Bakkt — the Intercontinental Exchange (ICE)-owned Bitcoin futures platform — has inked a partnership deal with Marsh to provide $500 million in crypto custody insurance coverage.

Writing in the company’s blog on Monday, Bakkt President Adam White announced the collaboration with insurance broker Marsh to provide $500 million in coverage to crypto custody clients. The $500M is aside from the $125 million in insurance already in the Bakkt warehouse.

Apart from the additional insurance coverage for institutional investors, White revealed that the company has also revamped its custody infrastructure involving examinations by KPMG and PricewaterhouseCoopers. The blog states:

These audited procedures and controls are essential to our institutional customers and led Tagomi, one of the most popular crypto prime brokers, to select Bakkt as their preferred bitcoin custodian.White also highlighted the company’s intention of making digital assets more accessible to merchants, as well as retail and institutional investors. Back in November 2019, BeInCrypto reported that Bakkt was extending its consumer app to retail users as well expanding the scope of its proposed services. Concerning loyalty points and rewards, White revealed that Bakkt is leveraging its acquisition of Bridge2 Solutions and partnerships with major brands to enable users to redeem these points for merchandise and gift cards. The Bakkt app will also allow customers to convert digital assets into cash or for use in micropayments like Starbucks coffee.

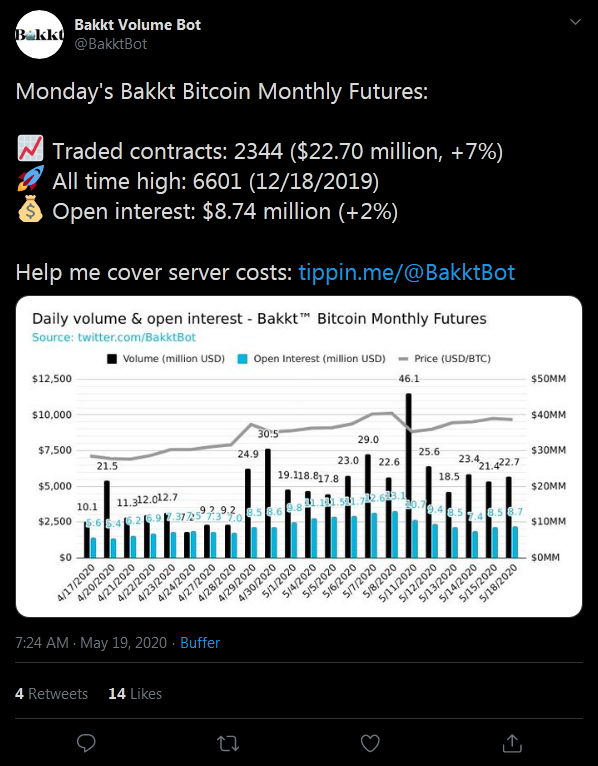

According to @BakktBot — a Twitter bot that tracks Bakkt’s Bitcoin futures product — trading volume as of press time stood at 553 BTC (about $5.35 million). Open interest over the last 30 days stands at $8.74 million.

According to @BakktBot — a Twitter bot that tracks Bakkt’s Bitcoin futures product — trading volume as of press time stood at 553 BTC (about $5.35 million). Open interest over the last 30 days stands at $8.74 million.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Osato Avan-Nomayo

Osato is a reporter at BeInCrypto and Bitcoin believer based in Lagos, Nigeria. When not immersed in the daily happenings in the crypto scene, he can be found watching historical documentaries or trying to beat his Scrabble high score.

Osato is a reporter at BeInCrypto and Bitcoin believer based in Lagos, Nigeria. When not immersed in the daily happenings in the crypto scene, he can be found watching historical documentaries or trying to beat his Scrabble high score.

READ FULL BIO

Sponsored

Sponsored