BeInCrypto takes a look at on-chain indicators for Bitcoin (BTC), more specifically Coin Days Destroyed (CDD) and Binary Coin Days Destroyed (Binary CDD). These indicators are used with the purpose of determining the age of BTC that are currently being transacted.

Despite the ongoing bitcoin price increase, CDD is consistently showing low values relative to those during the past three months. This shows that old coins are not moving and that long-term bitcoiners are holding with conviction.

SponsoredBitcoin CDD

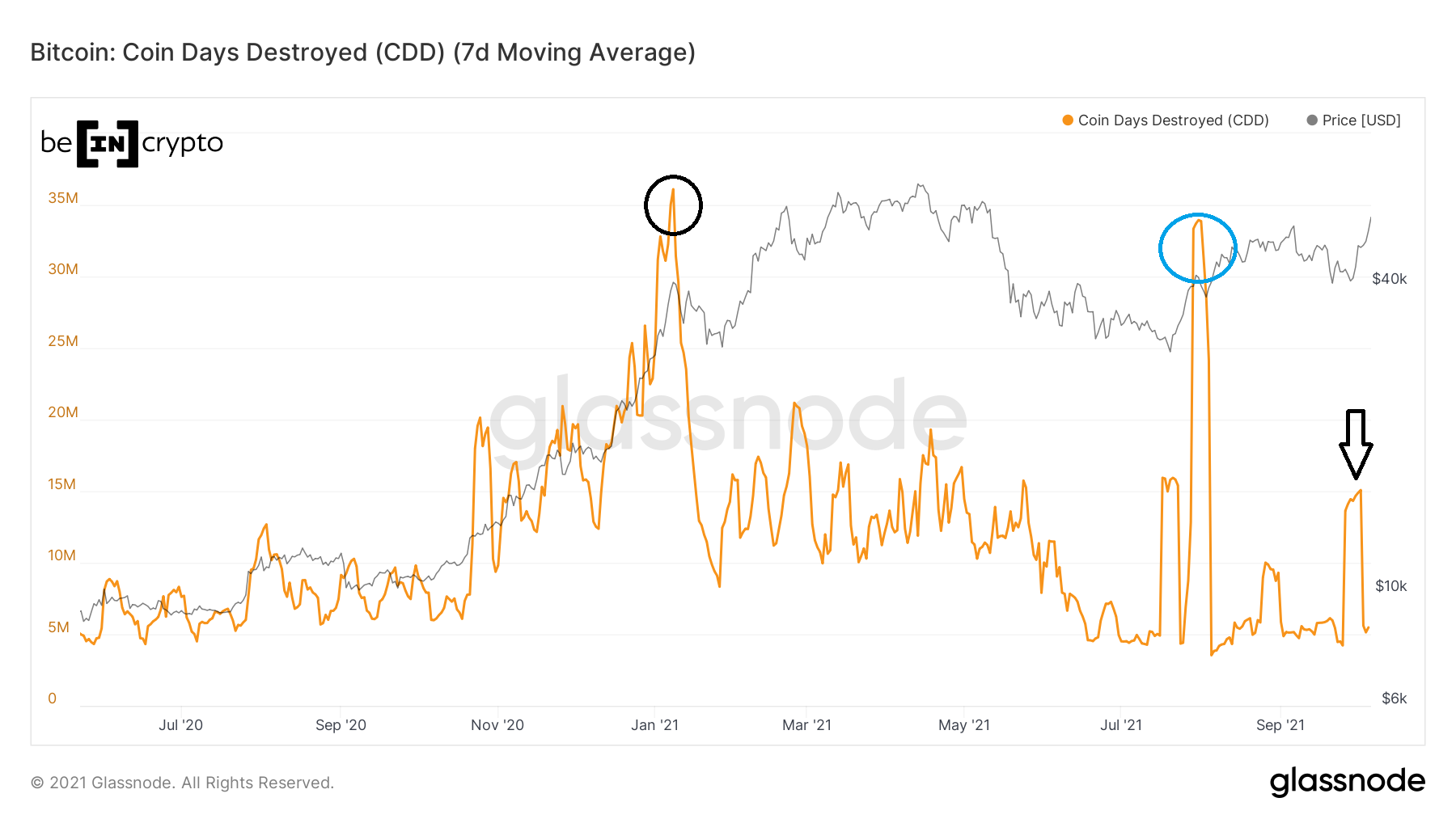

CDD is an indicator used to measure the lifespan of coins that are transacted. More specifically, it measures how many days a coin has ‘accumulated’ prior to being involved in a transaction.

These days are accumulated while a coin remains unspent and are then destroyed once they are transacted.

The CDD values show the number of coin days that are destroyed each day. The higher the number, the longer the time that these coins accumulated prior to finally being spent. The indicator often spikes prior to market cycle tops and during the first bounce after crashes. This is due to long-term investors rushing to liquidate their positions once they sense weakness.

