After weeks of caution, Bitcoin (BTC) traders are shaking off their fears and increasing their trading activity. This renewed momentum comes in response to the Federal Reserve’s decision to cut interest rates by 50 basis points (0.50%), reigniting market confidence.

Bitcoin is now trading above $61,000 for the first time in nearly a month, signaling a potential rally on the horizon.

Bitcoin Sees Resurgence in Trading Activity

The Federal Reserve’s 50 basis point rate cut is expected to drive more investment into riskier assets, such as Bitcoin. This trend has already begun, marked by a positive shift in sentiment toward the leading cryptocurrency.

After weeks of fear dominating the market, sentiment shifted to neutral on Wednesday following the rate cut. This shift signals renewed confidence, with Bitcoin holders neither overly pessimistic nor excessively greedy. In such neutral conditions, investors typically re-enter the market gradually, boosting trading volumes and contributing to a steady price increase.

Read more: Bitcoin Halving History: Everything You Need To Know

As of press time, Bitcoin is trading at $61,967. Earlier Thursday morning, BTC briefly reached $62,501 before experiencing a slight pullback. Over the past 24 hours, trading volume surged by 12%, totaling $46 billion.

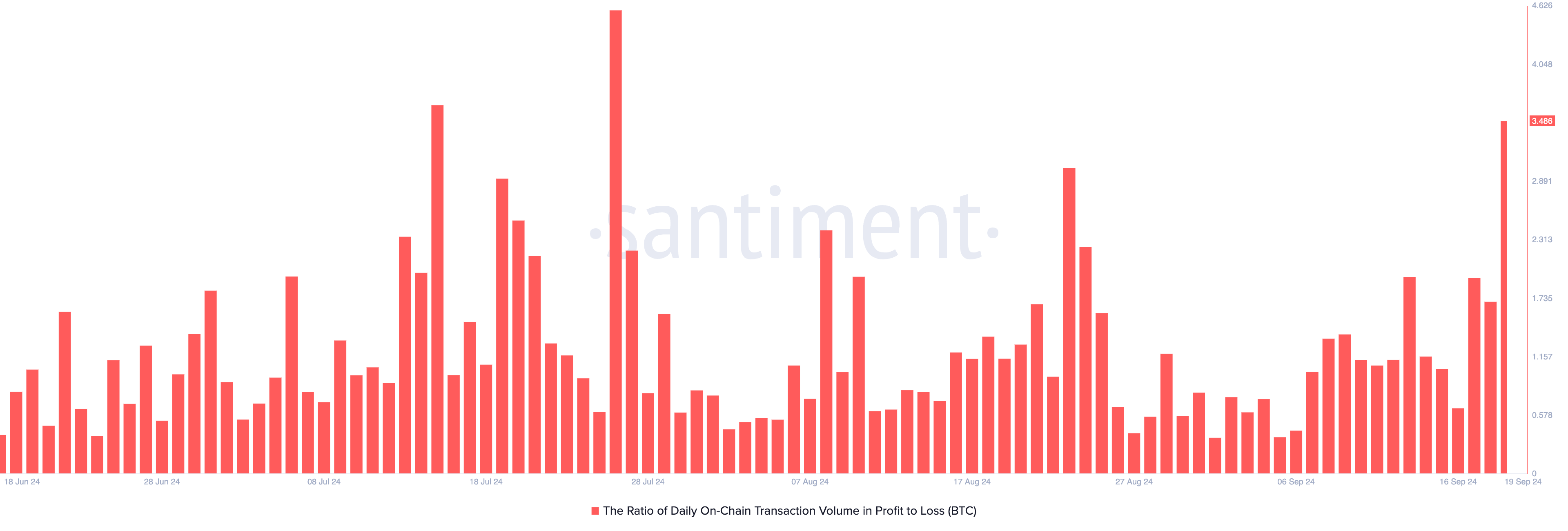

With Bitcoin trading at its highest in nearly a month, the majority of Thursday’s transactions have been profitable. According to BeInCrypto, the ratio of BTC’s transaction volume in profit to loss has reached its highest level since July, standing at 3.48. This means that for every transaction resulting in a loss, 3.48 transactions have turned a profit.

Despite Bitcoin’s positive price movement, Bitcoin spot ETFs saw their first net outflow after four consecutive days of inflows. SoSoValue reports that outflows from these funds totaled $53 million on Wednesday.

BTC Price Prediction: A Succesful Retest May Drive Coin Toward $64,000

Bitcoin’s recent price spike has pushed it above the critical resistance level of $61,388. Additionally, it is now trading above its 20-day exponential moving average (EMA), which indicates that buying pressure is surpassing selling activity.

While this rally is notable, Bitcoin is likely to retest this resistance level. Since the support floor flipped to resistance in early August, BTC has only managed to break through it once. Each rally attempt has faced strong selling pressure, leading to a downtrend. A failed retest could see Bitcoin drop to seek support around $54,302.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

However, if the retest succeeds and BTC breaks above the resistance, the uptrend will be confirmed, with Bitcoin potentially targeting $64,312.