Bitcoin network hash rates have surged to new record highs over the weekend. Furthermore, the pressure on Bitcoin miners has intensified as hardware prices also start to increase while profitability remains stagnant.

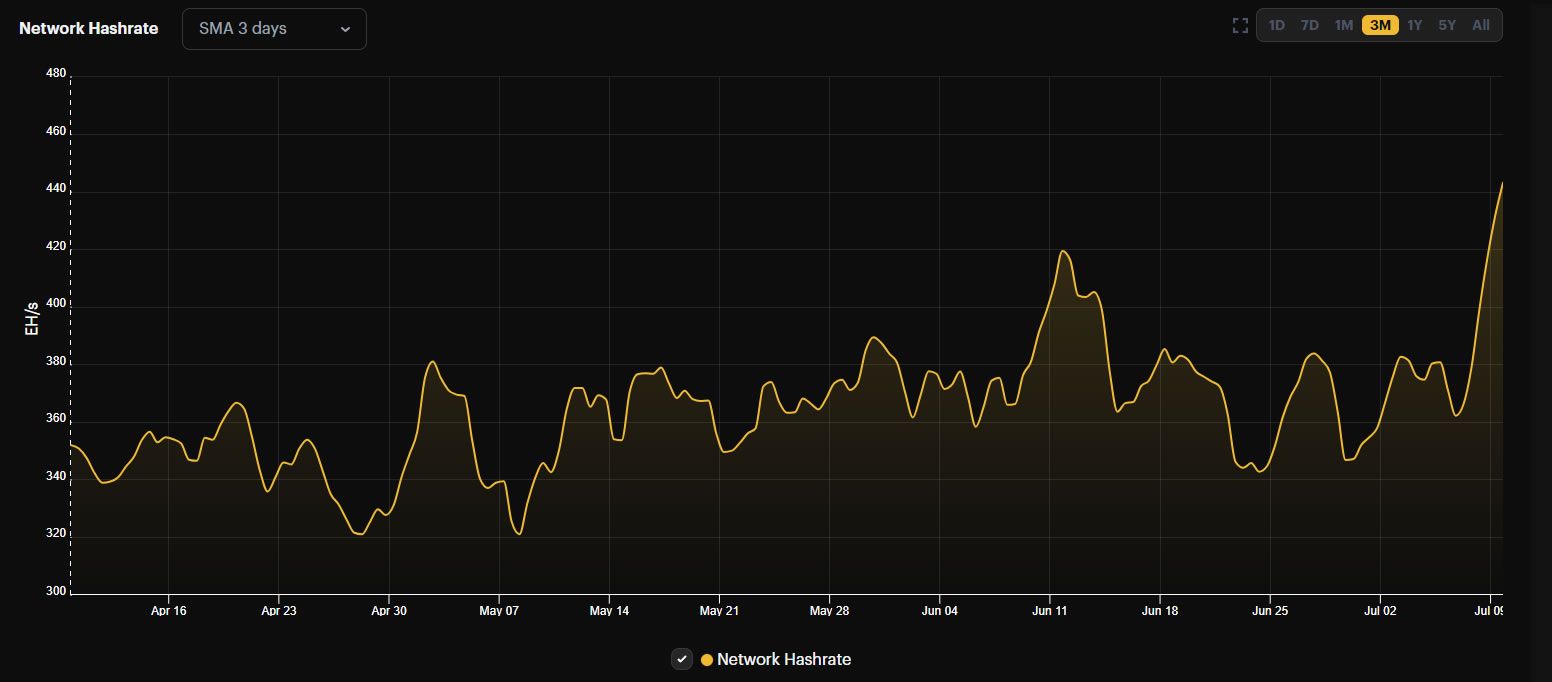

The Bitcoin 7-day and 3-day average hash rate increased to all-time highs over the weekend, according to Hash Rate Index.

Bitcoin Miners Facing Pressure

On July 9, the Bitcoin mining industry outlet Hash Rate Index reported on the remarkable rise of network horsepower over the weekend.

It noted that Bitcoin’s 7-day average hash rate hit 401 EH/s on Saturday, July 8. Moreover, the 3-day average has risen more than 18% to 444 EH/s (exahashes per second).

