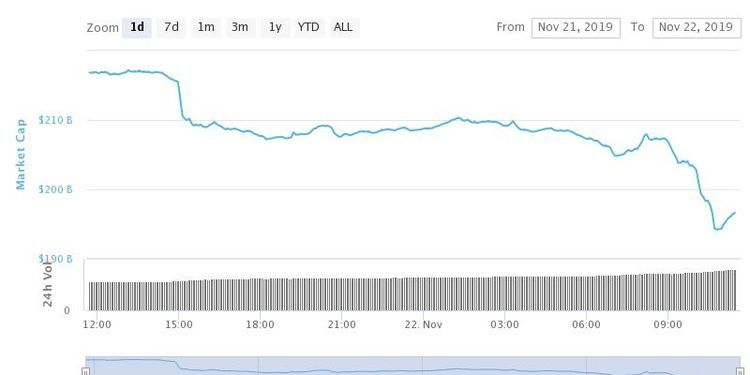

Bitcoin and leading cryptocurrency prices have taken a major hit over the last couple of days. As you might expect, there are no shortage of volunteers to deliver its last rites given the recent volatility.

Over the last 24 hours, Bitcoin has shed around $14 billion from its total market capitalization. This has brought the price down to around $7,180 at the time of writing.

Altcoins have generally fared worse in percentage terms. Ether and Bitcoin Cash have dropped by around 11.95 percent over the last 24-hours, and Litecoin by more than 10 percent.

As has become tradition, the sudden drops in prices have been accompanied by proud declarations of Bitcoin’s death. The latest is from Mark Dow, a global macro trader, author, and former policy economist at the US Treasury and IMF.

Altcoins have generally fared worse in percentage terms. Ether and Bitcoin Cash have dropped by around 11.95 percent over the last 24-hours, and Litecoin by more than 10 percent.

As has become tradition, the sudden drops in prices have been accompanied by proud declarations of Bitcoin’s death. The latest is from Mark Dow, a global macro trader, author, and former policy economist at the US Treasury and IMF.

Typically, as in the above case, those most eager to write Bitcoin off after violent moves to the downside are those with closest connections to the existing financial system. Dow has also been a consistent critic of the cryptocurrency himself over the years. In 2013, he tweeted:#Bitcoin is dying.

— Dow (@mark_dow) November 21, 2019

Bitcoin’s history is littered with so-called “Bitcoin Obituaries.” In fact, they have become so common that 99Bitcoins hosts a page dedicated to them. So far, Bitcoin has apparently been on death’s door (or through it) a total of 377 times. There has been at least one news article published on the cryptocurrency’s demise every year since 2010. The latest listed on the site was delivered by US entrepreneur and investor Jim Rogers via Portfolio Wealth Global’s YouTube channel. No doubt, there will be more in the works given the recent Bitcoin volatility. Yet, despite the number of deaths that have punctuated its short life, Bitcoin remains. It still functions as it did yesterday, last week, or last year. People used it and will continue to use it at much lower prices than it has recently fallen to.Gold is a tax on stupidity. Bitcoin is a tax on paranoid stupidity $GLD

— Dow (@mark_dow) April 12, 2013

If Bitcoin is here to replace the entire central banking system, as many believe it is, it will obviously not be a quick and easy transition. This will be a multi-decade story if it does happen at all. Bitcoin is software at the end of the day. It has no company to promote it and stands opposed to the most powerful industry on the planet. Hiccups in price are to be expected in such a small, uncertain, but growing market. They have also been a constant throughout Bitcoin’s history. To write Bitcoin off because of such is about as naive as believing that a peaceful overthrow of the world’s central banks will be done and dusted in a couple of years.

If Bitcoin is here to replace the entire central banking system, as many believe it is, it will obviously not be a quick and easy transition. This will be a multi-decade story if it does happen at all. Bitcoin is software at the end of the day. It has no company to promote it and stands opposed to the most powerful industry on the planet. Hiccups in price are to be expected in such a small, uncertain, but growing market. They have also been a constant throughout Bitcoin’s history. To write Bitcoin off because of such is about as naive as believing that a peaceful overthrow of the world’s central banks will be done and dusted in a couple of years.

Images are courtesy of Twitter, Shutterstock.

Did you know you can trade sign-up to trade Bitcoin and many leading altcoins with a multiplier of up to 100x on a safe and secure exchange with the lowest fees — with only an email address? Well, now you do! Click here to get started on StormGain!

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Rick D.

A former professional gambler, Rick first found Bitcoin in 2013 whilst researching alternative payment methods to use at online casinos. After transitioning to writing full-time in 2016, he put a growing passion for Bitcoin to work for him. He has since written for a number of digital asset publications.

A former professional gambler, Rick first found Bitcoin in 2013 whilst researching alternative payment methods to use at online casinos. After transitioning to writing full-time in 2016, he put a growing passion for Bitcoin to work for him. He has since written for a number of digital asset publications.

READ FULL BIO

Sponsored

Sponsored