Bitcoin’s (BTC) price volatility continues to challenge investors. Early Monday, it fell to $54,200, negating gains from a peak of roughly $58,500 over the weekend.

The last few hours have been particularly turbulent, with significant fluctuations and liquidations characterizing the market.

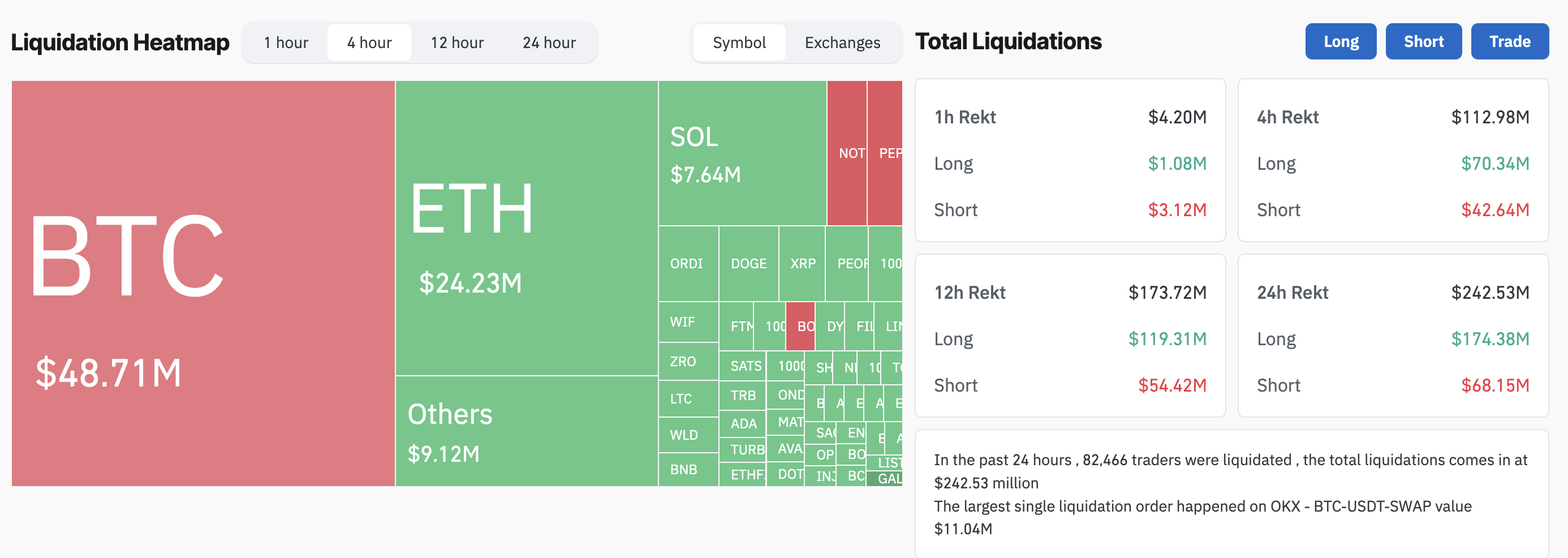

Bitcoin Causes Liquidations of Over $100 Million in the Last 4 Hours

Despite a promising attempt at recovery on Sunday, Bitcoin faced stiff resistance that led to a sharp decline. Within just four hours, the market experienced liquidations totaling $113 million, comprising $70 million from long positions and $42.64 million from short positions. Overall, nearly $250 million worth of trades were liquidated in the past 24 hours, indicating persistently choppy conditions.

Avinash Shekhar, co-founder of the crypto derivative exchange Pi42, provided insights into the market’s volatility in an interview with BeInCrypto.

“Bitcoin’s price is locked in a tug-of-war between bulls and bears. Sellers pulled the price down to near $53,500 on July 5, yet lower levels attracted buying by the bulls. Then, bears again drove the price down from $58,300 to $54,200 in the morning of July 8,” Shekhar told BeInCrypto.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Meanwhile, Metaplanet, a Japanese investment firm, has taken strategic steps to strengthen its position in the crypto market. On July 8, it announced a purchase of 42.47 Bitcoin, roughly worth around $2.35 million.

This happened after the company announced on June 24 that it would issue a $6.2 million bond to bolster its Bitcoin holdings. The decision aims to enhance Metaplanet’s financial stability by incorporating Bitcoin as a reserve asset. The firm seeks to mitigate risks associated with Japan’s economic challenges, including high government debt and sustained negative real interest rates.

Meanwhile, potential selling pressures loom from Mt. Gox investors and the German government. Recent reports indicate that Bitcoin addresses linked to German authorities transferred 700 BTC, valued at $40.47 million, to an unidentified ‘139PoP’ address this past weekend, as identified by Arkham’s on-chain analytics.

“The high on-chain selling pressure may be attributed to the commencement of Mt.Gox repayments, which have been awaited by investors for years. Although investors might wait up to 90 days to access the funds, the official news of repayments, confirmed by the verified movement of 47,228 BTC from a Mt.Gox-associated cold wallet to a new address likely designated for repayments, triggered market reactions,” Matteo Greco, Research Analyst at Fineqia told BeInCrypto.

This activity is part of a broader pattern of behavior from the German government, which has recently moved significant quantities of Bitcoin to major exchanges such as Coinbase, Bitstamp, and Kraken. These moves followed the seizure of 50,000 BTC earlier in the year from the film piracy site Movie2k.

Read more: Who Owns the Most Bitcoin in 2024?

The balance between optimism and caution in the crypto market continues to provoke debate and speculation among stakeholders. However, the sentiments are more aligned towards fear. The crypto fear and greed index indicates a score of 28, which is in the fear zone.