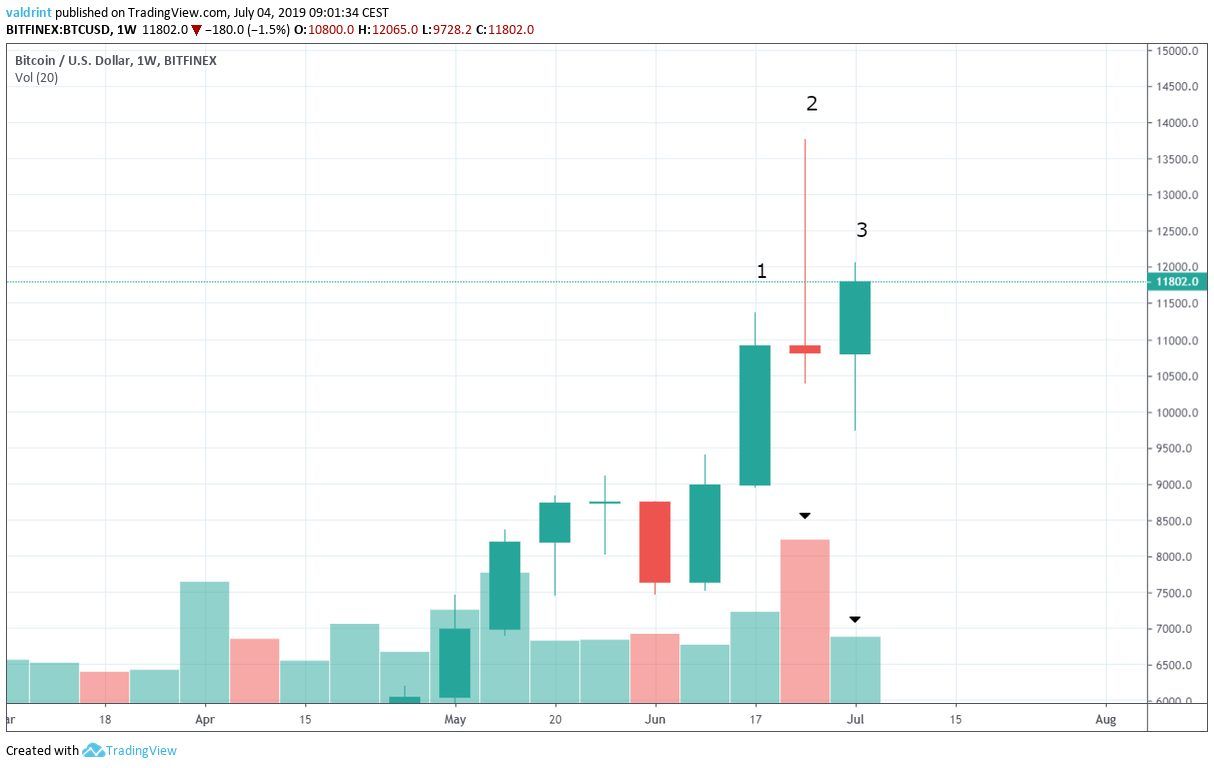

On July 2, 2019, the Bitcoin price made a low of $9728. A gradual uptrend began, which — at the time of writing — was still in effect.

The Bitcoin price is currently trading at around $11,800.

How low will the uptrend continue? Let’s find out:

For our previous analysis, click here.

If you want to trade Bitcoin (BTC) safely and securely on our partner exchange, follow this link to get set up on XCOEX.

The Bitcoin price is currently trading at around $11,800.

How low will the uptrend continue? Let’s find out:

For our previous analysis, click here.

If you want to trade Bitcoin (BTC) safely and securely on our partner exchange, follow this link to get set up on XCOEX.

Bitcoin Price: Trends and Highlights for July 4

- BTC/USD recently broke out from a descending channel.

- It is trading inside an ascending wedge.

- There is a slight bearish divergence developing in the RSI.

- The Bitcoin price has created two bullish candles in a row.

Previous Bitcoin Price Movement

Since June 27, the Bitcoin price has been trading inside the descending channel outlined below. On July 2, it reached the support line of the channel. A rapid upward move began, and on July 4 the price broke out from the channel.Bitcoin Price in an Ascending Wedge

Since reaching the aforementioned low on July 2 and touching the support line, the Bitcoin price has been increasing. It has been trading inside the ascending wedge outlined below: The divergence is not very significant in value and is only present in one indicator.

However, it is occurring at the resistance line of a bearish pattern, giving it more validity.

Finally, the convergence between the support and resistance lines does not occur until at least $12,500.

Therefore, it is possible that the Bitcoin price will continue to increase inside the confines of the wedge until it eventually breaks down.

A breakout looks unlikely.

The divergence is not very significant in value and is only present in one indicator.

However, it is occurring at the resistance line of a bearish pattern, giving it more validity.

Finally, the convergence between the support and resistance lines does not occur until at least $12,500.

Therefore, it is possible that the Bitcoin price will continue to increase inside the confines of the wedge until it eventually breaks down.

A breakout looks unlikely.

Candlestick Analysis

Yesterday we stated that:Today’s candle has so far been bullish. However, it is still contained within the real body of the bearish candle on June 30. A close above $12,000 would indicate that we are either in the B wave of an A-B-C correction or that the correction has been completed and the upward trend will continue.

However, instead of completing a bearish engulfing candle, the price has been increasing instead.

But, there are still four trading days left until the end of the week. Therefore, it is still possible that the Bitcoin price will decrease and create a bearish candle.

According to this analysis, the price is approaching a critical point, after which we will know whether the price is still in a correction or if a new uptrend has begun.

A breakout from the wedge or a close above the previous lower high at $12,500 would most likely confirm that an uptrend has begun.

However, instead of completing a bearish engulfing candle, the price has been increasing instead.

But, there are still four trading days left until the end of the week. Therefore, it is still possible that the Bitcoin price will decrease and create a bearish candle.

According to this analysis, the price is approaching a critical point, after which we will know whether the price is still in a correction or if a new uptrend has begun.

A breakout from the wedge or a close above the previous lower high at $12,500 would most likely confirm that an uptrend has begun.

Summary

The price of Bitcoin previously broke out form a descending channel. It is currently trading inside an ascending wedge. The price has been struggling to retrace above the 0.618 fib level of the entire drop, indicating that it is likely still correcting. Do you think the Bitcoin price has finished its correction? Let us know in the comments below.Disclaimer: This article is not trading advice and should not be construed as such. Always consult a trained financial professional before investing in cryptocurrencies, as the market is particularly volatile. Images are courtesy of Shutterstock, TradingView.

Top crypto platforms in the US

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored