Bitcoin halving is a critical event in the cryptocurrency ecosystem that affects market sentiment, miners’ profitability, and innovation. With just one year to go, analysts weigh in with varying predictions.

Bitcoin halving is a seismic event in the cryptocurrency ecosystem that occurs once every four years. It is an automated process built into the Bitcoin network’s code, which reduces the reward for mining new Bitcoin blocks by 50%. The halving process is crucial to the network’s security and stability and has a huge impact on the cryptocurrency market.

The impact of halving on market sentiment, miners’ profitability, and innovation in the crypto ecosystem has driven a surge in anticipation. With just one year left before the event, experts and investors in the crypto industry are closely monitoring its potential impact on the market.

Upbeat Sentiment

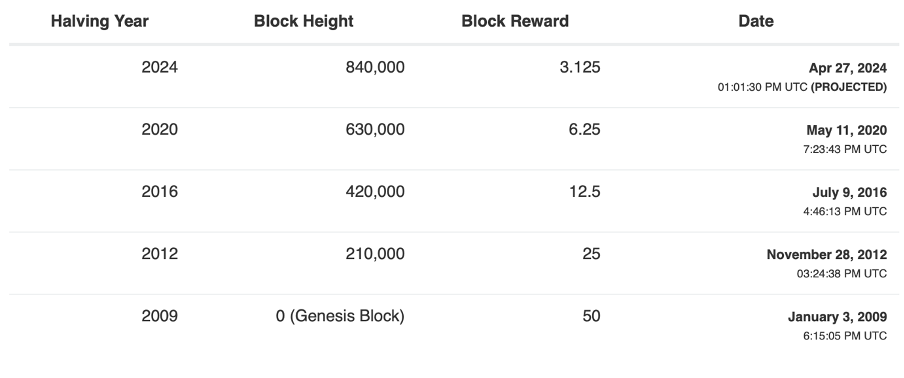

Bitcoin halving, a fundamental mechanism in Bitcoin’s protocol, profoundly affects market sentiment, creating a new supply shortage. A Bitcoin halving is set to take place every 210,000 blocks. So far, three Bitcoin halvings have occurred with dates, one in 2012, another in 2016, and the last in 2020. The bitcoin halving countdown shown below is for the next halving set to occur in 2024.

This reduction in mining rewards will further limit the number of new BTC entering the market. Consequently, this potentially drives up the price as demand grows amid decreasing supply. Thus, breeding a scarcity mindset among investors.

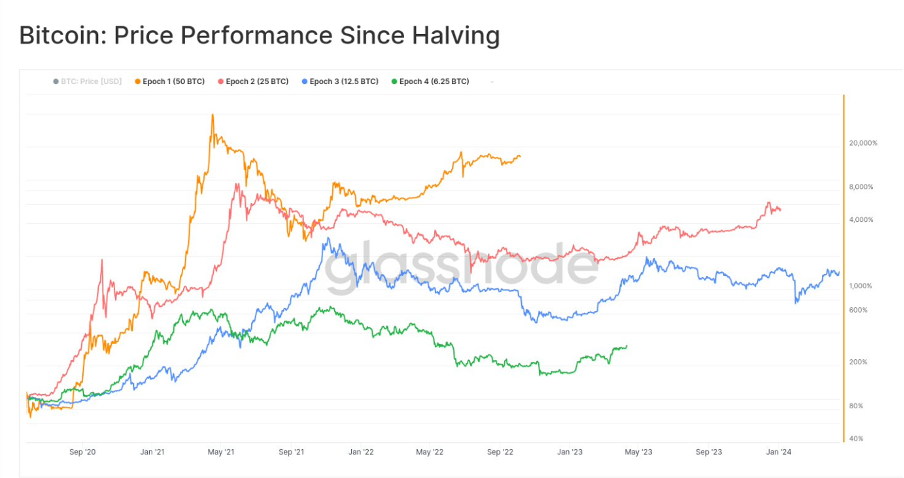

The reduced supply makes Bitcoin more valuable and attractive to investors, leading to a significant price surge. In the two previous halvings, the price of Bitcoin significantly increased (more than 1000%) within a year after the event.

This surge in price attracts more investors and media attention, leading to increased adoption and awareness of cryptocurrencies. However, the price surge is often followed by a significant correction as the market adjusts to the new supply-demand dynamics. This is evident in comparatively muted gains in percentage terms for the current cycle compared to past events.

Other Factors to Consider

The reduction in mining rewards has a direct impact on miners’ profitability. Mining is the process of validating transactions and creating new blocks, and miners are rewarded with bitcoin for their efforts. When the mining reward is halved, miners receive half the bitcoin for the same amount of work, which reduces their profitability.

Currently, the mining reward stands at 6.25 BTC per block. After the next halving event, which is expected to occur in 2024, the mining reward will fall to 3.125 BTC per block. As a result, miners may need to adjust their operations to remain profitable. They may need to upgrade their hardware or switch to more efficient mining algorithms. Additionally, some miners may need to shut down their operations entirely if they are no longer profitable.

Bitcoin halving can also drive innovation in the crypto ecosystem. Reducing mining rewards incentivizes developers to create new solutions to improve the network’s efficiency and security. For example, the introduction of the Lightning Network, a layer-two solution that facilitates fast and cheap Bitcoin transactions, was partially driven by the need to reduce the network’s congestion and transaction fees.

Additionally, Bitcoin halving events directly or indirectly also triggered new sustainable ways that use different mining algorithms or consensus mechanisms. Given the censures against high-energy mining operations, eco-friendly mining may offer unique features and benefits.

Experts Weigh In

The largest digital asset has climbed 67% since December 31 in a partial revival from an epic rout in 2022. While the token is struggling below $30,000, halving can trigger a further price incline. Different crypto analysts have portrayed their predictions for the upcoming event.

