Bitcoin’s (BTC) price is likely to reach $66,000 within a week or two, according to on-chain data. Based on the metrics analyzed, the coin, which recently went through a tough period, is flashing bullish signs.

As of this writing, BTC trades at $63,903 after initially closing in on $65,000. However, the recent pullback might not be able to stop the potential move.

Fresh Liquidity Continues to Flow into Bitcoin

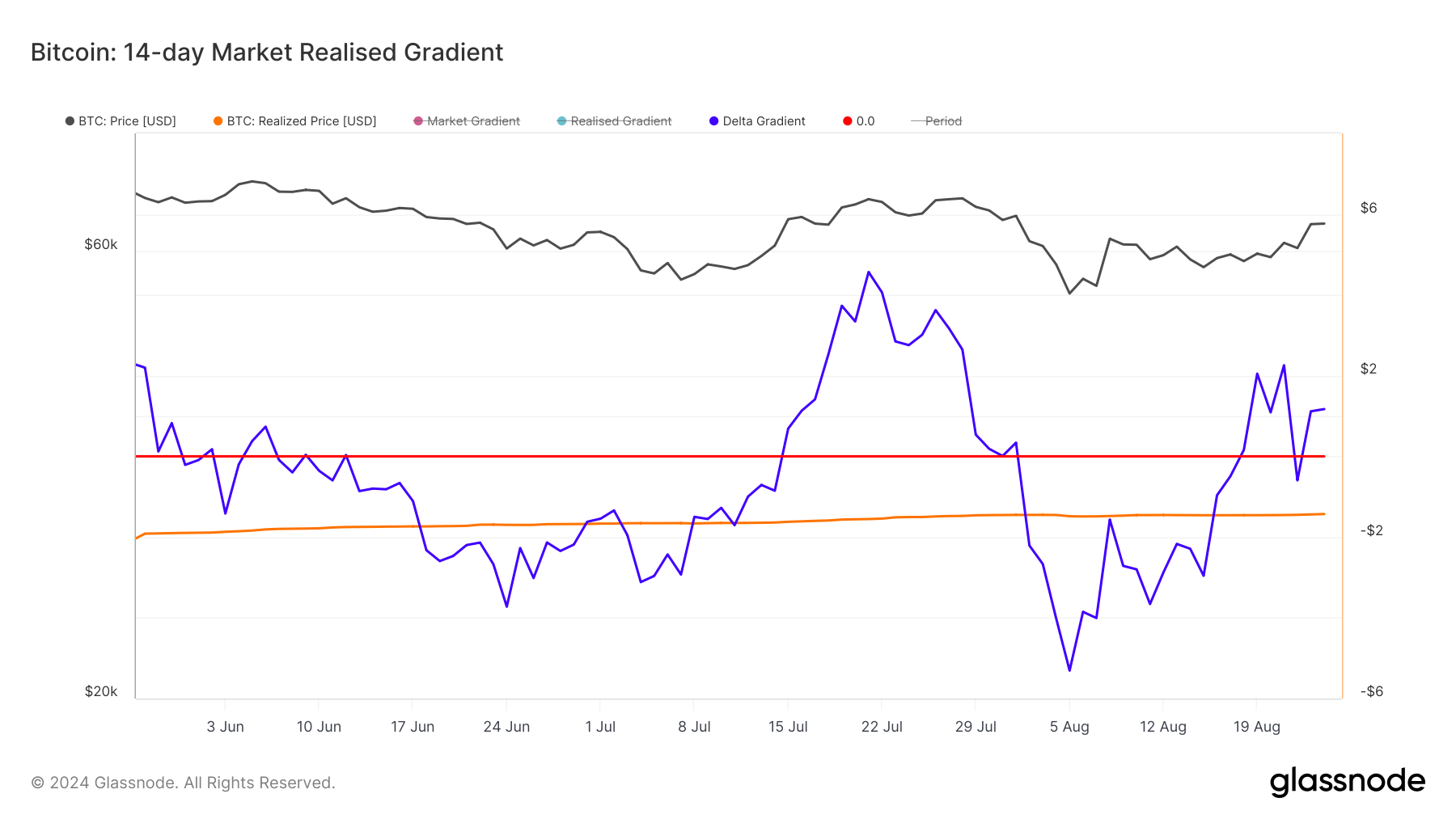

An evaluation of Glassnode data shows that Bitcoin’s 14-day Market-Realized Gradient stands at 1.17. This gradient employs the price at which each coin last moved to determine the length of an expected uptrend or downtrend.

Steep decreases in the 14-day Market-Realized Gradient indicate a drop in fresh capital flowing into the cryptocurrency. When this happens, BTC tends to undergo a price decline. However, at press time, the increase implies that Bitcoin has attracted substantial capital, which could drive notable value growth.

From the chart above, Bitcoin’s price hit $66,805 the last time the gradient was in a similar region. Therefore, if the pattern rhymes, the cryptocurrency’s value might hit or surpass $66,000 within the next two weeks.

Read more: What Is a Bitcoin ETF?

