Is the Bitcoin price still retracing, or has it begun a new upward move? Will it be successful in reaching $7,600? Continue reading below if you are interested in finding out.Technically short are would be 7.6k, but this is $BTC, so I would not be shocked by some scam wyck reaching 8.1/8.3 k. Blind shorts there, alert at 7.6k, will short the breakdown if my blind asks don't get filled. The pattern is very corrective till now, textbook corrective pic.twitter.com/hwNgJHm647

— Walter Wyckoff (@walter_wyckoff) April 6, 2020

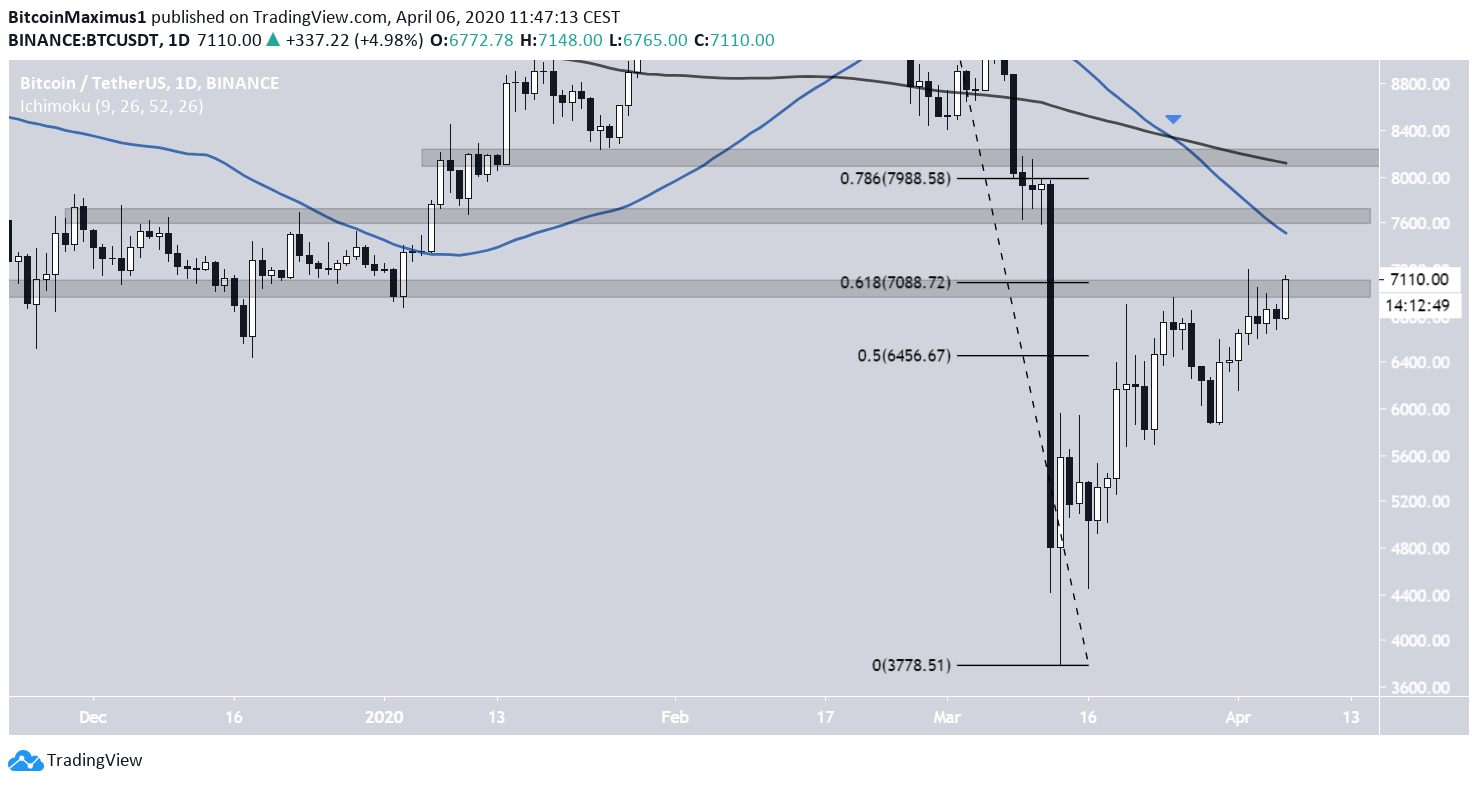

Overhead Resistance

While the current daily candlestick is bullish engulfing, there is considerable resistance right above the current price level. First, the price has yet to move above the resistance by the previous long upper wick on April 2, which also coincides with the 0.618 Fib level of the entire downward move. Next, if the price is successful in reclaiming this level, there is strong resistance at $7,600, as outlined in the tweet. This area has previously acted as resistance and support intermittently and coincides with the 50-day moving average (MA). The next resistance level is found at $8,200, coinciding with the 200-day MA. The 50- and 200-day MAs have already made a bearish cross. Therefore, even if the BTC price were to move above the current resistance level, the potential for further increases seems limited due to numerous resistance levels above the current one.

Ascending Wedge

Since reaching a low on March 13, the BTC price has likely been trading inside an ascending wedge. It is approaching the end of the pattern, which is projected to be on April 9 at the latest. Volume has been decreasing throughout the pattern, which is common in descending wedges. The volume is extremely small in the current candlestick, even though that is a bullish engulfing one. This is a bearish sign that suggests a lack of buying power. The resistance line of the wedge also coincides with the confluence of resistance levels discussed previously. This suggests that the price is likely to eventually break down from the wedge and head toward the $5,900 support.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.