Yet another bullish case is emerging for the Bitcoin (BTC) price following a noticeable decline in the volume of BTC transfers from miners to exchanges.

In a Tweet published on Thursday, crypto analyst @ColeGarnerBTC provided a chart from market analytics firm Glassnode showing the inverse correlation that exists between miner outflows and the Bitcoin price. In this case, the flows are making their way directly to exchanges:

Based on the chart above, periods of peak transfers from miners to exchanges act as a leading indicator for BTC price action. In other words, miners are offloading their stash and creating local tops in the process.

More often than not, the periods are immediately followed by a significant decline. Conversely, a massive plunge in miner outflows (as seen on the right of the chart) triggers a rally in the Bitcoin price.

Miners Bunkering Down for the Long-Term?

From the beginning of May, miner-exchange volume has plummeted to levels not seen since August of 2019. If the pattern holds, then Bitcoin could be in for another rally.

The data may not be that easy to interpret, however. Inefficient market participants have been offloading their BTC in recent weeks. As previously reported on BeInCrypto, miners sold more Bitcoin last week than they generated.

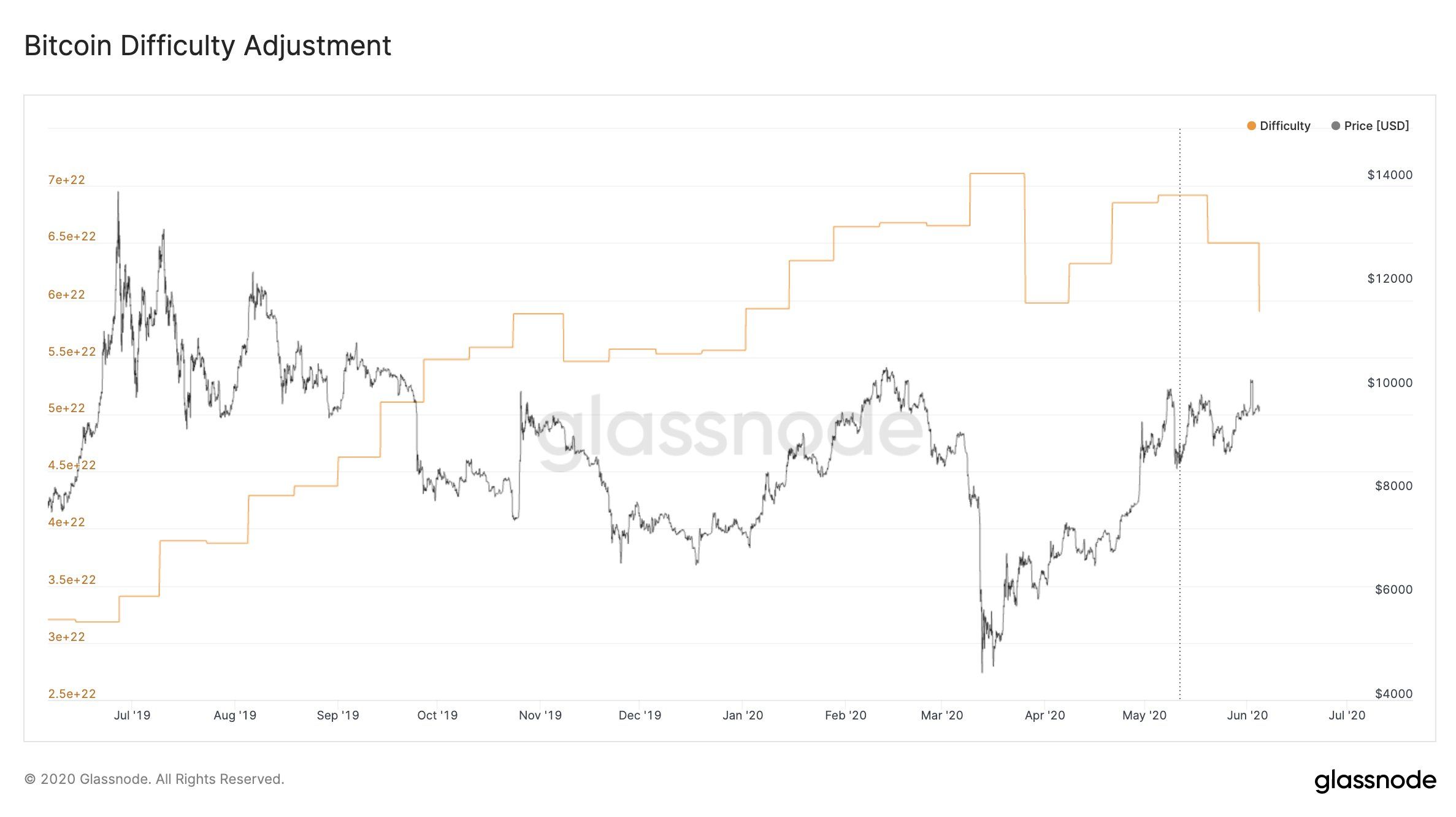

The shakeout of weaker hands could lead to more exits from the network, given the 50% block subsidy slash occasioned by the May halving event. Indeed, Bitcoin’s difficulty adjustment plunged 9.29% today, the second-largest decrease in 2020.

Miners Expand Operations in a Difficult Environment

Despite the difficult outlook, major players are still expanding their operations with additional hardware. U.S.-based Riot Blockchain recently announced the purchase of 1,000 S19 Pro miners from Bitmain.

The new acquisition brings Riot’s 2020 total to 3,040 rigs, which the company hopes will take its hashing potential to a staggering 567 PH/s.

Riot joins other rivals in the North American Bitcoin mining scene pursuing operational expansion with next-generation hardware. On Wednesday, BeInCrypto reported that Marathon acquired 700 Bitcoin miners, while competitor Bitfarms also purchased some 1,847 MicroBT mining rigs.