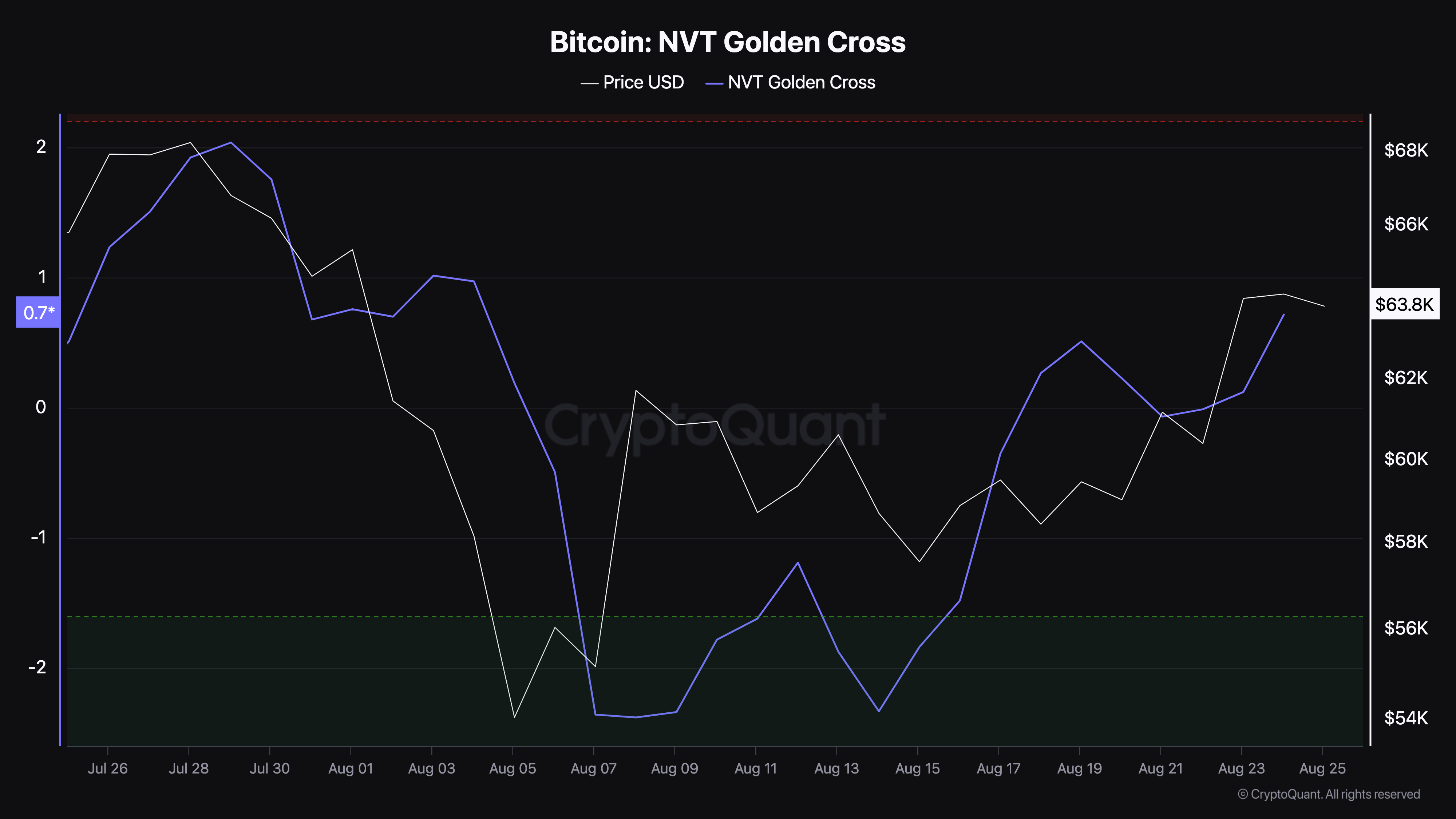

Furthermore, the Network Value to Transaction (NVT) Golden Cross appears to back a similar bias. For context, this metric measures if the value of a crypto is close to its bottom or near its top.

When the reading is under -1.6, the price is at its bottom, and upward pressure could be intense. However, values over 2.2 indicate that the crypto is overbought and could undergo a major correction.

In Bitcoin’s case, the NVT Golden Cross is 0.71, indicating that the coin has bounced off the top but is in a prime buying zone. Therefore, if the increase continues, so will BTC’s price.

Interestingly, Hardy, a crypto trader on X, also seems to share a similar thought. According to Hardy, Bitcoin is finally exiting its consolidation phase and even extended its targets beyond the price mentioned above.

“The real moves hit on weekdays. Next week is looking good; still riding this long to the top of the range. Eyes on $70K,” the trader posted.

BTC Price Prediction: Sellers Can’t Stand Buying Pressure

According to the daily chart, Bitcoin has formed an inverse Head and Shoulders pattern. This technical analysis pattern predicts the reversal from a downtrend to an uptrend and is crucial for confirming a bullish signal.

As seen below, the pattern consists of three parts: the first shoulder, which represents selling pressure and a rebound; the head, which indicates a steeper decline and a stronger rebound; and lastly, the second shoulder, which reveals how buying pressure invalidated sellers’s attempt to drive BTC lower.

At press time, Bitcoin broke above the neckline at $61,024, which was previously a resistance level. This breakout increases the coin’s chances of hitting a higher value. However, another resistance exists at $64,562.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Should Bitcoin breach this point, the cryptocurrency’s price could hit $66,849. However, if BTC is rejected at around $64,000, its value risks dropping by $60,000, which could invalidate the bullish bias.