The 2022 CryptoCompare Outlook report reveals that 2022 will likely be a year of NFTs, DeFi, and regulation, as well as institutional growth. Among the more notable insights is the fact that bitcoin-based products lost some of their dominance in 2021 as institutional investors begin turning to other assets.

The 2022 CryptoCompare Outlook report has been released, and it unveils some insights into how the market is developing. The report covers market dynamics and evolving trends in the crypto space, some very apparent and some less so.

CryptoCompare is a global cryptocurrency market data provider that provides retail and institutional investors with real-time and historical market data.

Bitcoin investment dominance dips

Calling 2021 an “inflexion point for the cryptocurrency industry,” CryptoCompare said that it was a year when multiple sub-sectors saw expansive growth alongside the growth of institutional adoption. It extrapolates from recent trends to speculate on trends and developments for the coming year.

Noting that the world’s economies have suffered much because of the pandemic, the risk of markets has risen. This macroeconomic change has been accompanied by increased interest in the crypto market, but this too has proven to have risks.

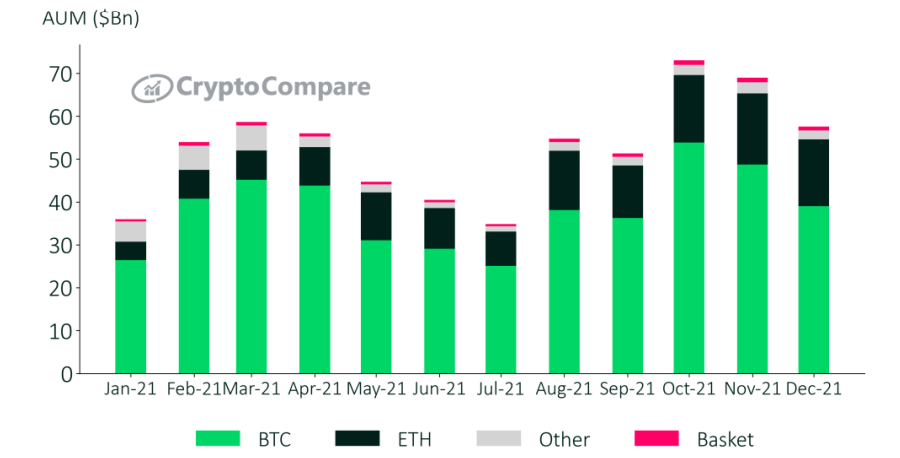

However, one particularly interesting development is the fact that the dominance of bitcoin-based institutional products fell by 74.9% to 67.8% in AUM over 2021. However, overall, more institutional investors have been taking to crypto, specifically other assets. Total AUM of crypto assets grew $36 billion to $58 billion over the year.

As for major trends, it expects to see in 2022, NFTs and Web3 are predictably the top mentions. Both of these sub-sectors experienced a landmark 2021, reaching into the mainstream and attracting the attention of celebrities and other prominent figures. NFTs saw a 15x growth in 2021 and was especially notable in making a mark in the wider world.

Regulation to become key development in 2022

CryptoCompare does not believe that regulation will decline in 2022 and that is certainly true. The pace of regulation has ramped up multifold in 2021, with bans, tax schemes, and registrations being enforced across the world.

With the bull run of 2021 and the rise of meme coins, regulators have had no choice but to step in and ensure investor protection. However, the specific regulatory approach has varied from country to country. China, for example, has banned cryptocurrencies, while some have allowed the market to exist but with restrictions.

Regulation will have a huge impact on how the market develops, but for the most part, things appear optimistic. Some regulators see potential in cryptocurrencies, though they are keen on making sure there is no room for fraud, scams, and the financing of illicit activities.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.