Liquidity is projected to surge into the crypto market in the fourth quarter of the year, creating a favorable environment for a potential parabolic rally in both Bitcoin (BTC) and altcoins. This influx of capital could drive prices higher as investors look to capitalize on the anticipated momentum.

Today, Bitcoin’s price surged past $65,000, marking a significant milestone. However, according to a recent report, this rise is just the beginning of a potentially massive price boom. The anticipated surge is likely fueled by the return of retail investors and an influx of billions of dollars from the Chinese market.

More Capital Means More Upside for Bitcoin, Alts

Bitcoin’s recent jump could be attributed to the 50 basis point Fed rate Cut earlier this month. However, the number one cryptocurrency is not the only asset benefiting from the decision.

Since the rate cut, altcoins, which endured a prolonged downtrend for the last two quarters, have now enjoyed significant rallies. Despite the improved market condition, 10x Research, led by analyst Markus Thielen, believes the recent gains are nothing compared to what’s coming in Q4.

“Altcoins are exploding. Further upside appears likely as stablecoin minting accelerates and Chinese OTC brokers report billions in inflows. With Bitcoin breaking above $65,000, we anticipate a swift move toward $70,000, followed by new all-time highs in the near term,” Thielen said in the September 26 report.

While Bitcoin’s dominance has fallen, the total market cap of altcoins has increased by 15% since September 17.

However, the recent decline in BTC’s dominance does not mean that the coin price will continue to decrease. In 10x Research’s report, Theieln mentioned that Bitcoin could gain from a fresh $278 billion capital injection from the Chinese market in Q4.

“The $278 billion Chinese stimulus plan could ignite a parabolic rally in cryptocurrency prices, fueled by increasing global liquidity,” the report stated.

If that happens, then Bitcoin’s price could reach $70,000 before October, popularly called “Uptober,” closes. Another interesting twist to the matter is the rising participation of retail investors.

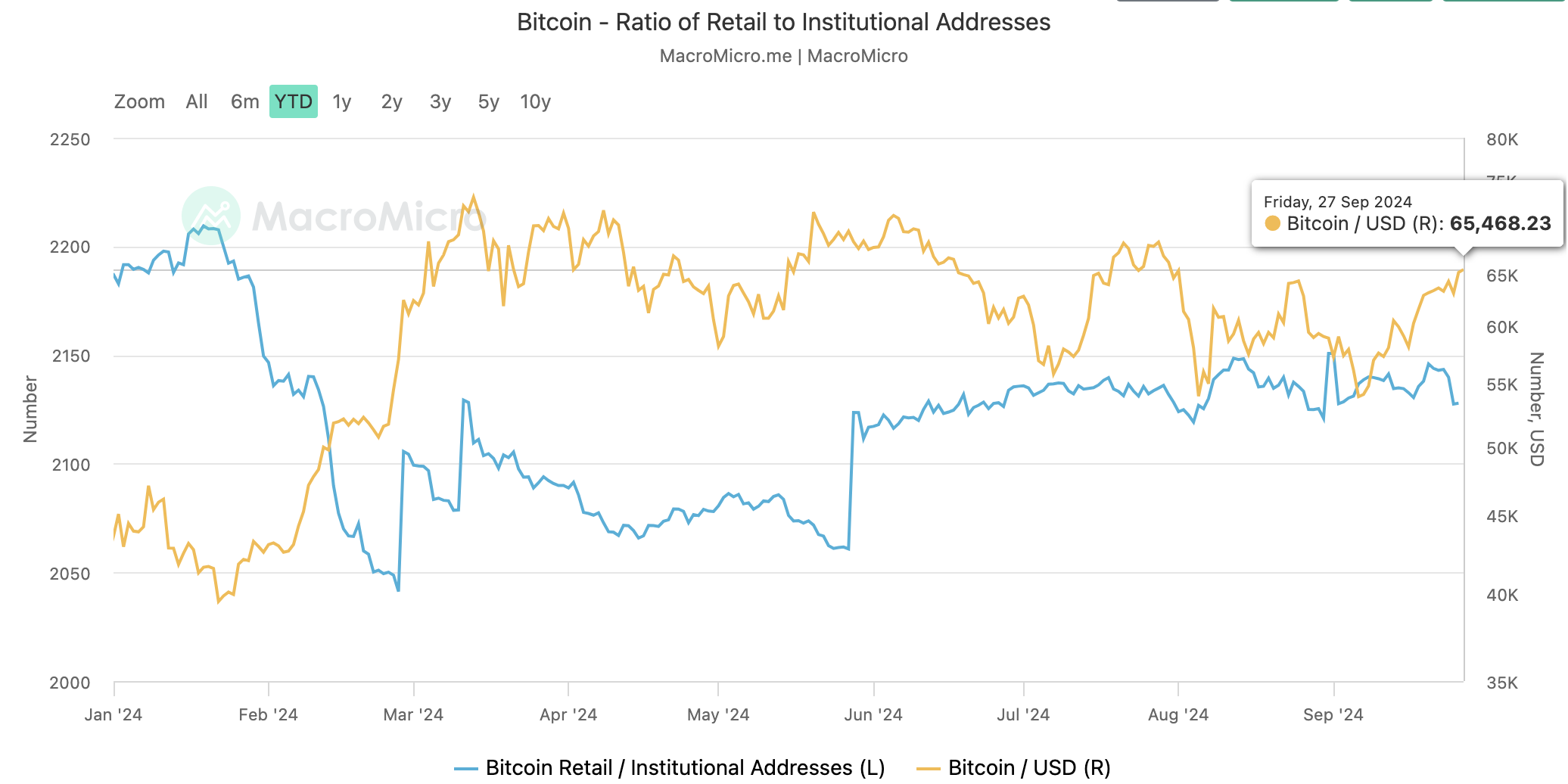

For most of this year, retail investors have stood on the sidelines as institutional investors have pushed BTC’s price to its all-time high (ATH). However, as of this writing, things have changed as the retail to institutional addresses have increased.

