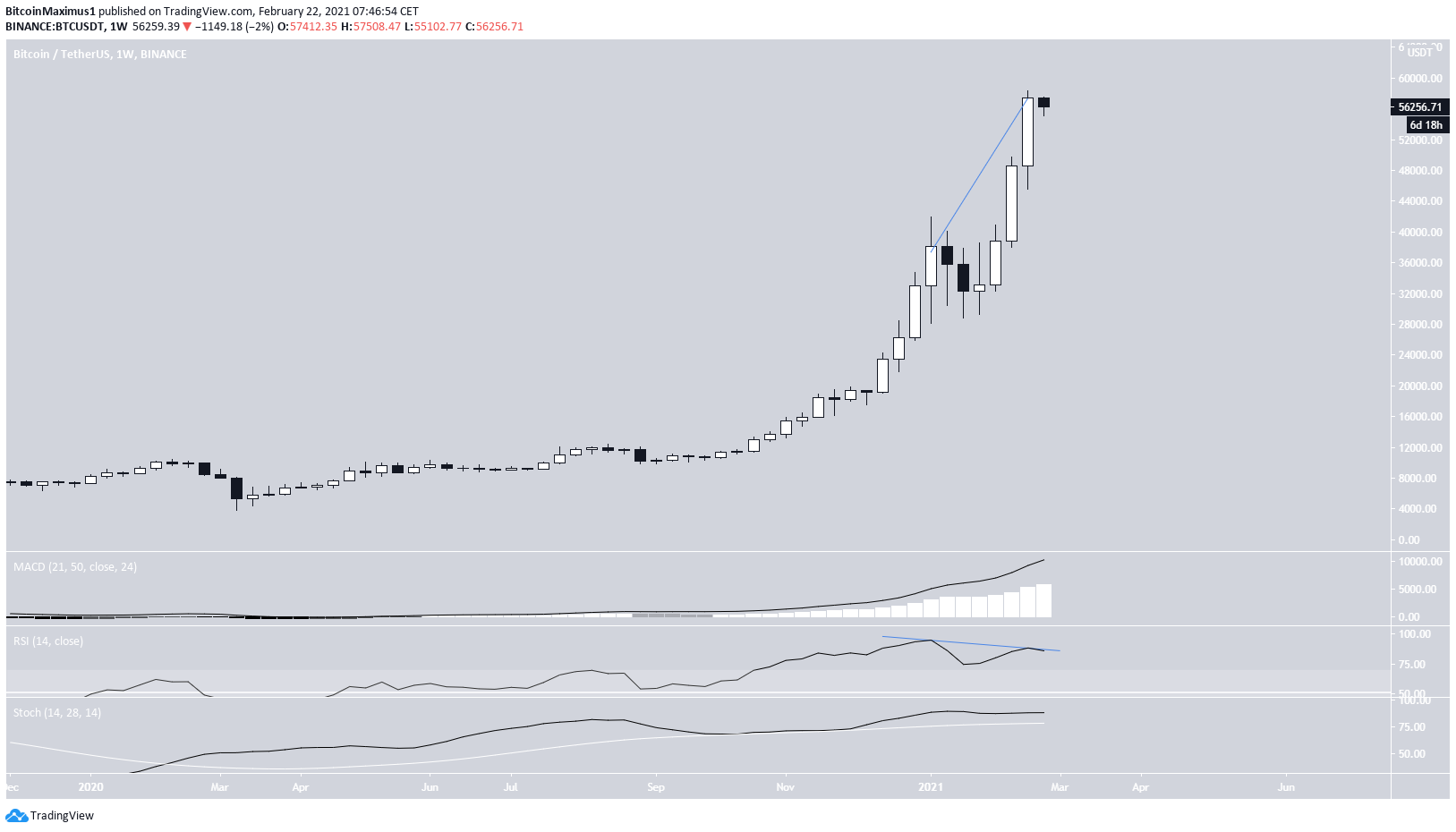

The Bitcoin price increased considerably during the week of Feb. 15 – 22, going from a low of $45,570 to an all-time high price of $58,352. The closing price was near the all-time high, creating a bullish belt hold candlestick in the process.

While the MACD and Stochastic oscillator are increasing, the weekly RSI has generated a considerable bearish divergence. This is a potential sign that the price might be approaching a top.

Future Movement

Despite the bearish divergence in the weekly time-frame, the daily chart still shows a bullish trend.

Bitcoin created a Doji candlestick on Feb. 20 — a sign of indecision. The MACD, RSI, and Stochastic oscillator are all increasing, suggesting that the trend is still bullish.

However, a short-term correction may be expected when looking at the two-hour chart. It shows a decreasing MACD and RSI. The latter has just crossed below 50.

If BTC decreases, there is a minor support area at $52,500. This target also coincides with a potential ascending support line that has been in place since Feb. 8.

Besides the wick support from Feb. 20, there is no other support below the current price until $52,500.

