Bitcoin’s (BTC) price has had a rather disappointing week, while Ethereum (ETH), nearly following in BTC’s footsteps, did manage to recover slightly. Ripple’s (XRP) price, on the other hand, not only failed to recover but is also facing further decline.

Bitcoin’s Price Stabilizes.

Bitcoin’s price declined 6% during the previous weekend, from $64,000 to $60,400. The crypto asset nearly fell below the $60,000 mark before recovering over the week.

At the moment, BTC is changing hands at $61,525, noting a slight recovery, and could continue to do so. This is because Bitcoin hit the oversold zone according to the Relative Strength Index (RSI).

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100, with readings above 70 indicating overbought conditions and readings below 30 indicating oversold conditions.

The chances of a recovery from here are high, and BTC could reclaim the support of $63,068 over the weekend.

Read More: Bitcoin Halving History: Everything You Need To Know

On the off chance, this does not happen and falls back down instead, a drawdown to $60,000 is also possible.

Ethereum Begins Recovery

Ethereum’s price bounced back from the 38.2% Fibonacci Retracement to trade at $3,445 at the time of writing. ETH is close to flipping $3,459 into support again, which could aid the second-generation cryptocurrency in pushing towards the 50% Fib line.

The MACD also supports a potentially bullish outcome as the red bars continue to recede. The Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

The beginning of a rally would be confirmed once the indicator notes a bullish crossover.

Read More: How to Invest in Ethereum ETFs?

However, if BTC falls and ETH follows in its footsteps, a drop below the 38.2% Fib line is possible. This would bring the altcoin down to $3,200.

XRP Price Is Not Recovery-Bound

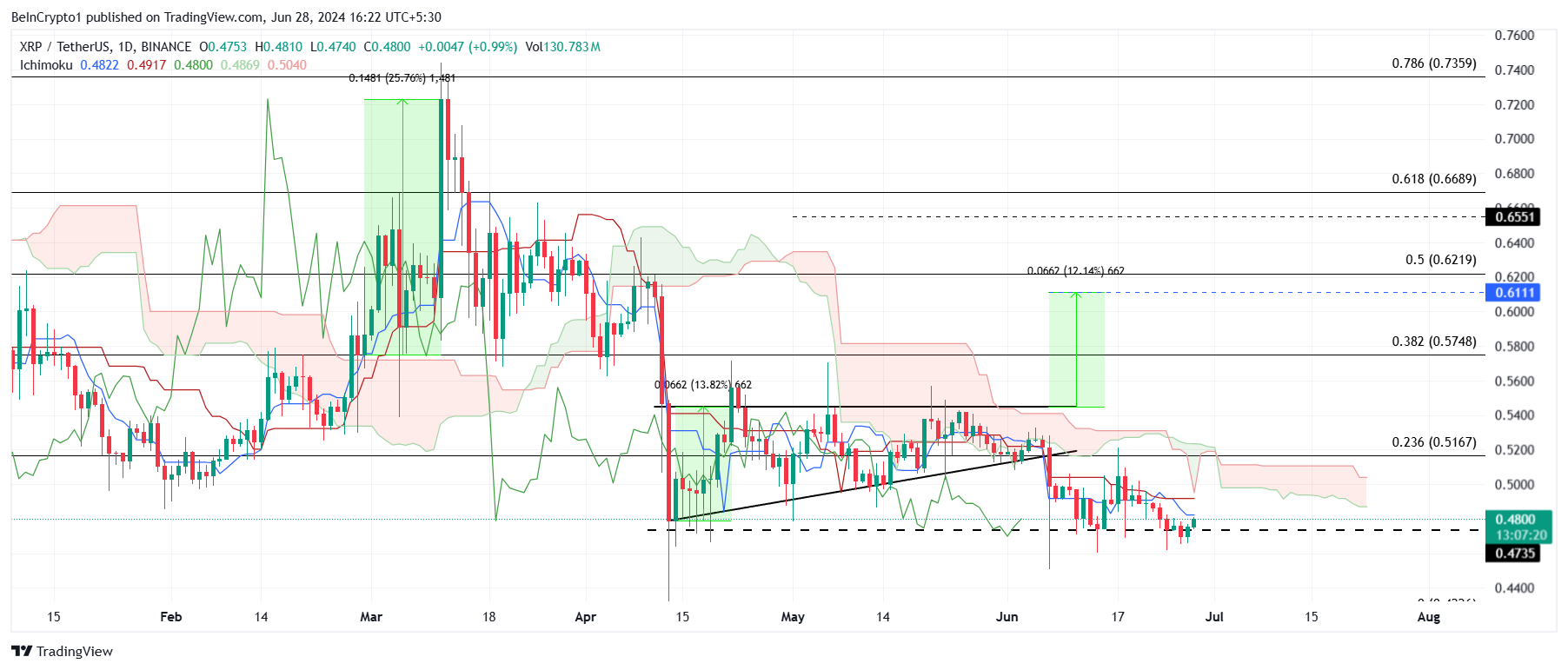

XRP price continues to decline on the daily chart after failing the ascending triangle pattern. At the time of writing, the altcoin is trading at $0.4800, hovering closely above the support floor at $0.47.

The Ichimoku Cloud is currently displaying a bearish outcome for XRP. It is a comprehensive indicator that defines support and resistance, identifies trend direction, gauges momentum, and provides trading signals.

The indicator is currently above the candlesticks, which is a negative sign for the altcoin. Thus, the XRP price could fall through this support floor to reach a low of $0.44.

Read More: Ripple (XRP) Price Prediction 2024/2025/2030

The best way for XRP to prevent a drawdown is to note a sideways pattern. The altcoin’s likely course is consolidation between $0.47 and $0.51.