Bitcoin (BTC) has held on above the $32,100 support area for the third straight day.

Bitcoin is expected to increase in the short-term at least until it reaches the breakdown level at $37,550.

Bitcoin Holds Support

For the third straight day, BTC held above the $32,100 support area, which is the 0.382 Fib retracement of the entire upward movement. BTC created another lower wick, a sign of buying pressure. The next support area is found at $29,050, the 0.5 Fib retracement level of the same scale.

Technical indicators have clearly turned bearish. This can be seen in the form of a falling MACD and a bearish cross in the Stochastic oscillator. However, the daily RSI has generated a very significant hidden bullish divergence, a strong sign of continuation which could be the catalyst for a bounce.

Future Movement

The six-hour chart shows that BTC has been following an ascending support line since Dec. 17. It has bounced four times above it up to this point — most recently during the aforementioned Jan. 11 low.

If BTC continues increasing, it’s likely to find resistance at $37,550. This target is a combination of the 0.618 Fib retracement level, a previous support level, and a potential descending resistance line (dashed).

Lower time-frames support the beginning of the upward movement towards $37,550. The charts show a breakout from a short-term descending resistance line and a bullish divergence in the RSI, along with an increasing MACD.

Currently, BTC is re-testing the resistance line it broke out from and is expected to increase after.

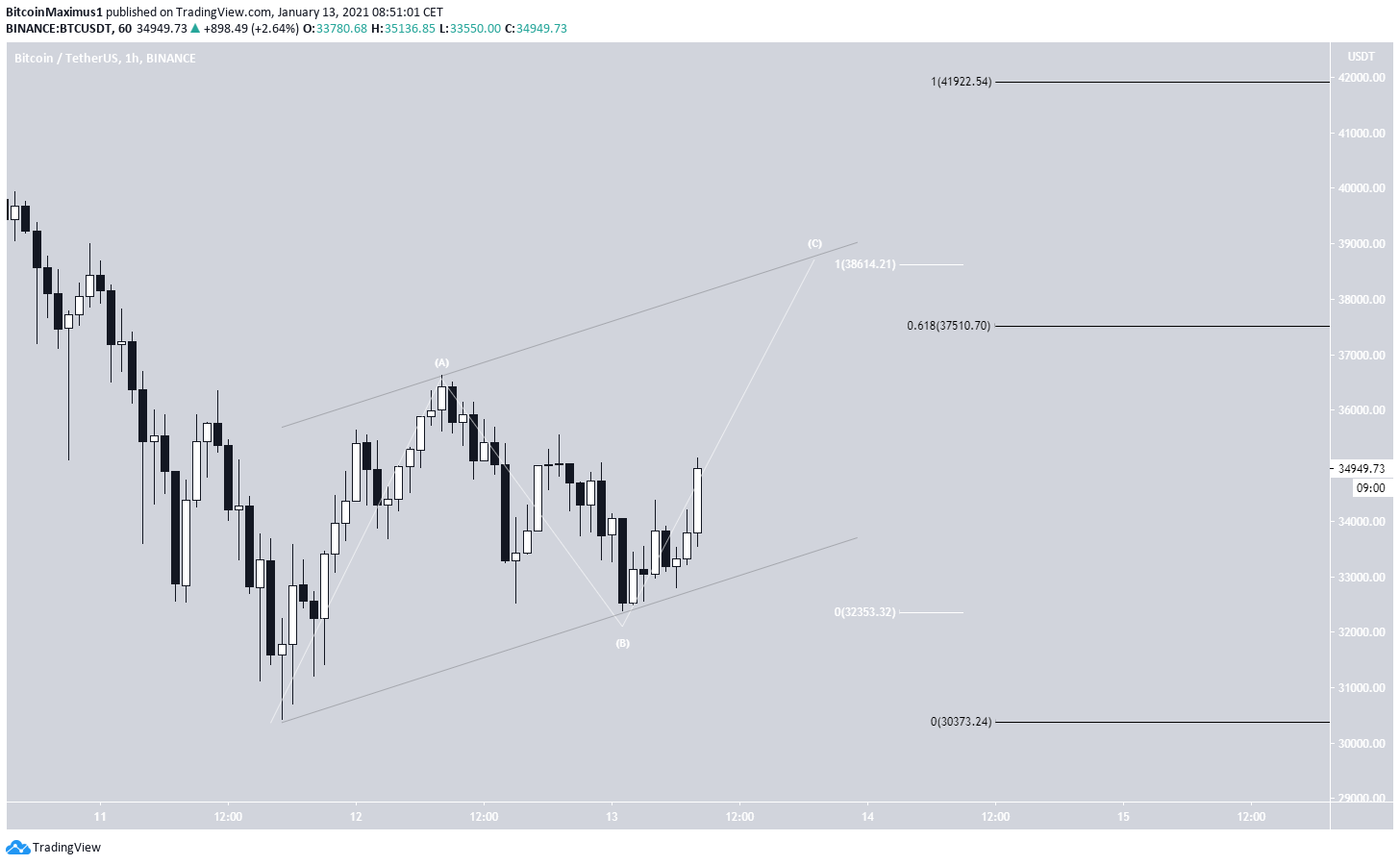

BTC Wave Count

Beginning with the $30,420 low on Jan. 11, BTC seems to have completed the A and B waves of a zigzag A-B-C correction.

A likely target for the top of the C wave is found at $38,614, which would give the A:C waves a 1:1 ratio. The target is also close to the 0.618 Fib retracement level at $37,510.

It also coincides with the resistance line of a parallel channel connecting the bottom of the A and B waves.

Conclusion

Bitcoin is expected to increase toward the range of $37,500-$38,614 to reach the previous breakdown level and complete the A-B-C structure.

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here!

Disclaimer: Cryptocurrency trading carries a high level of risk and may not be suitable for all investors. The views expressed in this article do not reflect those of BeInCrypto.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.