Bitcoin’s (BTC) ongoing struggle to break past the $60,000 mark hasn’t triggered a sell-off among holders. Instead, many are holding onto their assets, as shown by the decline in exchange activity.

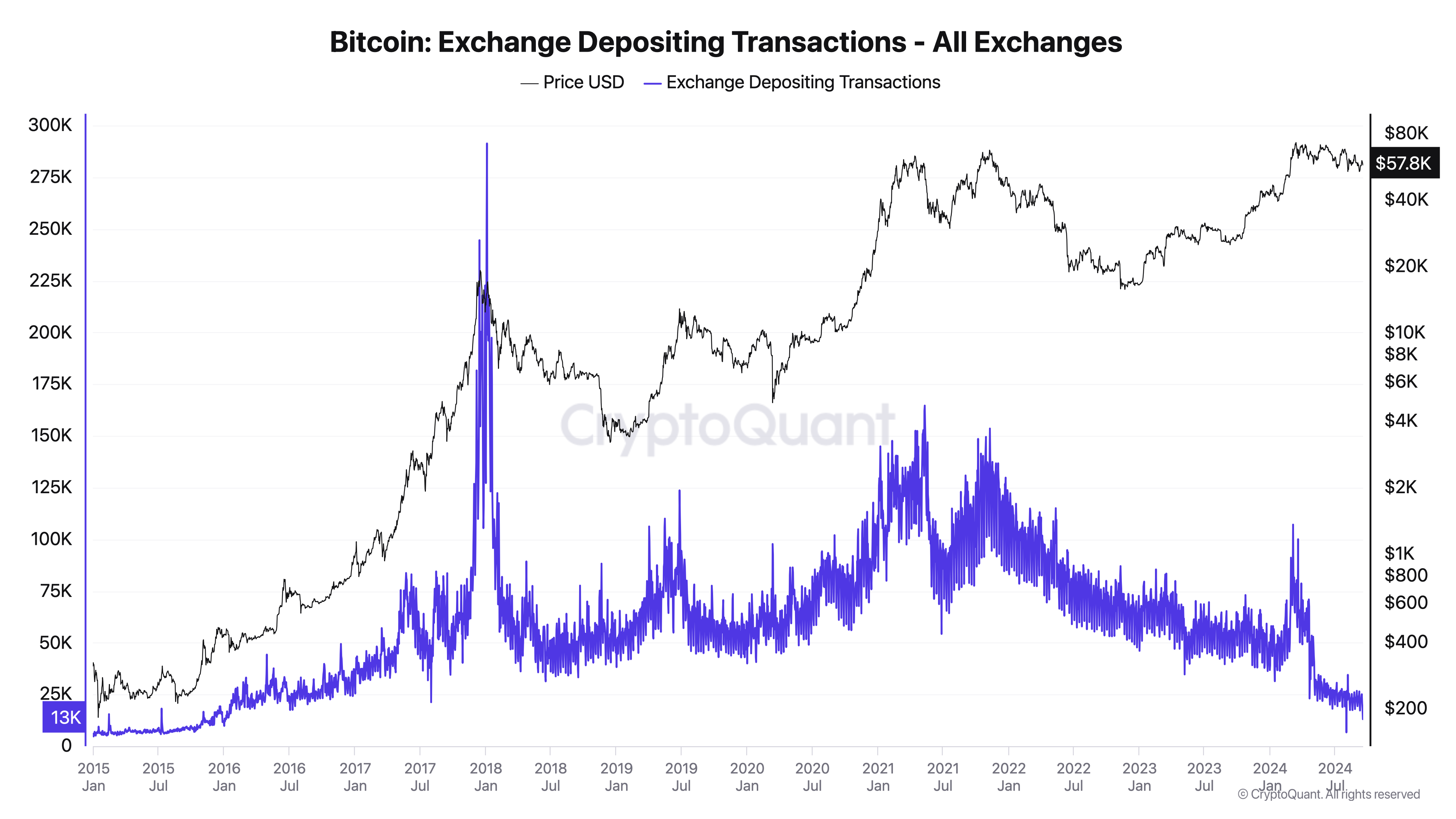

The number of daily addresses sending BTC to exchanges has hit a multi-year low, a trend that coincides with the market’s anticipation of the Federal Reserve’s decision at its September 18 meeting.