A Bloomberg Intelligence analyst, Jamie Douglas Coutts, sees BTC surpassing the $50k mark. Further, he added:

“Bitcoin cycles bottom around 12-18 months prior to the halving, and this cycle structure looks similar to the past ones, albeit many things have changed. While the network is vastly stronger, Bitcoin has never endured a prolonged severe economic contraction.”

Meanwhile, Markus Thielen, research head at Matrixport, predicted that Bitcoin will reach around $65,623 by April 2024. This is more than double the current price.

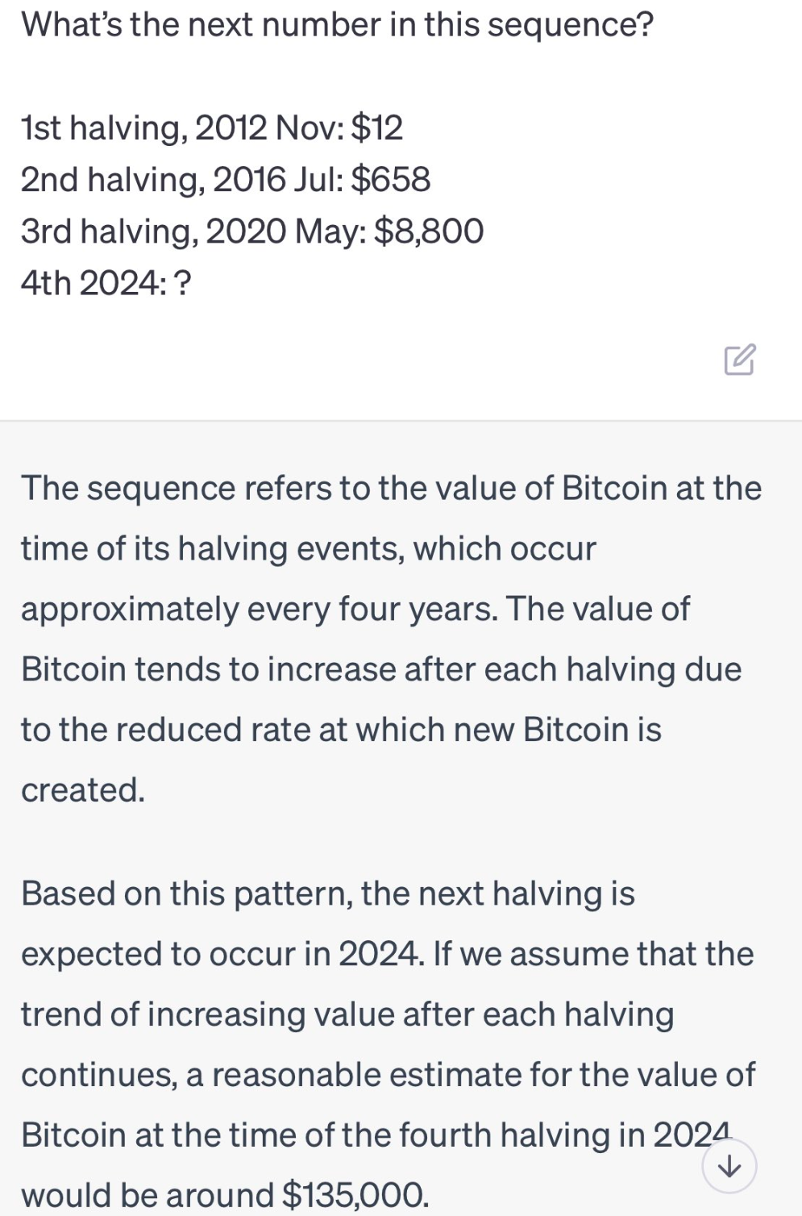

Other renowned analysts have aired their views on the same concept. Some even gave a staggering price surge prediction following financial instability in America. On a subtler note, the latest trend around artificial intelligence (AI) also has a prediction regarding Bitcoin’s price. Herein, taking the value to more than $100,000- have a look:

Redditors Have a Go

BeInCrypto reached out to Reddit users in one of the popular channels (r/CryptoCurrency). The aim is to understand Redditors’ perception of the anticipated price surge, allegedly taking Bitcoin to over $50,000. The responses are as follows:

One of the users found the stated value as a “realistic outcome.”

“This is, for me, the most realistic outcome. Even though we can’t predict anything for sure since the past years were quite insane. When you zoom out on graphs, you can clearly see we’re not anywhere near a breakout.”

Another user took a different approach to answering the question.

“If you just take a glance at history, we should expect to crab with pumps and corrections the rest of 2023, well into 2024 (past the halving). The bull cycle should return in late 2024 and into 2025, and profits can be taken near the tail end of 2025.”

The same user added, “We have never had crypto through a recession, historical inflation, wars, anti-crypto regulation. So this time may be ‘different,’ and a blow-off top may be off the table. In any case, we are still in the accumulation/fire sale zone right now.”

Expectations vs. Reality

Bitcoin halving is a critical event in the cryptocurrency ecosystem that significantly impacts market sentiment, miners’ profitability, and innovation. The reduction in mining rewards creates scarcity and drives up the price of Bitcoin, leading to increased adoption and awareness of cryptocurrencies.

Contrarily, the price expectations may or may not hold. The price of Bitcoin, like any other asset, is subject to various factors that can influence its value, such as supply and demand, market sentiment, economic conditions, government regulations, and technological developments. Historically, halving events have been associated with increases in the price of Bitcoin due to the reduction in the supply of new bitcoins entering the market.

However, past performance does not necessarily indicate future results, and there is no guarantee that this trend will continue.