Read more: 10 Best Altcoin Exchanges In 2024

Retail Returns and Institutions Can Bet More

This increase is beneficial not only to Bitcoin but also to altcoins. For example, the prices of altcoins like Shiba Inu (SHIB) have rallied by 41% in the last seven days. SEI’s price has jumped by 31%, and likewise — Wormhole (W).

Interestingly, 10x Research also agrees, noting that the move seems to be starting from South Korea. With this development, it appears that the Chinese $278 liquidity, alongside significant market participation from the Asian region, could play a huge role in the projected upswing for the rest of the year.

“Retail crypto trading activity in South Korea supports this trend, with daily trading volumes now hovering around $2 billion. Although still below the staggering $13 billion seen in early March 2024 — when crypto volumes were double that of the local stock market, and Shiba Inu, traded in Korea, alone reached nearly 40% of the stock market’s volume — altcoins have dominated trading in the past week, surpassing Bitcoin,” 10x Research wrote.

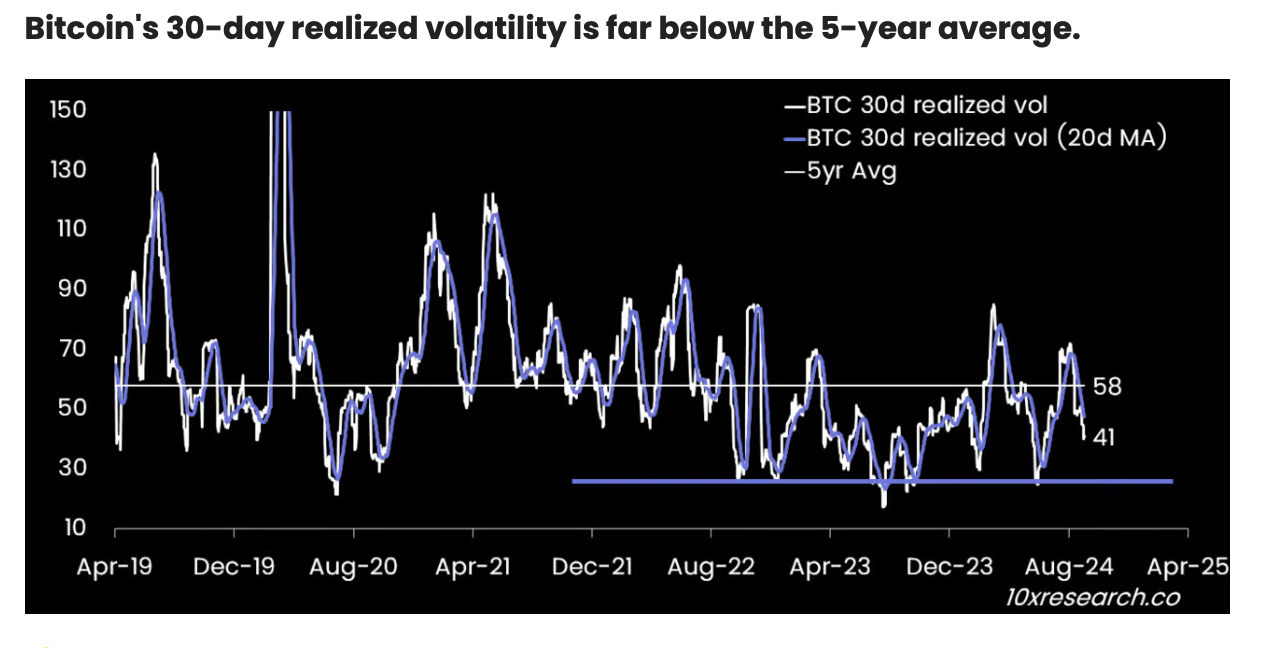

In addition, Bitcoin has registered a decline in its 30-day realized volatility. This decline means that institutional investors can increase their position size, consequently leading to BTC and the border market to higher values.

BTC Price Prediction: It’s Evidently a Bullish Cycle

From a technical point of view, Bitcoin has finally broken above the descending channel. Since July, this bearish pattern has restricted the coin from rising past $65,000.

However, with support at 62,825, BTC successfully breached the region. According to the daily chart, Bitcoin’s price might now face resistance at $68,253, which is a major point of interest. Breaking this hurdle could be crucial to rising toward $73,095.

If that happens, then BTC might reach a new ATH before Q4 ends, with potential targets starting from $76,075.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

However, the rejection of $68,253 could invalidate this prediction. Should that happen and the crypto market liquidity fails to pick up, Bitcoin’s price might drop to $58,188.