Bitcoin Traders Hold Onto Their Coins

On-chain data shows a decline in BTC’s Exchange Depositing Addresses, which track the number of addresses sending inflow transactions from the Bitcoin network to crypto exchanges. This metric has been trending downward since reaching its year-to-date peak on March 5.

Over the past week, the number of addresses that have deposited their coins on exchanges has dropped by 19%. When this metric falls, traders or investors are holding onto their coins rather than selling them.

The recent decline in exchange activity coincides with market predictions of a 50% chance for a half-percentage-point rate cut at the Federal Reserve’s meeting on Wednesday.

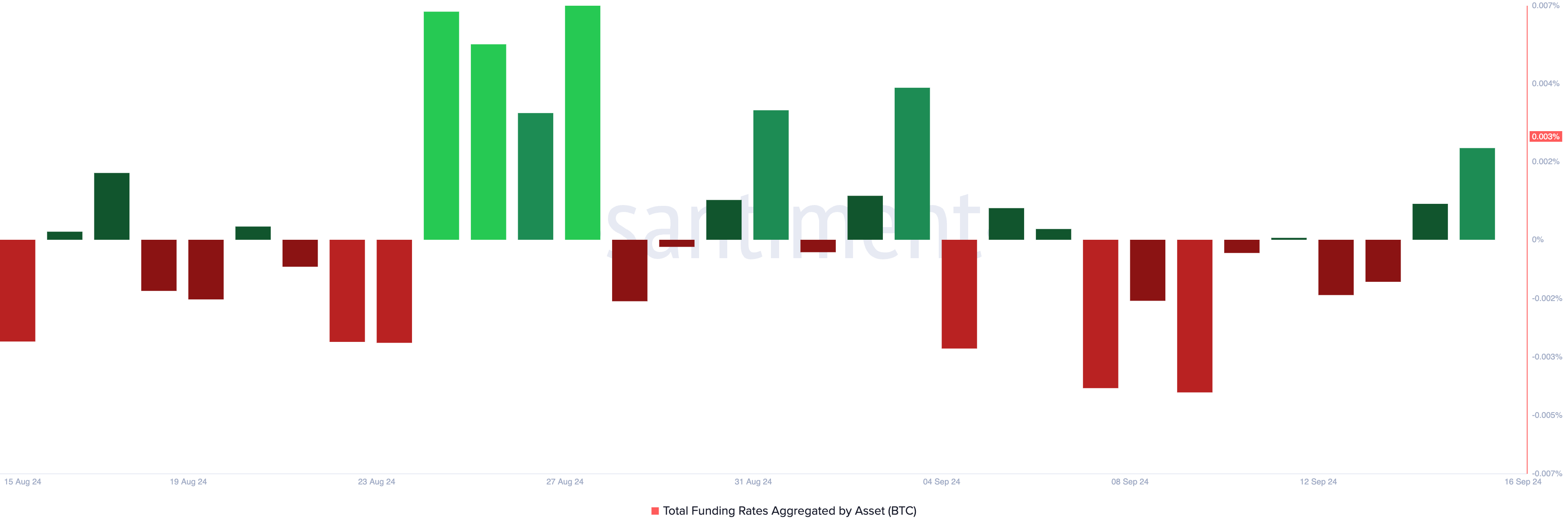

When Bitcoin’s selling pressure eases ahead of a potential rate cut, it often suggests that investors anticipate a more favorable market environment. This growing bullish sentiment is reflected in Bitcoin’s funding rate, which turned positive two days ago after six consecutive days of negative values.

At 0.003% as of press time, BTC’s funding rate indicates stronger demand for long positions over short ones.

Read more: 5 Best Platforms To Buy Bitcoin Mining Stocks After 2024 Halving

BTC Price Prediction: A Rally Past $61,000 Is Possible

At press time, Bitcoin (BTC) is trading at $58,726, continuing its price decline from last weekend. However, the rising Chaikin Money Flow (CMF) suggests that accumulation is taking place.

Currently, the CMF, which tracks the flow of money into and out of BTC’s market, sits at 0.06, forming a bullish divergence with the falling price. This indicates that market participants are accumulating more BTC ahead of Wednesday’s Federal Reserve meeting.

If the coin rebounds, it could retest the resistance level at $61,388, potentially pushing BTC’s price toward $64,312.

Read more: Where To Trade Bitcoin Futures: A Comprehensive Guide

However, if accumulation slows and the downtrend continues, BTC might lose support at $54,302 and drop to the August 5 low of $49,000.