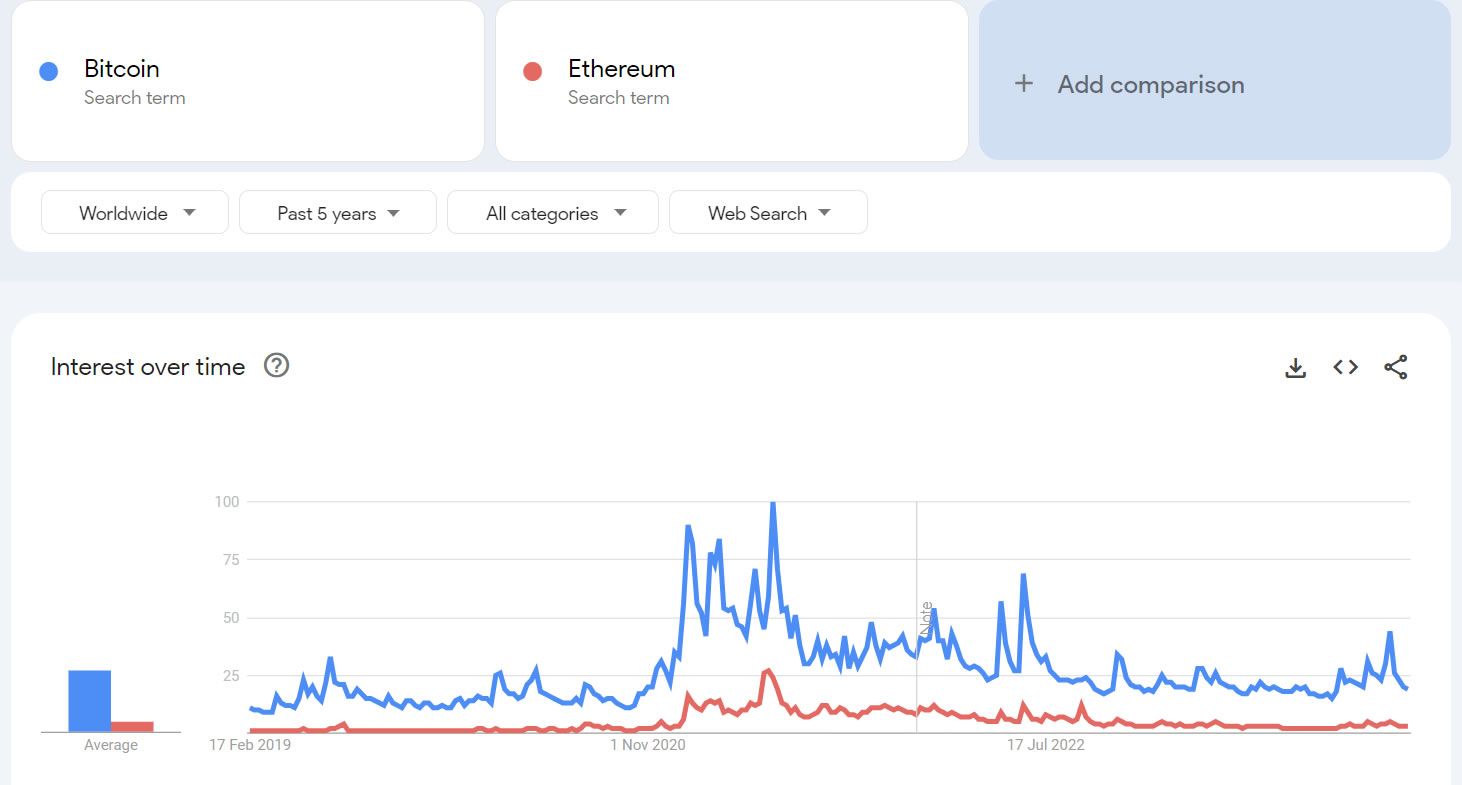

Crypto markets and Bitcoin prices may be close to two-year highs, but retail interest and search engagement have fallen back to bear market lows. Crypto social media and Google Trends show very low engagement rates at the moment.

Engagement compared to the ETF approval week is down around 80% and has returned to bear market levels again.

Bitcoin Google Searches Sluggish

According to Google Trends, searches for ‘Bitcoin’ are back at cycle-low levels again. This follows a brief spike in January when the spot ETFs were launched in the United States.

Bitcoin Archive commented on the search trends, saying:

“I don’t know what the implications are for the shape of this cycle, but it does seem that we are very early, still.”

They compared Bitcoin search trend activity to previous years. There was an increase in Twitter activity around October and November 2020 as BTC broke $15,000. However, it is now down 85% from the previous all-time high. It is the same situation for Ethereum search trends despite ETH staking hitting record levels.

“It still feels like a bear-market ghost town sort of vibe. Same regulars posting and engaging, perhaps more often, but it’s still the same crew.”

Search trends are currently at a quarter of the levels they hit during the 2021 bull market, yet Bitcoin prices are just 30% away from all-time highs.

Read more: How To Buy Bitcoin (BTC) on eToro: A Step-by-Step Guide

They also took a look at the Bitcoin subreddit, which was

“Growing steadily, but there’s no bump.”

Moreover, Reddit posts and comments are both at bear market lows, with no rise in activity or interest.

Nevertheless, the Bitcoin fear and greed index tells a different story, with a ‘greed’ reading of 70. The index went as high as 94 in December 2020 but has never returned to those levels of extreme greed since.

No FOMO Until ATH

Observers are largely in agreement that retail FOMO (fear of missing out) usually comes around the market peak, which could still be a year away.

Therefore, price discovery above $70,000 could be the trigger to spark the next wave of retail FOMO.

Investor and analyst Fred Krueger commented that, in general, most Americans aren’t that interested in investing.

“They only get interested when they think they can make a lot of money quickly. Searches for “stocks” etc. show the same pattern. They get really interested right around parabolic moves up.”

At the time of writing, BTC was trading at around $48,000 following a 12% increase over the past seven days, so somebody is paying attention.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.