Bitcoin has seen a modest decline in recent sessions, with prices holding just above key support levels. Despite this pullback, analysts suggest the dip may pave the way for fresh capital inflows.

Short-term holders (STHs) entering at current levels could provide fuel for a rally toward higher price targets.

Bitcoin Investors Are Awaiting Gains

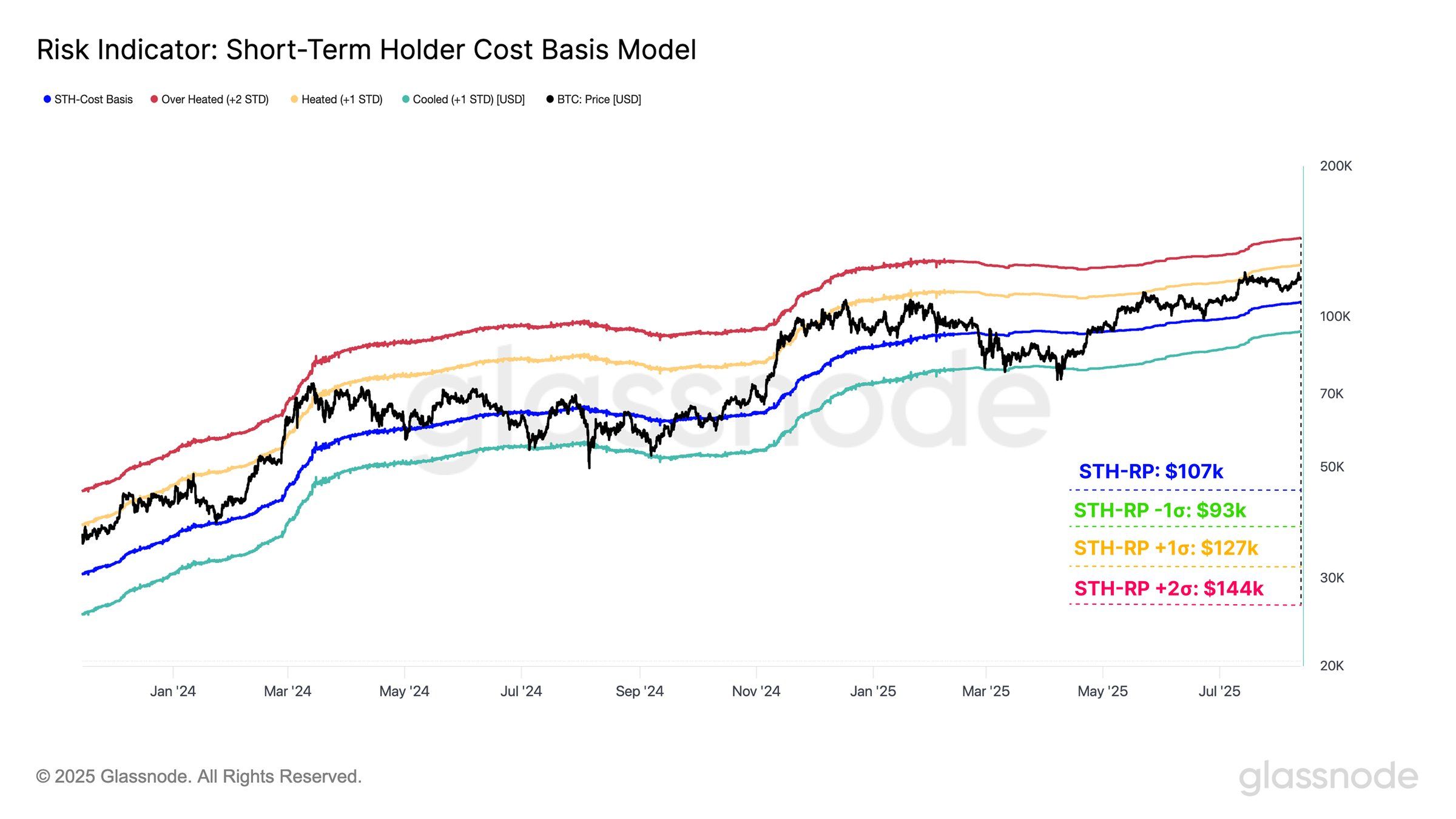

The STH Cost Basis Model serves as a useful framework for understanding investor behavior. It establishes an average entry price for newer Bitcoin wallets while applying standard deviation bands to highlight overheated zones. These zones often align with profit-taking points, where traders begin to exit as prices stretch higher.

Based on this model, $127,000 emerges as the first major ceiling. Historically, this level has preceded local tops, as early profit-taking occurs. The +2σ band around $144,000 is typically where euphoria peaks, triggering sharp corrections. Until then, sentiment suggests there may still be upside room before major selling pressure.

