Analysts have raised Bitcoin’s price target to $112,000 following a spike in exchange-traded fund (ETF) inflows.

This increased activity suggests bullish sentiment among institutional investors, potentially driving the cryptocurrency to new highs.

Bitcoin ETF Inflows to Trigger Price Boost

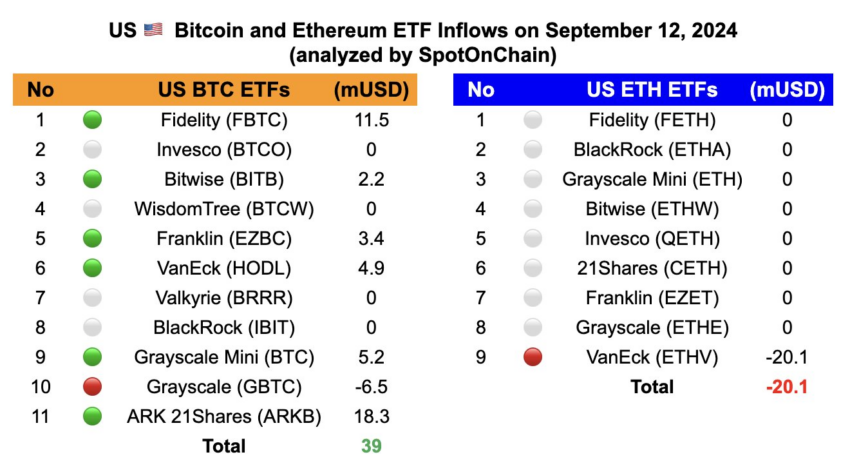

SpotOnChain analysts reported significant inflows into Bitcoin ETFs. Bitcoin’s net flow turned positive, with $39 million in inflows, reversing previous weak volumes.

In contrast, Ethereum ETFs saw net outflows for the second consecutive day, with Grayscale’s ETHE experiencing a $20 million outflow, while other US Ethereum ETFs had zero net flow.

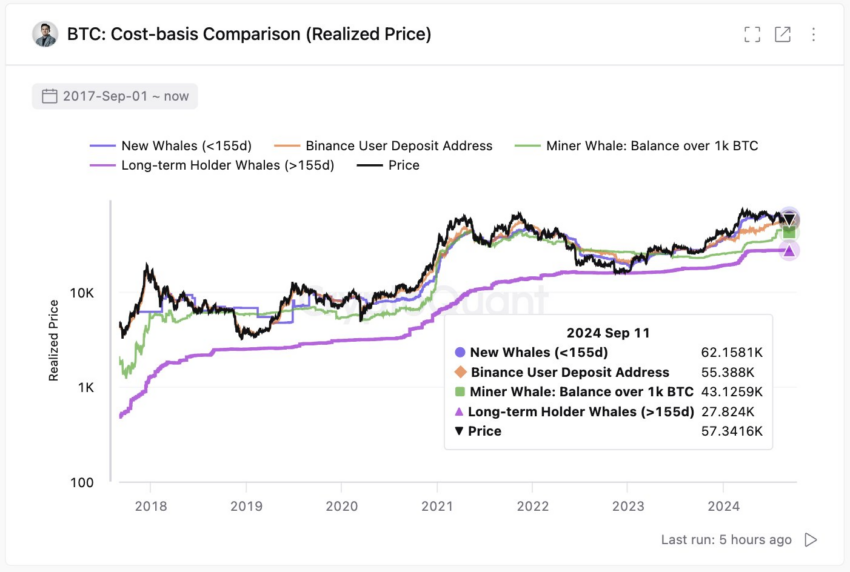

The positive inflows occur when Bitcoin ETF investors’ cost basis is higher than Bitcoin’s price. CryptoQuant CEO Ki Young Ju noted that the cost basis for “New Custodial Wallets/ETFs” is $62,000, while Bitcoin trades at around $57,000.

According to Ark Invest Research Associate David Puell, these market conditions suggest that the average ETF investor may be at a loss. Still, the historical perspective reinforces the potential for a significant upward movement.

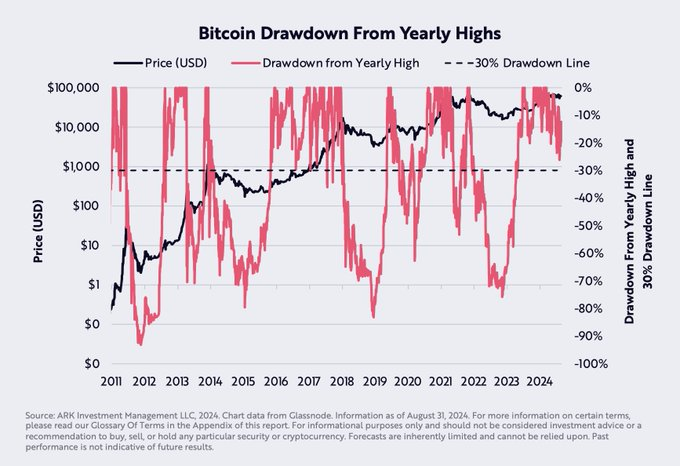

“When measured against bitcoin’s rolling yearly highs, the percent price drawdown in 2024 still suggests the kind of correction associated historically with bitcoin’s bullish primary trends, like those seen in 2016 and 2017, for example,” Puell said.

The convergence of increased ETF inflows, institutional accumulation, and historical patterns contributes to the consensus among analysts that Bitcoin is poised for a significant rally.

Miky Bull, for instance, raised his Bitcoin price target to $112,000, reflecting confidence in the cryptocurrency’s potential to surpass previous highs.

“Bitcoin to a first target of $112,000 this year. History has indeed prevailed. In 2016 and 2020 Q4 post-halving witnessed the beginning of a parabolic rally to a cycle top,” Bull affirmed.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

His analysis points to Bitcoin’s cyclical price movements, especially following halving events that reduce mining rewards and precede substantial price increases. The recent spike in ETF inflows could serve as a catalyst, influencing investment and adoption.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.