Highlights

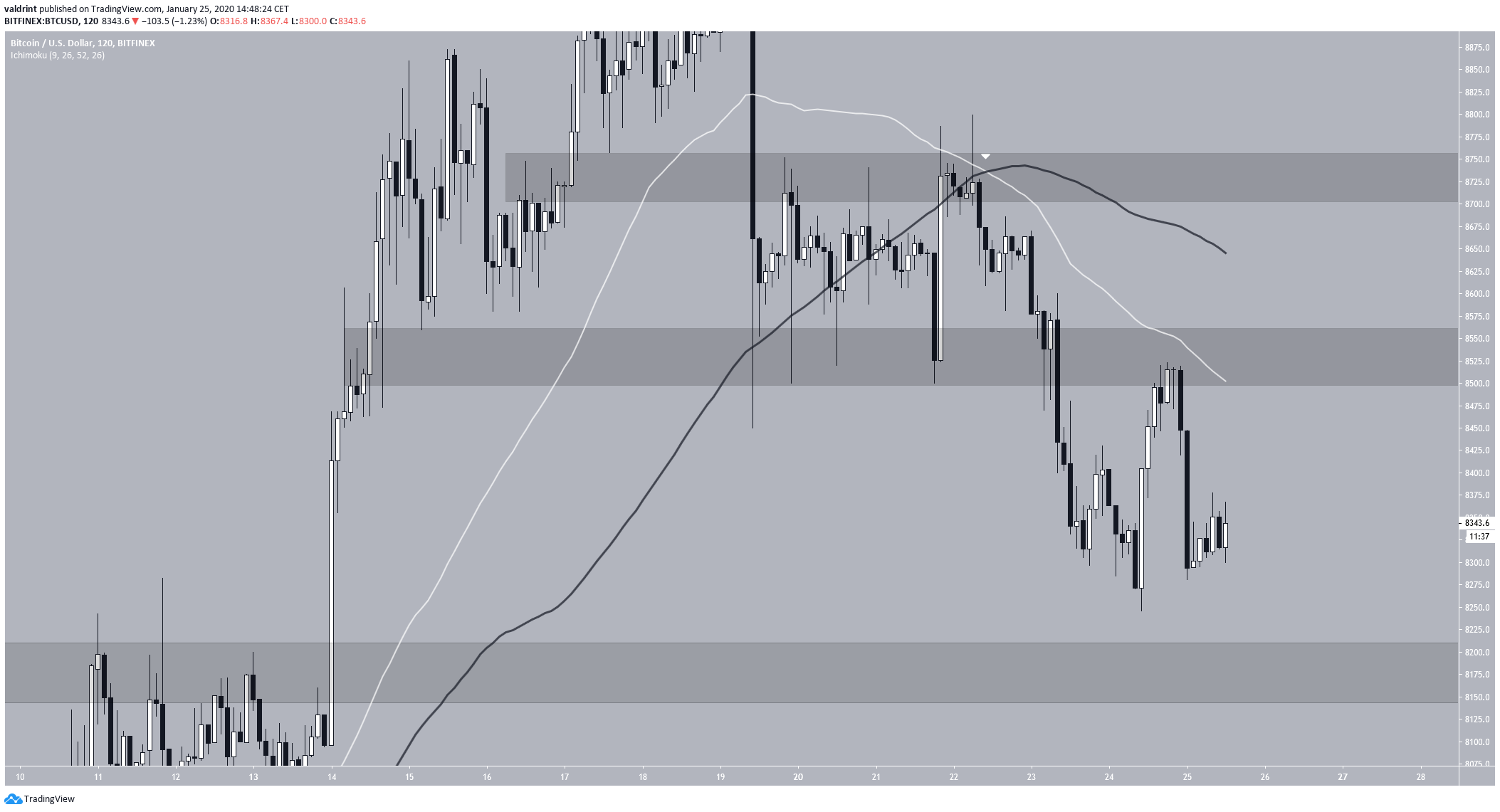

- The price broke down below $8500.

- There are signs of a short-term reversal.

- There is resistance at $8500 & $8800.

- There is support at $8200.

Let’s take a closer look at the Bitcoin price and determine the possibility that this movement transpires.$BTC #BITCOIN

— Michaël van de Poppe (@CryptoMichNL) January 25, 2020

Following the plan so far, rejected at $8,500 and retesting this area for support.

Doesn't look that strong yet, which means that I think we'll swipe liquidity below the low at around $8,200.

If that happens and we bounce up, I think we'll retest $8,800. pic.twitter.com/V6XJf9DQ3s

Bitcoin Price Reversal Signs

The Bitcoin price decreased below the $8500 support area on January 24 and then validated it as resistance afterward. During this movement, BTC touched the 100-hour moving average (MA) but failed to flip it. In addition, the 100- & 200-hour MAs have made a bearish cross, and the price is trading below both. It is safe to say that Bitcoin is currently in a short-term downward trend, at least since breaking down from the ascending wedge. The 2-hour RSI movement confirms the short-term bearishness since it has been below 50 since January 19, the breakdown date.

However, it has started to display some signs of strength. The price moved upward after generating bullish divergence and attempted breaking through $8500.

While the RSI failed to stay above 50, it successfully completed a failure swing bottom by increasing above the top between the divergence points.

The price has created something like a double bottom near $8300. While we could definitely see the movement outlined in the tweet, in which the price decreases below this low before swiftly reversing, we could see a straight price increase from this level towards the next resistance area at $8500, and possibly $8800.

The 2-hour RSI movement confirms the short-term bearishness since it has been below 50 since January 19, the breakdown date.

However, it has started to display some signs of strength. The price moved upward after generating bullish divergence and attempted breaking through $8500.

While the RSI failed to stay above 50, it successfully completed a failure swing bottom by increasing above the top between the divergence points.

The price has created something like a double bottom near $8300. While we could definitely see the movement outlined in the tweet, in which the price decreases below this low before swiftly reversing, we could see a straight price increase from this level towards the next resistance area at $8500, and possibly $8800.

To conclude, the Bitcoin price has broken down below the $8500 support area and is looking for support. We believe it is possible that it reverses near $8200 and begins to move upwards.

To conclude, the Bitcoin price has broken down below the $8500 support area and is looking for support. We believe it is possible that it reverses near $8200 and begins to move upwards.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.