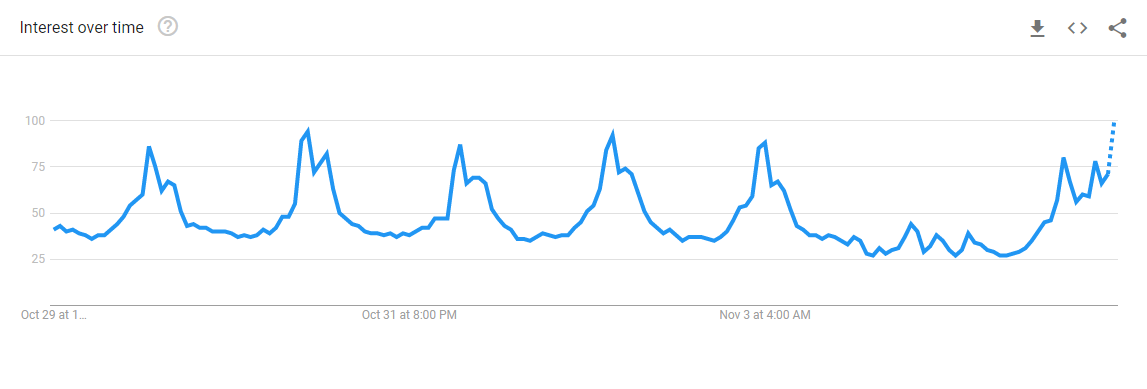

The bitcoin price has breached $15,000 even at the height of all the uncertainty in the United States. Google Trends data suggests that Bitcoin has piqued the interest of the mainstream.

A wave of fear-of-missing-out (FOMO) appears to have hit the bitcoin market. The BTC price is up more than 100% year-to-date as investors such as Paul Tudor Jones, Square, and MicroStrategy buy the dip, thrusting the leading cryptocurrency into the spotlight.

Meanwhile, JPMorgan is finally putting its digital currency JPM Coin to work, according to Bloomberg, and has completed its maiden transaction, which likely bodes well for mainstream adoption.

Bitcoin Bulls

A rising tide appears to be lifting all boats, with the broader cryptocurrency market largely trading in the green alongside bitcoin.

Spencer Noon of DTC Capital tweeted that new entrants in the cryptocurrency space will often opt to buy altcoins rather than bitcoin amid a preference to own a full coin vs. stacking sats.

$15k #BTC is the best advertising the broader #crypto space has had in years. As new people enter the space, historically we've seen they buy alts instead of BTC. Unsophisticated crypto investors are heavily influenced by unit bias and don't want to buy a fraction of a coin.

— Spencer Noon 🕛 (@spencernoon) November 5, 2020

Meanwhile, Binance CEO Changpeng Zhao has taken the opportunity to raise his BTC price outlook, advising that bitcoin is now barreling toward $20,000, where it would surpass its all-time high set at year-end 2017.

https://twitter.com/cz_binance/status/1324401210309275648

According to Google Trends, there has been a notable increase in “bitcoin” searches over the past seven days, with searches hitting a peak for the month on Nov. 5.

Crypto Adoption

Meanwhile, industry infrastructure seems to be paving the way for greater wide-scale adoption and making it easier to integrate cryptocurrencies into the mainstream.

On this front, London-based cryptocurrency startup Koinal announced that it inked a deal with trading platform Huobi that makes it easier for investors to buy bitcoin with their debit or credit cards.

According to the announcement, users can pay for several cryptocurrencies, including BTC, LTC, XRP, ETH, BCH, TRX, and a few others using Visa, Mastercard, or China Union Pay.

In general, the barrier for first-time bitcoin buyers has been somewhat difficult, so deals like this may go a long way.

Bitcoin Hashrate

There have been some dips in the Bitcoin hashrate lately, but the overall trend appears to be intact. In recent days Twitter influencer Bitcoin Jack, who boasts more than 67,000 followers, commented on the appearance of miner capitulation, which happens when miners take the opportunity to sell their bitcoins because mining isn’t otherwise generating enough revenue.

According to Charles Edwards of Capriole Investments, however, those price dips could be explained by “Chinese miners relocating from hydro fuel,” adding that the “wet season is over.” He further noted that the hashrates have “recovered about 50%.”

It is driven by Chinese miners relocating from hydro fuel. Wet season is over.

Hash Rates have already recovered about 50%. Provided the recovery continues over the next 2 week's, nothing to be worried about here.

— Charles Edwards (@caprioleio) November 2, 2020

As long as that recovery persists, Edwards added, there is no need to lose any sleep.