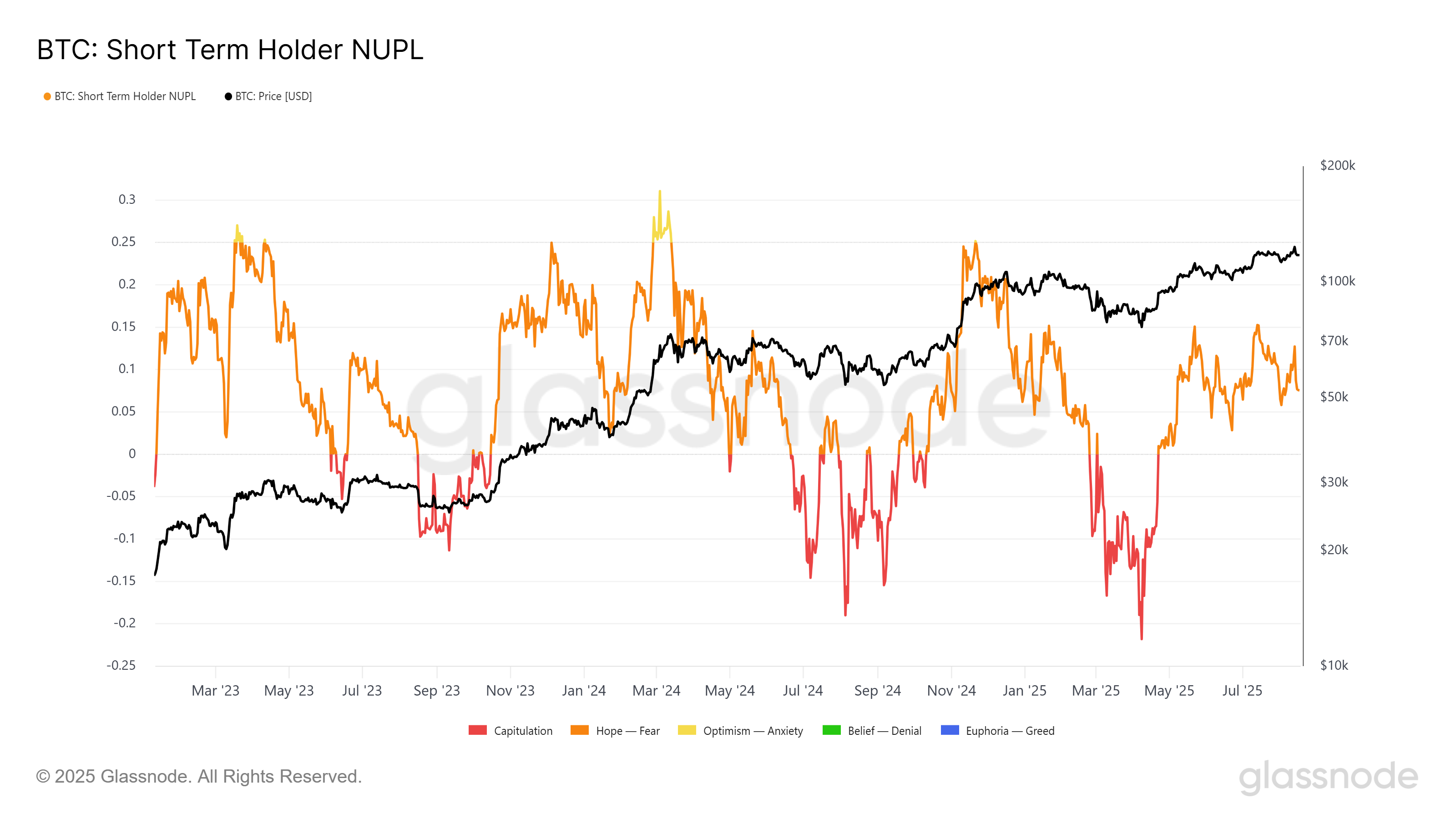

The STH Net Unrealized Profit/Loss (NUPL) provides additional insights into broader momentum. Historically, the 0.25 threshold has marked saturation points for STH profits, often followed by periods of consolidation or mild corrections. This trend helps highlight when markets become overheated and vulnerable to reversals.

Currently, the NUPL sits at just 0.07, far below the saturation mark. This indicates there is still room for profit expansion before a reversal becomes likely. As prices rise, this could validate the cost basis model, reinforcing expectations that Bitcoin can advance further before encountering heavy selling pressure.

BTC Price Is Holding On

At the time of writing, Bitcoin trades at $115,448, holding firmly above the $115,000 support. The models suggest that selling by STHs will remain limited until BTC approaches $127,000, which sits above the previous all-time high of $124,474 and marks the next major profit-taking level.

For Bitcoin to reach this target, broader market support will be necessary. Geopolitical tensions remain a drag on sentiment, but renewed investor confidence could aid momentum. Reclaiming $117,261 as support and pushing to $120,000 would set the stage for a potential new all-time high in the near term.

If conditions worsen, Bitcoin risks losing $115,000 support, with a possible decline to $112,526 or lower. Such a move would invalidate the bullish thesis and highlight the vulnerability of BTC to external pressures, reinforcing caution among traders while the market reassesses its trajectory.