“The amazing thing is, the lion’s share of this growth (damn near all of it) occurred this weekend.”

BitInfoCharts confirmed that the hash rate spike hit a record high of 465 EH/s on July 8, falling to 428 EH/s the following day.

The report also noted that last week’s heat waves in Texas were too weak to cause substantial problems with the Texas power grid. Bitcoin miners curtail during extreme weather, but they are currently back at near full capacity, hence the increases in hash rates.

It added that this could cause a large upward difficulty adjustment of above 7.5%. Mining difficulty is currently at 50.64 T, just below its peak last month, but the next adjustment will likely take it to a new all-time high.

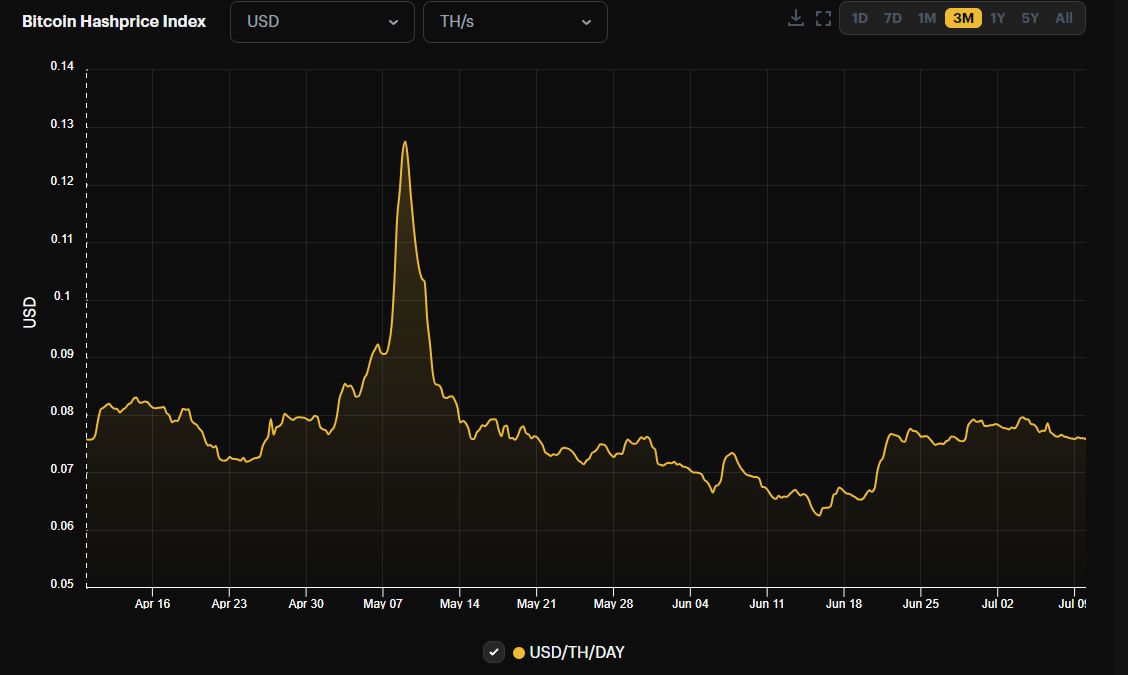

BTC Hash Price Dropping

Furthermore, these factors will all put more pressure on Bitcoin miners as the hash price continues to fall. Hash price, or mining profitability, is currently $0.075 per TH/s per day. It spiked to $0.127 in early May during the ordinals minting craze that heavily congested the network.

“Hope y’all enjoyed those $70-80/PH/day payouts, because unless Bitcoin’s price rips even harder in the coming week, miners could be facing down sub-$70/PH/day hashprice when the next adjustment comes”

The pain for Bitcoin miners doesn’t end there. The report noted a further divergence in the premium of next-generation ASICs like the S19 XP to new and mid-generation hardware.

“As miners prepare for the halving and prioritize these rigs, they are rising in price while other models fall or stagnate,” it reported.

Bitcoin prices have been pretty stagnant over the weekend, hovering just above $30,000. They retreated slightly during the early hours of July 10 as the asset fell to $30,190.

A fall below $30,000 is looking likely as market sentiment wanes and the correction begins to accelerate. This will likely mean more bad news for miners.