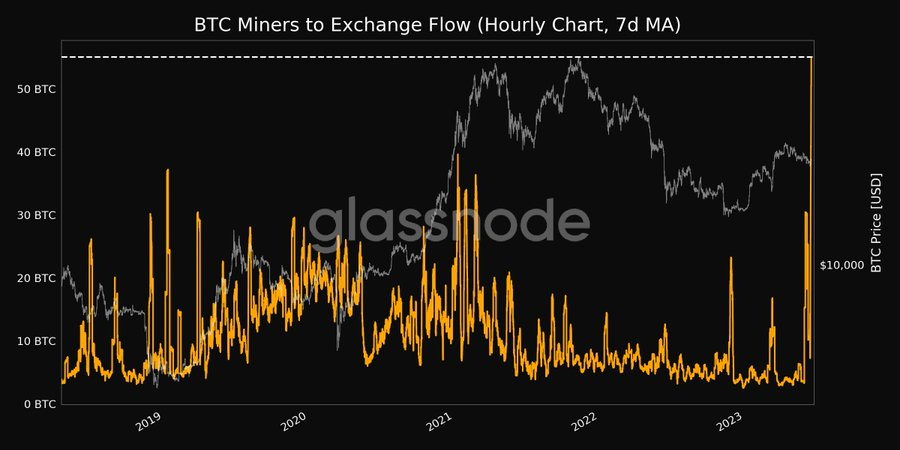

Bitcoin miners transferred more BTC to exchanges over the past week than at any point in the past five years, according to data from Glassnode.

The blockchain analytics firm reported that the 7-day moving average hourly chart for BTC miners showed that their exchange flow reached a 5-year high of 55.068 BTC.

Bitcoin Miners’ Balance

Despite the rate of fund flow from miners to exchanges, miners are still holding 1.829 million BTC (around $49 billion), according to data from Glassnode.

Miners’ reserves increased during the early days of June. It went from 1.836 million recorded on May 31 to 1.845 million as of June 2. However, it experienced a slight decline after news of the U.S. Securities and Exchange’s (SEC) lawsuit against Coinbase and Binance emerged around the same period.

On June 11, Glassnode reported that miners were sending significant coins to exchanges, with the largest inflow equal to $70.8M.

Despite the increasing miners’ flow to exchanges, BTC’s balance on exchanges reached a 3-month low of 2.28 million BTC due to the outflows exceeding inflows. For context, Bitcoin’s exchange outflow exceeded inflows during the past 24 hours by $56.3 million, according to Glassnode data.

What Does This Mean for BTC Price?

There are mixed reactions to what this could mean for Bitcoin. Generally, the flow of funds to exchanges suggests that an entity plans to sell. This might mean miners want to cash in on their BTC due to the unfavorable regulatory environment.

Meanwhile, some market analysts believe that the miners’ transactions indicate their confidence in Bitcoin future prices since their profitability is highly dependent on how well the asset performs.

Whatever the view, Bitcoin saw its value drop significantly during the past two weeks, with several negative news impacting its performance. However, sentiments surrounding the flagship digital asset appear to have shifted after BlackRock applied for a Bitcoin Spot ETF.

According to BeInCrypto data, Bitcoin was trading for $26,496 as of press time after rising by 0.04% in the last 24 hours.

More From BeInCrypto:

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.