When looking at the movement in the 2020/2021 bull market, there was a considerable spike on Jan 8, when the BTC price first broke out above $40,000. This was the first sign of profit-taking since CDD reached a value of 36 million (black circle).

Following this, there was another considerable spike on July 31 (blue circle). At the time, this was a bearish sign, since the upward move seemed like a relief rally, due to long-term coins being sold.

SponsoredHowever, during the current upward move, CDD has shown very low readings, reaching a high of 15 million (black arrow). This is comparable to readings during late May/early June 2021 when the BTC price fell to $30,000.

So, even though the BTC price is increasing, the majority of coins that had remained dormant are not moving. This is a sign of strong conviction in the bullish market.

Binary CDD

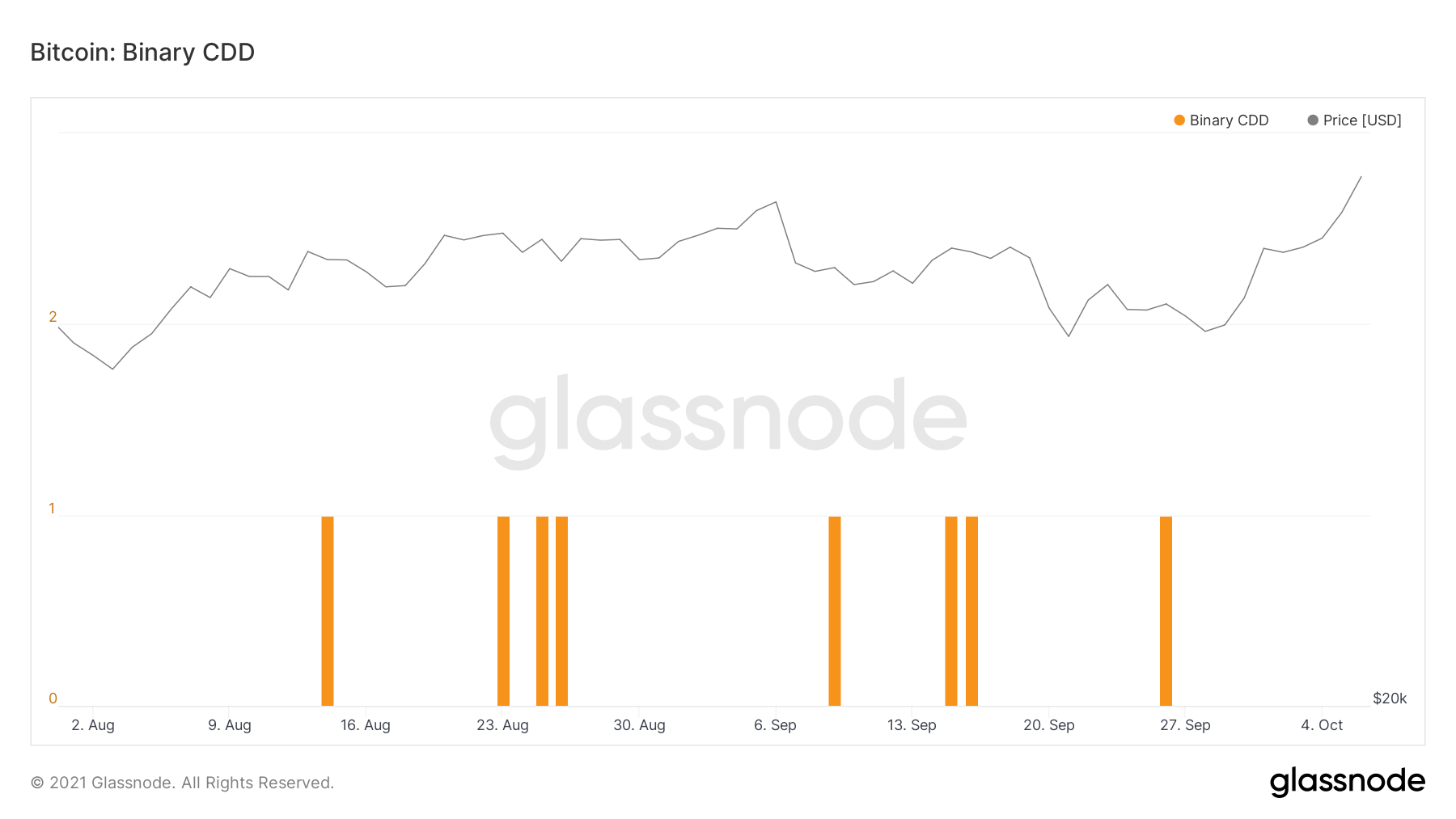

Binary CDD takes an average of the CDD reading. It gives a value of one if a specific day’s reading was higher than the average and a value of zero if it was lower.

Since Aug 1, only eight days have had readings higher than the average. This is seen as a bullish sign, since the BTC price is increasing, the average CDD is falling. This confirms a strong bullish conviction in the market.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.