BTC Wave Count

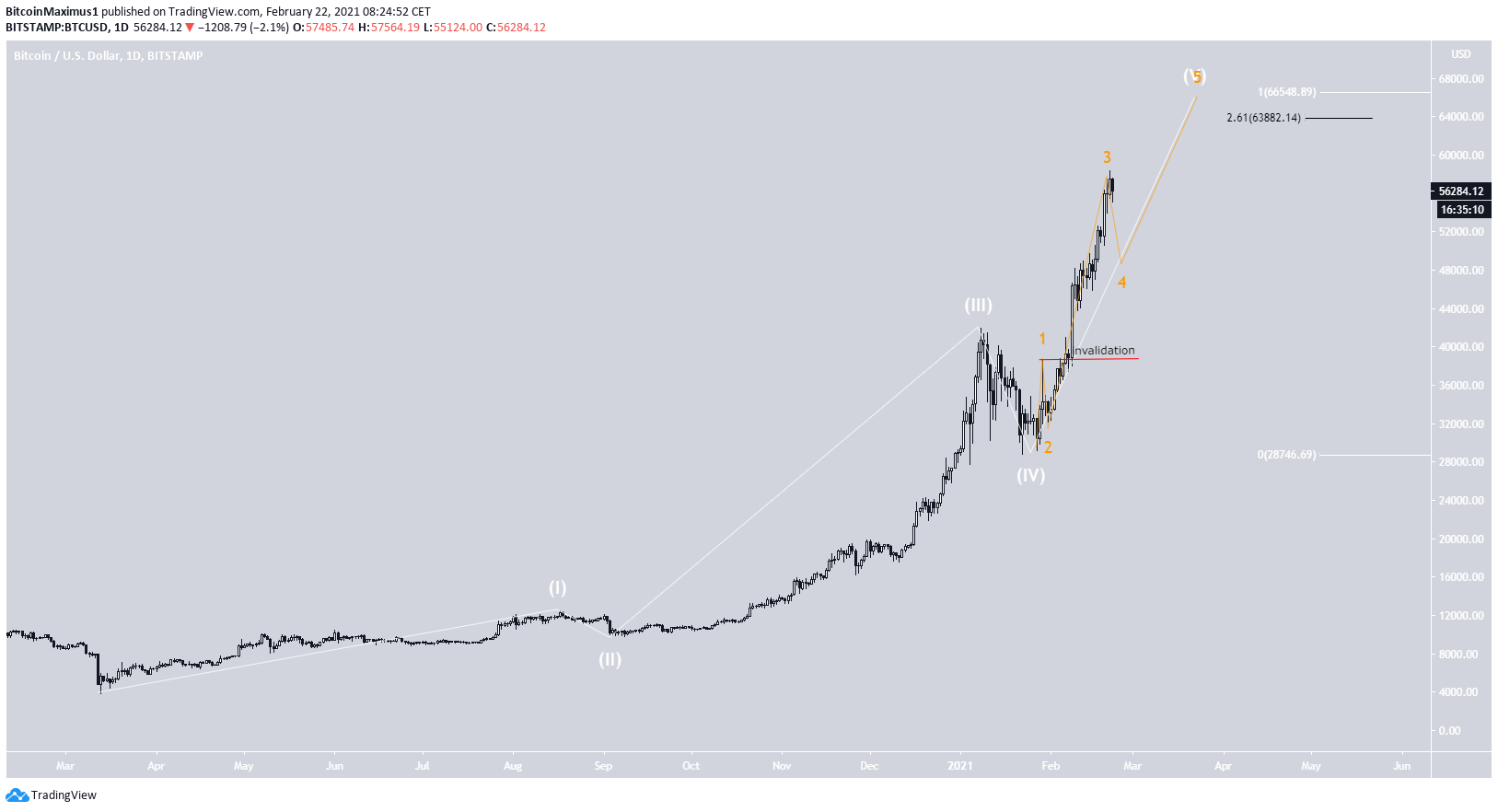

The wave count suggests that BTC is in the fifth and final wave of a bullish impulse that began in March 2020 (shown in white below). The most likely target for the top of the movement is found between $63,882-$66,548.

The sub-wave count is shown in orange.

A decrease below the sub-wave one high at $38,620 would invalidate this particular wave count.

The shorter-term count indicates that BTC has potentially begun sub-wave four, which is normally corrective. The most likely target for the bottom of the correction is found between $44,862- $47,861. This range is the 0.382-0.5 Fib retracement levels of the most recent upward movement.

The minor sub-wave count is shown in black.

Conclusion

It’s possible that BTC has begun a corrective period and will decrease towards $44,861-$47,861. Nevertheless, the longer-term trend is still bullish and Bitcoin is expected to make another high afterwards.

A decrease below $38,640 would indicate that the bullish trend is over. At the current time, this does not seem likely.

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here!